The low starting point will give the Government the possibility of reaching the legislative elections with favorable numbers to show. The devaluation of December 2023, and the path chosen by the Executive Branch to reduce the fiscal deficit generated a negative impact in terms of inflation, economic activity and income of the population. Some variables, such as inflation or credit, have already shown clear signs of improvement in recent months, while the situation in terms of purchasing power and activity is even more fluctuating.

In this framework, most analysts agree that The ability of the economic team led by Luis Caputo to sustain the current exchange rate calm will be keyin a context of devaluation of regional currencies and with reserves that are not abundant.

Inflation

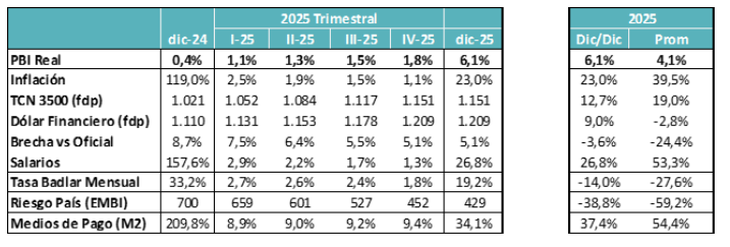

Of the consulting firms surveyed by Ámbito it is Fernando Marull and Associates (FMyA)very close to the Government in ideological terms, the one with the best prospects in terms of inflation. Its projection indicates that the Consumer Price Index (CPI) will rise 22%much lower than the almost 120% expected for the data closed in 2024.

image.png

MegaQM’s expectation is very similar, which foresees 23%. “If the crawling peg can be lowered to 1%, monthly inflation will continue its downward path,” they elaborated on the matter.

For its part, From Analytica they see an inflation floor at 25%. Its director, Claudio Caprarulo, explained to this medium that the consulting firm has developed different scenarios, to which different probability of occurrence was assigned, which can take the CPI above 25%.

With similar logic, EcoGo postulated three scenarios: one in which the plan drawn up by the economic team led by Luis Caputo works, one in which the plan does not work, but without a correction with the International Monetary Fund (IMF) and another with a correction with the body. For the first scenario, the projected inflation is 28%, but in the other two the number rises to 54% and 59%.respectively.

Looking ahead to the first quarter, Leila García Kerman, from EconviewstoIt sees a monthly price increase similar to that of recent months, around 2%. “We believe the end of the country tax could help a downward trend,” he said.

Dollar

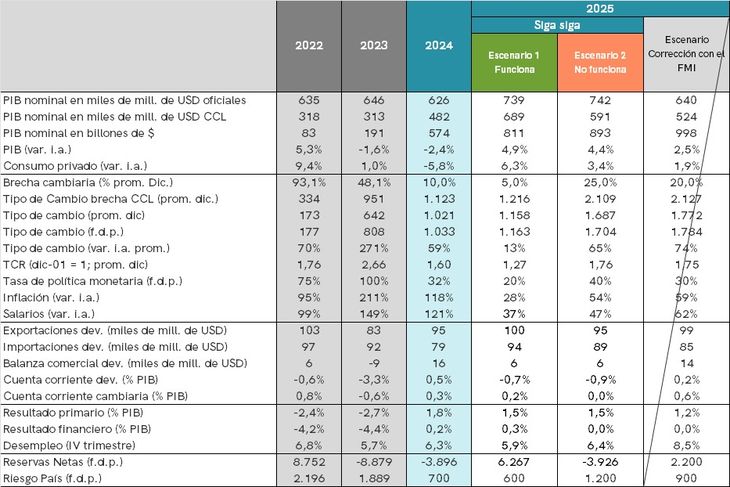

Regarding the exchange rate, in FMyA they predict ato reduction of the monthly “crawling peg” towards the 1% zone starting in February, which would result in an adjustment of the official dollar of just 14% throughout 2025. Regarding the stocks, they consider that there will be a “very gradual release.”

MegaQM sees an even smaller increase, 12.7%. “Today the focus is on lowering the nominal value and that implies cutting the crawling peg to 1% monthly and thus seeking convergence towards lower monthly inflation levels,” they explained, although they warned of risks on the external front since “they look weak commodity prices (soybeans and oil) and we also find ourselves with a stronger than expected dollar scenario, with depreciation of the currencies of some of our main trading partners.

image.png

A challenging year in exchange matters is also perceived by Analytica. “The need to reach an agreement with the IMF and issue debt in foreign currency as soon as possible requires changes to be made in the current macroeconomic regime. Removing new layers from the exchange rate and eliminating the blend dollar will surely be part of them.“said Caprarulo.

For the most optimistic scenario, EcoGo sees an increase in the wholesale exchange rate similar to that of its peers, specifically 13%. However, for the other two scenarios this variation jumps to 65% and 74%respectively.

“The most critical for the exchange rate would be February (moment of least agricultural liquidation and definition of the harvest and where monetary demand reverts seasonally) and August/October with the electoral contest,” remarked Sebastián Menescaldi, director of the entity.

GDP

Finally, FMyA estimates an increase in the Gross Domestic Product (GDP) of 5% in the coming year, “in coherence with the recovery that has already occurred in recent months of the Monthly Estimator of Economic Activity of the INDEC.” The improvement would be driven by both consumption (+4.5%), investment (+10%) and exports (+5%), while imports would show an annual jump of 20%, due to the normalization of foreign trade and a more vigorous activity.

If this forecast is met, the economy would not only recover what was lost in 2024 but would exceed the previous threshold (since last year the drop would have been slightly less than 3%).

Beyond its optimism, FMyA highlighted that the evolution of the economy is not free of risks, both due to global and domestic issues. Among the first they pointed out the “delicate situation in Brasil and emerging economies, within the framework of Donald Trump’s government in the United States.” Likewise, among the latter, they emphasized the segments of the population that are being left behind by government policies (Public Employees, Retirees, and traditional industrial sectors, affected by the opening of imports).

MegaQM forecasts a cumulative growth in activity of 4.1%. “Our expectation is that, hand in hand with new investments and a certain recovery in real wages, two additional points of net growth will be achieved in 2024,” they said in a report.

Analytica sees a 4% growth ceilingwhich may be lower if the optimistic scenario suffers from some negative shocks. For its part, EcoGo sees GDP growth of 4.9% in the most favorable scenario for the country, falling to 4.4% in and 2.5% in the other two scenarios.

Projections 2025

It is worth remembering that next Tuesday the Central Bank will officially announce the Survey of Market Expectations (REM) for December, which brings together a large number of projections, both from consulting firms and financial entities.

Source: Ambito