The Court of Appeals of Mar del Plata removed a ruling that declared unconstitutional the collection of a Road Tax for loading fuel.

The Chamber of Appeals for Administrative Litigation of Mar del Plata this Wednesday reversed a first instance ruling that prevented the city of Mar del Plata from charge a Road Tax. It happened on the same day that the Government asked the provinces to promote the repeal of “municipal taxes.”

The content you want to access is exclusive to subscribers.

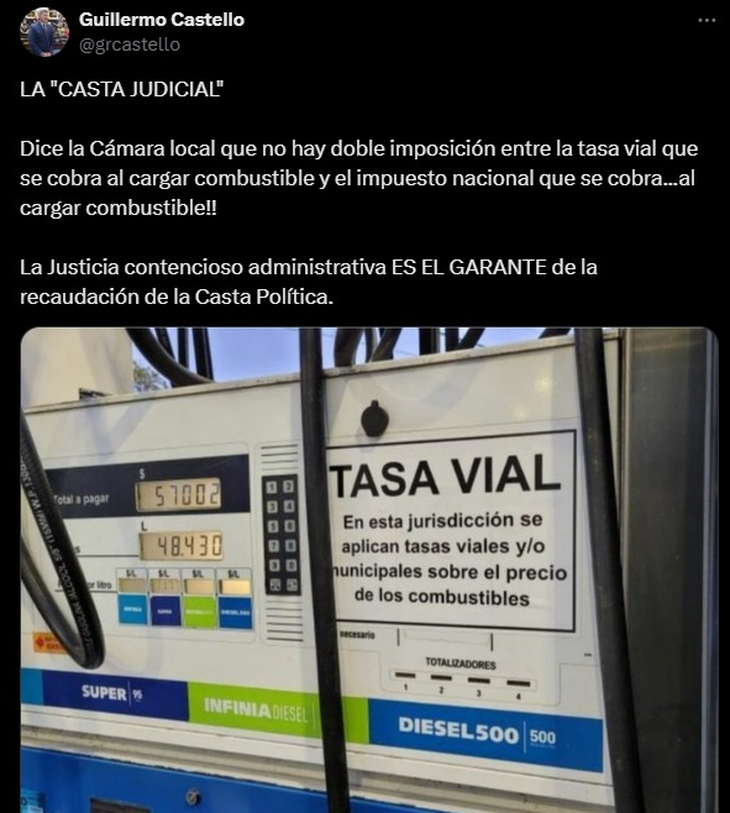

After a presentation by the provincial deputy Guillermo Castello of Freedom Advances (LLA)a trial judge declared unconstitutional a Road Tax thatIt is charged every time fuel is loaded in the General Pueyrredón Municipality, where the city of Mar del Plata is located.

The first instance ruling was in August of last year. The Administrative Litigation Court considered that the collection of the fee did not provide any benefitso it was more like a tax. Furthermore, according to the ruling, it was colliding with the Tax on Liquid Fuels provided for by national law 23,966.

Mar del Plata Road Tax.png

The Municipality of General Pueyrredón, governed by Guillermo Montenegro (PRO), He appealed the ruling and got the Court of Appeals to agree with him. In their recitals, the judges held that “the rate It is defined as a tax category derived from the power of the State, which, although it has a legal structure analogous to that of the tax, It is differentiated from this by the de facto budget adopted by the law, which consists of the development and provision of a state activity that concerns the obligated party.

The libertarian deputy Guillermo Castello criticized the ruling. “Administrative litigation Justice IS THE GUARANTEE of the collection of the Political Caste,” he questioned in his X account.

The Government asked the provinces to promote the repeal of “municipal taxes”

In order to “avoid increases in tax pressure”, the Ministry of Economy sent a note to the provinces asking them to “implement measures so that their municipalities adapt to the legislation and promote the repeal of fees“whose value “is not proportional to the cost of providing the service.”

The Government considered that these rates are “illegal and arbitrary” and stressed that “they fail to comply with Law 23,548 on Federal Co-participation of Fiscal Resources.”

In this regard, they specified that the request is to eliminate those municipal taxes that coincide with taxable events or bases with the co-participating national taxes or that do not respect the jurisprudence of the Supreme Court of Justice of the Nation.

Source: Ambito