The Ministry of Economy will carry out this week the first debt tender in pesos of the year. This Monday, Luis Caputo’s team will make the call and announce the menu of instruments involved. on Wednesday It will be the placement, in which the Government will seek to renew the maturity of a fixed rate capitalizable bill (Lecap) scheduled for this Friday.

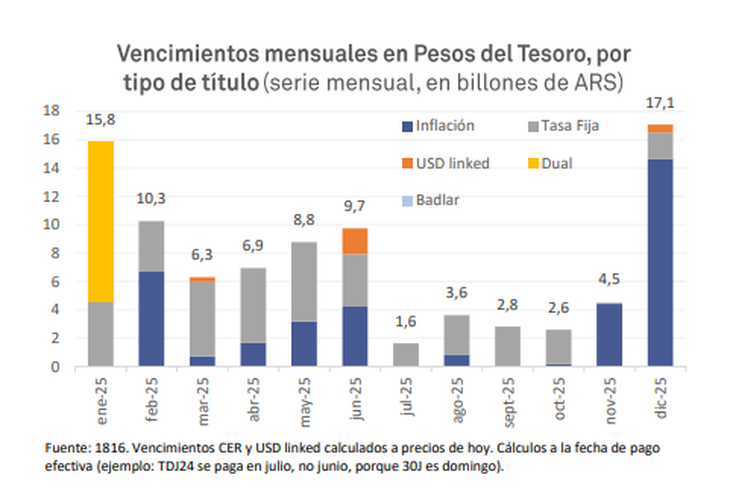

January is a month of large debt commitments in local currency. They are around $15.8 billion, according to estimates by the consulting firm 1816. However, the bulk is concentrated at the end of the month and will be faced in a second tender, scheduled for Wednesday the 29th.

Instead, In this Wednesday’s tender, Economy will face commitments for nearly $1.7 billiona much lighter amount and, above all, concentrated in a Lecap that expires this Friday.

Debt, dollar and rates: expectations in the city

Thus, the Ministry of Finance, which leads Pablo Quirno, will announce this afternoon the conditions for the operation and the menu of titles that it will offer to investors.

The truth is that, beyond the combo of instruments eligible for placement, in the city they calibrate their next financial decisions based on the expectation of key definitions in exchange and monetary matters after the publication of the December inflation data.

The National Institute of Statistics and Censuses (INDEC) will announce this Tuesday, at 4 p.m., the consumer price index (CPI) from last month, which consulting firms estimate below 3%. Javier Milei already announced that, if the indicator is around 2.5%, the reduction in the rate of devaluation will become effective of the official exchange rate from 2% to 1% monthly.

The cut in the exchange rate would seek to support the process of slowing inflation at the beginning of the year at the expense of giving another twist to the exchange rate appreciation. The economic team maintains that, at the current level, the “crawling peg” stopped acting as an exchange anchor for the CPI. The decision would also aim to avoid a drastic reversal of bets on the “carry trade”, which last year left juicy profits in hard currency.

image.png

Yet, The market expects that the significant drop in the pace of monthly increase in the official dollar will be accompanied by a new cut in the interest rate. reference of the Central Bank (BCRA), although more moderate.

The consultant 1816 noted: “We assume that, when they lower the ‘crawl’, they will also lower the monetary policy rate (MPR), although in a considerably smaller proportion. The crawl pace will drop by half, but the rate may drop 10% or 15%, that is, between 300 and 500 basis points from the current 32% TNA of the LEFI rate.”

It is clear that, if these decisions are made this week, it will affect the result of the placement of debt in pesos.

Debt: the tender calendar

This Wednesday will be the first tender of the year. Days ago, the Government announced that In 2025 there will be two placements per month, except for December, month in which there will be only one.

It will be a year with significant maturities in local currency, which reflect not only the profile that emerged from last year’s refinancing but also the capitalization of interest on fixed-rate bonds and bills.

$15.8 billion expires in January; in February, $10.3 billion; in March, $6.3 billion; in April, $6.9 billion; in May, $8.8 billion; in June, $9.7 billion; in July, $1.6 billion; in August, $3.6 billion; in September, $2.8 billion; in October, $2.6 billion; in November, $4.5 billion; and in December, $17.1 billion.

image.png

Source: Ambito