The measures that the economic team announced this last week have a common thread: the bets on reinforcing the incentive for dollar credits to the private sector, which were the main support of the Central Bank’s foreign currency purchases and the exchange rate scheme during the last months, fed back with the “carry trade”. The initiatives to try to stimulate consumption in dollars within the country, the reduction in the rate of devaluation since February and the decision, for now, not to accompany this announcement with a rate cut point in this direction.

The reason is that financing in foreign currency (both banking and through stock market issues) is settled in the official market by the companies that take it. In the case of bank credit, settlement is mandatory and automatic; In the case of negotiable obligations, doing so enables companies to access the official dollar to repay both the capital and the interest on these debts. These settlements fuel the supply of foreign currency in the exchange market and allow the BCRA to maintain a considerable purchasing balance. despite the current account deficit.

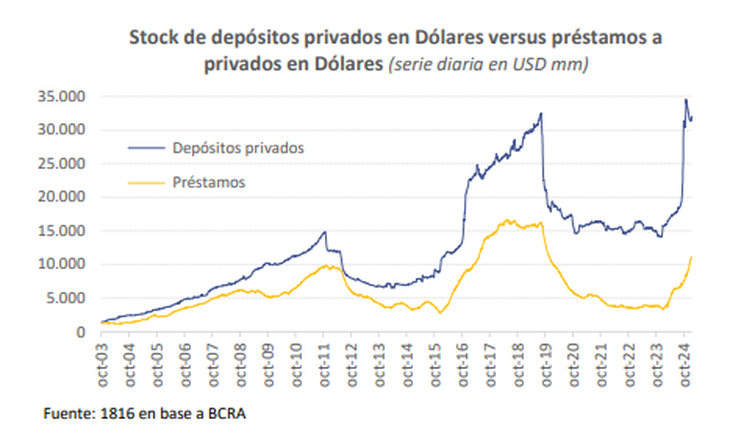

Driven by the strong growth of foreign currency deposits resulting from laundering, the stock of bank loans in dollars to the private sector was shot from US$6,581 million in mid-August 2024 to US$11,138 million on January 10 (latest data available), which involved an additional offer of US$4,557 million. The consulting firm 1816 highlighted that this increase “explains practically 100% of BCRA purchases” in the official market during that period. In their latest report, their analysts noted that They still have a lot of growth potential. given the level of private deposits in dollars, which is above US$31 billion.

image.png

This dynamic works in tandem with the “carry trade” incentive.the strategy known as the financial bicycle that consists of getting rid of positions in dollars, starting to make a rate in pesos through instruments that have a performance higher than the rate of devaluation and then dollarizing again to make juicy profits in hard currency. In part, the “carry” of recent months was fueled by loans in dollars to companies that got on the bike.

The announcement of local payments in dollars

This Thursday, The BCRA enabled payments in foreign currency with debit cards in all businesses in the country and called on the acquiring companies to adapt the systems for implementation before February 28. Payments in dollars with debit cards were also enabled through QR interoperable, which must be in place before April 1. In addition, the Government established that the prices of products on shelves can be displayed at the same level in pesos and dollars.

The economic team presented the measures as a step towards “coin competition”. In addition to the fact that it will depend on how much real acceptance payments in dollars have, analysts interpreted the measure as a mechanism to try to provide more fuel to the dynamics of dollar loans.

image.png

The economist Emiliano Libman considered that the measure can boost the growth of deposits in dollars, which determines the loanable capacity in foreign currency: “Although there is still a lot of room for banks to continue expanding credit in dollars with existing deposits, the process could lose strength. Currency competition could give impetus to the growth of deposits and allow the process of credit expansion in dollars not to lose momentum.”.

Along these lines, he considered that, for that reason, “shortly we will be discussing whether banks will be able to lend dollars to those who do not have income in said currency”, something that is prohibited by current regulations arising from the experience of the 2001 crisis.. In fact, for some time now some private financial entities with national capital have been quietly asking for flexibility, something that many economists consider risky.

In dialogue with Scopethe financial analyst Christian Butler agreed that the measure seeks to keep the dollars deposited within the banks, which favors the evolution of credits in foreign currency, which in turn feed the “carry trade.”. “In this way, the BCRA buys the dollars that it can later use, in the best of cases, to reinforce reserves or to intervene in financial dollars and prevent the gap from increasing or, as it did last year, to sell them to the Treasury to comply with debt payments,” he noted.

Furthermore, Buteler stated that, if at any time distrust grows due to some internal or external problem, it is much easier for the public to go and withdraw the dollars if they are deposited as savings than if that money has already entered the transactional circuit of the economy. “The Government also points to that. Although that has to be seen. Because Whoever laundered what they did was regularize their savings; From there to voluntarily wanting to transform it into transactional money there is an abyss. “I don’t see it as automatic or as simple,” he said.

However, the analyst also considered that it is likely that the Government will at some point prepare to expand access to bank loans in dollars to more actors. “The ‘carry’ has a limit” because, at some point, the companies that entered begin to have more credit cancellations than disbursements, he noted. And he added that, although he believes that the Government aims for this to happen when more dollars begin to enter through other means, it cannot be ruled out that they seek to add more players to the circuit.

Dollar, rate, “carry trade” and credit

The other decisions of the economic team point in the same direction. The announcement that the exchange table will mark that the official dollar will begin to rise 1% monthly since February (half current pace) comes to reinforce the incentive to get on the financial bike since it expands the return in hard currency that is obtained by making a rate in pesos.

That signal was reinforced with the BCRA’s decision this Thursday not to advance, at least for now, in a cut in the monetary policy rate.which currently marks a return of 2.7% monthly effective (TEM) for banks that own LEFI. It remains to be seen if any reduction is implemented in the coming weeks or already starting next month. However, the Treasury acted along the same lines: in the peso debt tender on Wednesday it validated Lecap and Boncap rates slightly higher than those of the secondary market.

If it continues at the current level, the monetary policy rate will begin to yield 1.7% TEM measured in official dollars. “A spread like that would be remarkably high.” (1.7% TEM is more than 20% annually) and in fact it is something that we have not seen since May 2024,” the company measured. consultant 1816. And he added: “Such a difference between rates in pesos and local rates in dollars would further encourage the generation of loans in foreign currency”.

“A potential adverse effect of keeping the rate unchanged is that it implies a higher financing cost for both non-exporting companies and the Treasury.”. If the Government is determined to maximize the expansion of private financing in dollars, a perhaps more effective policy (but also more risky from a macroprudential point of view) would be to relax the credit regulations that today only allow exporters to access these lines. he warned.

In any case, the economic team seems determined to reinforce the circle that, until now, has allowed the BCRA to maintain a significant volume of foreign currency purchases despite the red current account exchange rate in recent months. The fact is that the confirmation that the trend towards exchange rate appreciation will be reinforced with the lowering of the “crawling peg” predicts an increasingly greater drain on dollars from the tourism account and a possible compression of the surplus in the balance of goods.

Source: Ambito