The risk rating agency Moody’s warned that 2025 will be a more challenging year for Argentine companies when it comes to refinancing their debtssomething that began to be seen in practice weeks ago with the default of several major companies linked to the agricultural sector.

In a report published this Monday, Moody’s noted that “Argentine corporate issuers have adequate levels of liquiditymeasured as cash coverage and short-term debt equivalents, particularly those issuers that have A/A+.ar ratings or higher”, but warned that those levels began to deteriorate last year.

“As a result of the drop in the level of activity in the first months of 2024, added to fewer financing alternatives in the dollar linked stock market instruments, the liquidity level of companies deteriorated in 2024mainly in issuers with a rating of A-.ar and remains at adjusted levels for companies rated in the range of BBB or lower,” the firm’s report emphasized.

In that sense, he indicated: “We consider that those Issuers with liquidity levels below 50% that have a low level of idle lines with financial entities and do not have the capacity to place hard dollar debt will face a greater refinancing risk in 2025.”.

image.png

X-ray: the credit situation of Argentine companies

The document of Moody’s emphasizes that companies with a rating A/A+.ar or higher have “high levels of liquidity that exceed the maturities of the next 12 months (cash to short-term debt above 100%) and broadly mitigate refinancing risks in the short term”.

Instead, A-.ar issuers and particularly in the BBB range or lower “are the companies with the greatest challenges in facing the maturities of the next 12 months”. On average, issuers rated A-.ar have cash coverage and cash equivalents. debt short-term at levels of 45% in 2024, below 62% in 2023, while on the other hand, issuers with a BBB rank or lower have tight liquidity metrics that are on average below 20%, explained the report.

“The AAA.ar rated issuers“Although they have a coverage level that is around 80%, they share high financial flexibility with broad access to financing in the local and international capital markets and lines available with local, bilateral and foreign entities,” he explained. universe of companies.

Dollar linked: they anticipate higher rates and shorter placement terms

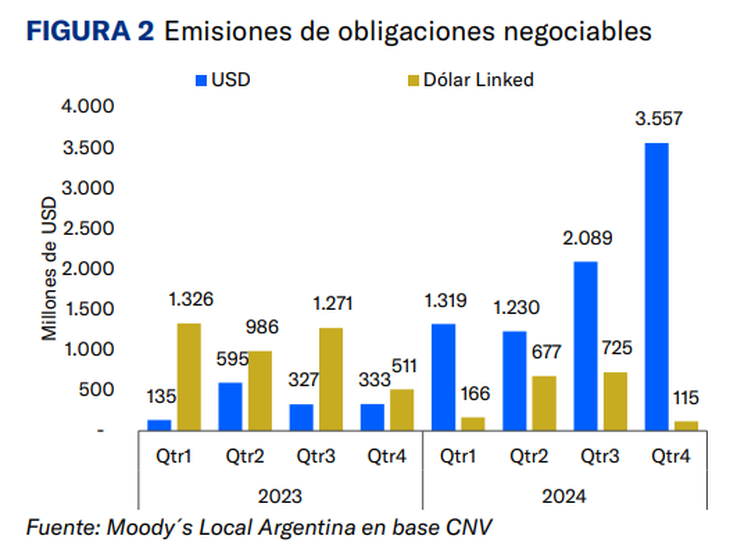

According to the rating agency’s analysis, the greatest difficulties of corporate issuers would be reinforced by the poor outlook for dollar-linked debt, which already lost ground last year.

image.png

“For the next 12-18 months we expect the decline in the depth and terms of dollar-linked instruments to continue, coupled with a considerable rise in the cost of financing.in line with what happened in 2024, and more pronounced as a result of recent events of non-compliance. This new scenario “represents fewer refinancing alternatives for issuers with a high use of dollar-linked promissory notes and negotiable obligations, which will have to take on debt at a higher cost in both dollars and pesos.”.

Likewise, Moody’s considered that, given a scenario of lower expected inflation and greater exchange rate stability, “the real rate in pesos begins to position itself at positive levels and could put pressure on interest coverage and the generation of operating cash flows.”

“Towards 2025, we expect placement rates for dollar-linked instruments to continue rising with smaller issue sizes and shorter terms. After a 2023 marked by a high demand for coverage by investors in the event of a possible jump in the exchange rate, where a record was observed in the issuance of dollar-linked instruments with a virtually negative cost; In 2024, dollar-linked issues lost share due to greater demand for hard dollar instruments and the return of corporates to international markets,” the report stated.

According to Moody’s numbers, the amount of dollar linked issues decreased to $1.7 billion from record levels of $4 billion in 2023. In the same sense, issuance terms fell to 27 months in 2024, from 36 in 2023 and the average placement IRR rose to 4.7% from -0.9% in 2023.

In short, the rating agency’s view raises questions. After you sign as The Grobo and Groovesamong others, failed to fulfill their commitments, the question is whether the situation could expand to other sectors.

Source: Ambito