The Central Bank confirmed that, in January, it expanded its intervention on financial dollars. In the first 16 days of the month, it used US$619 million of reserves to avoid a rise in the MEP dollar and the CCL. It is about the largest amount allocated by the BCRA since it launched this strategy in July. The objective was to contain the upward pressures on the exchange gap at the beginning of the seasonal period of reversal in the demand for money to try to keep expectations of devaluation and, therefore, inflation at bay.

The numbers, which the monetary authority usually publishes with a delay, come from a presentation made in London by the vice president of the BCRA himself, Vladimir Werningbefore investors.

image.png

The US$619 million that the BCRA allocated to contain the gap, only in the first half of January, is almost double what it used in all of December (US$325 million)which was until now the month with the greatest intervention. In his presentation, Werning sought to show that this intervention is much lower than the foreign currency purchased by the Central Bank in the official market (US$1,329 million in the first 16 days of the month), which still allows it to preserve a significant net balance between both operations, mostly used to pay debt.

However, the increasing volumes of intervention, something that had already been pointed out by Scopereflect that the upward pressures on the exchange gap (today located around 13.5% in the case of the CCL) They are older at the beginning of the year.

Werning He spoke this Monday in London before investors, within the framework of the 11th BBVA Latin America Conference. His presentation was titled “Argentina’s Economic Program (Stage 3): Internal Stability (lower monetary stocks and fiscal balance) provides a solid foundation to build External Flexibility (higher foreign exchange stocks and balance of payments balance).” There, he reaffirmed the direction of the economic program and He referred to the next steps of the BCRA and the Government. The priority is “to get out of controls and implement currency competition,” he said.

The BCRA and inflation expectations

During his presentation, the official reviewed the path taken so far in Javier Milei’s administration and praised the impact of “anchors” deployed in the economic program (fiscal, monetary, exchange rate and income) that, according to their analysis, avoided “hyperinflation.” It is a line that at the beginning of this year the Government intends to reinforce through the continuity of the adjustment, of the “carry trade” incentive, of the reduction in the rate of devaluation and of the ceiling on joint ventures.

Likewise, he assured that this gave way to a “collapse of inflation expectations” among different actors. Firstly, he stated that the perception between the general public is that “inflation has dropped a lot and is expected to continue decreasing” for which he cited a survey by the consulting firm Poliarquía that shows that these expectations have fallen to levels not seen in two decades.

Regarding the projections of the city analystsemphasized that “they continued to be systematically revised downwards,” in accordance with the Market Expectations Survey (REM) carried out by the BCRA at the end of December. According to the latest REM, consulting firms and banks foresee a continued slowdown in the monthly CPI from 2.7% in December to reach 1.8% in June.

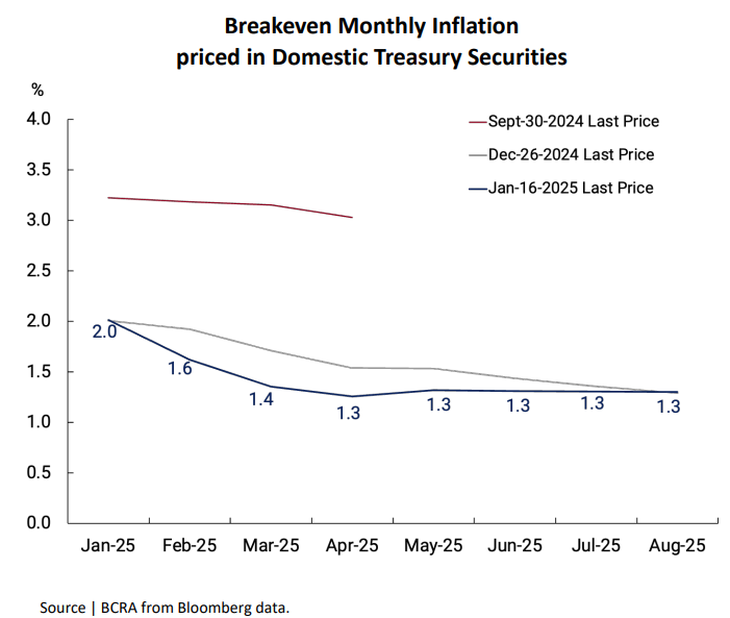

Furthermore, he stressed that the expectations of the investors reflected in the quotes of Treasury peso securities and dollar futures reflect an alignment both with a significant slowdown in inflation and with compliance with the reduction of the monthly devaluation rate from 2% to 1% starting in February . With one of the graphs that he showed to the audience, he celebrated the city’s optimism: he indicated that the call “breakeven inflation” (the expectation implicit in yields in pesos) is 2% for January, 1.6% for February, 1.4% for March and 1.3% from April to August, according to Prices in effect as of January 16. The growing direct intervention on financial dollars, despite the continuity of the “blend dollar”, is understood within the framework of the official objective of keeping expectations on nominal variables anchored.

image.png

Next steps: stocks and coin competition

In the last section of his presentation Werning referred to the next steps facing what the Government calls the “stage 3” of the program. At that point, he assured that The priorities are “get out of control and implement currency competition.”

The message coincided with what the entity chaired by Santiago Bausili raised last Thursday when announcing the enabling payments in dollars with debit cards (starting in March) and with QR (starting in April) in all businesses in the country, a measure that marked the path to “currency competition.”

The truth is that there is agreement among economists that Talking about real currency competition while there is an exchange rate does not make much sense.. Also, as he said Scopethere is agreement among analysts that One of the short-term objectives of this measure is to try to keep dollar deposits within the system. (which increased sharply due to money laundering) which are the necessary ceiling to promote the generation of credits in foreign currency to the private sectorone of the main sources of foreign currency supply during recent months that allowed the BCRA to maintain a significant purchasing balance.

Something about that seemed to suggest Werning in his presentation. There, he maintained that the “income from the capital account (corporate issuances and household repatriation) will support the current account,” which in recent months became deficient as a result of the tourism boom abroad, among other factors, stimulated by the growing exchange rate appreciation.

image.png

The official indicated that, with these next steps, they will seek to advance “greater external flexibility.” Although he stated that, in view of the lifting of the stocksthere are some conditionslike the reduction of inflationary inertia and strengthening of reserves of the BCRA, two points that both Luis Caputo and Javier Milei have been scoring.

The reality is that, after the last foreign currency purchase (for more than US$835 million) that the Treasury made to the BCRA in view of the upcoming debt maturities, Net reserves once again remained in negative territory for more than US$10,000 millionif they are measured according to the methodology of the International Monetary Fund (IMF), which excludes Bopreal maturities in the next 12 months and Government deposits.

The Government is betting that one of the key sources of recomposition of the reserves, necessary to move closer to lifting the stocks, comes from the new program that is currently being negotiated with the IMF. After the meeting between Milei and Kristalina Georgieva, head of the organization, it was learned that a mission from the Fund will arrive in Buenos Aires next week with the aim of accelerating the discussions.

With the boost represented by the inauguration of Donald Trump in the United States, the big question is knowing What conditions will the IMF set? to enable greater indebtedness (there is talk of about US$11,000 million). Above all, in exchange matters. The thing is that the Government wants to reinforce reserves to get out of the stocks but also to shore up its exchange rate scheme, which includes appreciation (used to contain inflation). In Washington they consider that the exchange rate should be higher. Can there be an agreement that does not include a devaluation?

Source: Ambito