2025 begins after a Javier Milei’s first year with important achievements in the economic area. First, after many years, he managed to accumulate a Primary surplus of 1.8% of the internal gross product (GDP)for the period, and in the order of 0.3% once the interest payment is discounted; on the other, the Anti -inflationary program He has paid off, which translates into an important political credit from now on.

Therefore, it is not surprising that 2024 was an exceptional year for Argentine fixed income, with sovereign bonds in dollars that more than doubled their hard currency value from very depressed values, and investments in pesos that comfortably exceeded 100% per year of return since the government prioritized the Tax anchor as the center of your economic program.

For this 2025, the Government accelerates the objective of consolidating and deepening the disinflation path. To do this, an ambitious objective of moving from an inflation record of 117.8% in 2024 to the 20% zone in this period is proposed. The first stage is underway with the decrease in the rhythm of devaluation of 2% to 1% monthly since February.

The heart of the program remains a strict fiscal execution, something that is clearly challenging and tied to the eventual increase in collection product of economic growth. On the other hand, politics becomes greater prominence in this Electoral year. The approval of structural reforms that boost the activity and return competitiveness to the private sector, requires a greater political consensus that will be available from the end of the year if the government achieves favorable performance in the legislative.

The career of the pesos for 2025

In the face of this new year, it is worth resuming our usual exercise of “The weight career”with the aim of making available to the investor our analysis of the fixed income alternatives available in the local market to protect the value of the portfolios and take advantage of the opportunities.

image.png

image.png

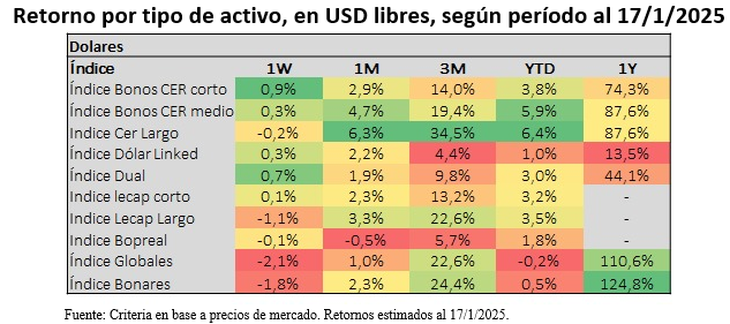

As can be seen in the first picture, Sovereign bonds in dollars – global and bonares – measured both in pesos and dollars, have won the race in 2024and accumulate a gain in local currency of between 100% and 114%, followed by these very far by the bonds that adjust their capital for inflation (CER coefficient), the latter generating an income in the range of 65% to 80% in The last 12 months.

Although measured in pesos, all market instruments have lost inflation just less than 120% in 2024, the entire Argentine fixed income spectrum has generated Attractive returns in dollars given the low variation of the dollar MEP During the last year. Thus, we can see that the sovereign bonds issued in dollars doubled their value, generating a gain greater than 100% in that currency while the country risk was compressed. In turn, the bonds in pesos with CER adjustment had returns that originate up to 90%.

The other participants of the weight race, especially the “Linked dollar” have had a much more modest return, in the hands of the monthly depreciation rhythm of 2% that remained all year old, and before the lower future devaluation expectations that brought a lower need for exchange coverage.

Economic panorama for this 2025

At this stage of the plan, The Government decided to lower the depreciation rhythm of the official dollarthis time to the rhythm of 1% monthly in order to guarantee the decrease in the rhythm of inflation using the “exchange anchor” as a complement to the “fiscal anchor” that we mentioned above.

The main market concern continues to be the capacity of the Central Bank (BCRA) to improve its liquidity to be able to get out of the current stock without shocks in the exchange rate. Despite record purchases of almost US $ 19,000 million during 2024, Net reserves are still in negative terrain for approximately US $ 6,500 million. At the beginning of the year the Government continues to accumulate net purchases supported by the dynamics of generation of dollars, which grew strongly after the success of laundering, and confidence in the plan.

It will be fundamental to be able to retain the acquired reserves that the government has within its reach the option of taking voluntary debt in hard currency as part of the available financing tools menu. Access to the market becomes a possibility in 2025, driven by the sustained country’s sustained risk. Likewise, and as an accelerator of the market output, the alternative of a new agreement with the International Monetary Fund (IMF) is maintained, although this will need to achieve the parliamentary support set by law.

What bonds invest in this 2025?

If the objective of the investor is the administration of the liquidity (box) in pesos, we see Indifference in the short -term options offered. The fixed rate yield curve is inverted, offering lower returns from March.

For investors whose investment objectives tolerate an extension of deadlines, we see attractive in average term LECAPS (3 to 6 months) yield between 2.2 and 2.4% monthlyand allow to capture (fix) rate in an expected scenario of low inflation, where it gradually converges to the rhythm of the “crawling” of 1% monthly.

In the field of dollar bonds, the stars of 2024, We continue to identify value in global bondshighlighting its favorable risk-back relationship. This given the firm conviction of the government to maintain fiscal discipline, together with an express commitment to honor the debt.

With return rates in the order of 11%, global bonds still have room to continue compressing and achieve yields of emerging b- rating emitters that navigate around 9% average. We expect for this year improvements in the current CCC credit qualification granted by risk rating agencies, after the vote of confidence that the market has already granted. Consequently, Much of the expected return in the year will come from the improvement of parity (price) that in this event could be up to 15%to which the entrance for interest coupon must be added. This of course is far from the spectacular returns of 2024, but we still consider them very attractive.

Therefore, when analyzing the sovereign debt under different assumptions and scenarios, we continue to see opportunities in the longest section of the “Hard Dollar” Curve New York Law. The Global 2035 (GD35) and the Global 2041 (GD41) are presented as the most attractive optionsboth in a standardization scenario of the sovereign curve, and in the most adverse scenario, where the slightest parity and legal protection (GD41), work as dample of the fall.

Source: Ambito