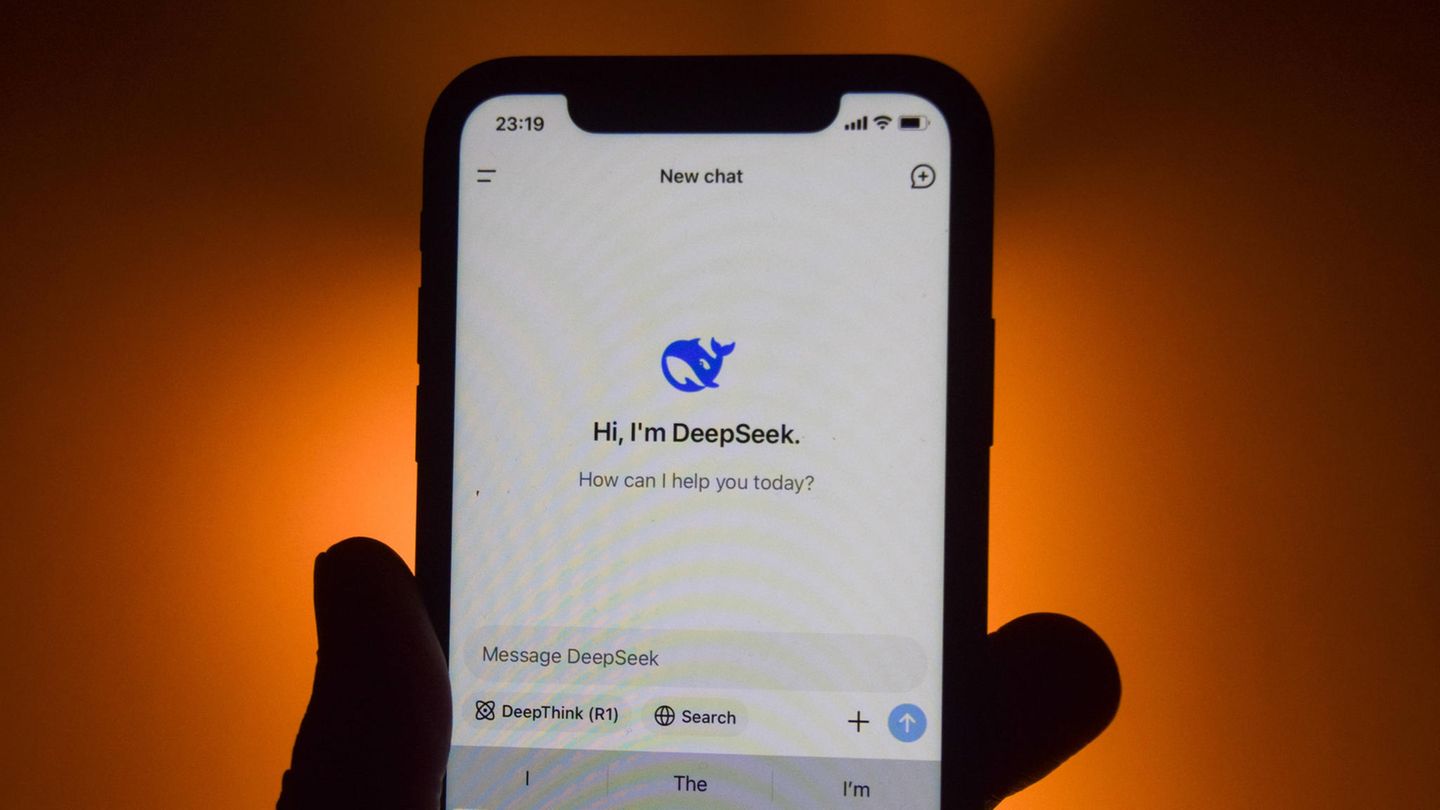

Deep Seek

New Ki-Chatbot from China shocked Wall Street-Nvidia experiences historical crash

Copy the current link

A start-up from China claims to have trained its AI model extremely cheaply. This triggered a massive price slide for US companies like Nvidia. What is behind it.

A Chatbot from China shocked the Wall Street: Panische Investors let the IPO of the CHIP group Nvidia collapse by almost $ 600 billion in one day.

The trigger was the realization that software with artificial intelligence may be trained with much less computing power – and with it also chips from Nvidia – than you have thought so far. Because the Chinese start-up deep Seek claims to have learned its new AI model with costs of less than six million dollars and on a few slimmed down Nvidia chip systems.

You don’t know whether all of this is right. This is how speculation in the industry was that Deep Seek may have access to more Nvidia chips than admitted in view of the US export restrictions. However, investors who have driven Nvidia’s share in the expectation of a future mega business in recent months received cold feet on Monday. US President Donald Trump spoke of a wake-up call for American companies-and at the same time found it “positive” that AI could be cheaper.

The Nvidia share fell by almost 17 percent and the etched $ 589 billion. A US company had never lost so much value in one day-but none was as expensive as Nvidia with almost 3.5 trillion dollars.

What can the US do with better chips?

But what does that mean for the future? American companies recently surpassed with announcements how much money they want to put in AI infrastructure. The Chatgpt inventor Openaai and several partners alone promised to invest $ 500 billion in data centers in the coming years. At the Facebook group Meta, founder Mark Zuckerberg only prospect of $ 60 billion this year. Does Deep Seek now show that you will make do with significantly less computing power?

US experts prefer to see it the other way around. The question was not whether Deep Seek can overtake today’s market leader in the United States, emphasized X. Eyeé from the AI consulting company Malo Santo. It is much more about how quickly you can implement the Chinese research approaches. “If Deep Seek can develop this with old hardware, what can we do with newer hardware?” She asked in the US broadcaster CNBC.

Other AI companies doubt costs

The tech industry will still “need a lot of chips”, was also convinced by industry analyst Stacy Rasgon. “It is clearly a panic today,” he emphasized with a view to the stock exchange reaction. At the same time, Rasgon doubted the information from China: “You did not train the model for $ five million, that didn’t happen.”

Last week, the head of the AI SCALE AI, Alexander Wang said that after his information, Deep Seek had access to 50,000 H100 chip systems from Nvidia, but could not talk about it because of US export restrictions. The US government allows Nvidia to only sell chips to China that are less powerful.

Who is behind Deep Seek?

The company was founded in 2023 by the Hedge Fund Manager Liang Wenfeng-and is said to have secured a package of Nvidia chips. Deep Seek relies on open source models in which the source code is publicly visible. The data is stored on servers in China. The Chinese government does not enjoy information, such as the massacre on the place of heavenly peace in 1989, are embezzled by the chat bot. The fact that Deep Seek rose to first place in the US app store for the iPhone has a special irony in view of the hard approach against Tiktok.

The Deep Seek shock also affected other stocks. The semiconductor companies Broadcom and Marvell gave up on Wall Street about the same size as Nvidia on Monday. The AI server manufacturer Super Micro fell by around twelve percent, Dell by almost nine percent.

Shares of US energy groups were even more under pressure, which had recently benefited from speculation to higher electricity demand from AI data centers. The paper of the chip company Broadcom lost around 17 percent. Constellation Energy’s share fell by a fifth, and Vistra’s course even collapsed by 28 percent. The shares of Apple and the Facebook Group Meta, on the other hand, brought the prospect of cheaper AI.

Dpa

MKB, by Andrej Sokolow

Source: Stern