Today, Argentina belongs to the category “Standalone”, In order to economies with access barriers for foreign investors, political tensions, small capital markets and economies with insufficient regulations. According to the MSCI, the “standalone” countries are those newly incorporated into the index or that have been reduced from emerging or border categories, as is our case.

Other countries in this category are Jamaica, Panama, Trinidad and Tobago, Bosnia, Malta, Zimbabue, Lebanon and Palestine. Craig Feldman, head of MSCI index management research, recalled that since 2019, international investors in Argentina face capital controls in the sharing market.

In its latest report on the Argentine Variable Income, the financial entity maintains that local actions They exceeded the performance of their regional peers in 2024. And it highlights the fact that today they coticen with an 18% premium compared to the MSCI LATAM index, with a price-benefit ratio (p/e) of 10, similar to that of Mexico.

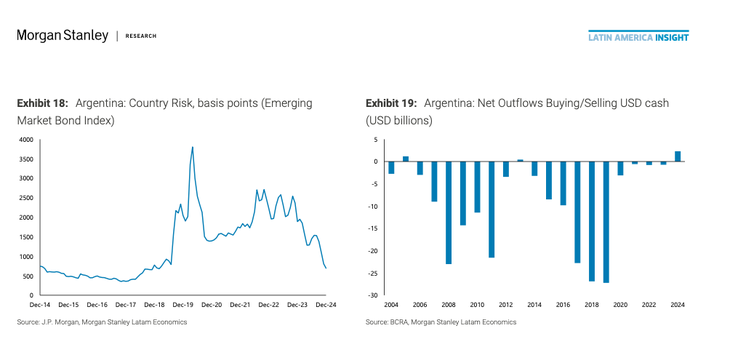

The Investment Bank emphasizes that the key to the sustainability of this stock market rally It will be the sustained growth of business profits, “which would help compensate for the highest risk of Argentina’s country compared to other markets in the region.”

In that sense, Morgan Stanley Weigh the Argentine actions within its investment strategy called “Texas Trade”, Focused on sectors such as energy, agriculture and deregulation. In line with this vision, the bank added to Vista (view), and Edenor (EDN) within its model portfolio of Latin America, together with Free Market (Meli) and Globant (GLOB).

The “Andean Spring”

“Could Argentina be the kick for an Andean spring?”wonders the giant of Wall Street, which analyzes that the economic turn in charge of this government captured the attention of the world. “We believe that Latin America also observes and that Argentina could return to the emerging market index of MSCI within a period of two to 3 years,” says the document.

And add: “The standardization of the exchange rate could accelerate a possible inclusion in MSCI Emerging Marketswhich in turn would help reduce the cost of capital for Argentine shares and facilitate the reopening of capital markets, ”warns Morgan Stanley.

Morgan Stanley 1.png

In this regard, Sergio Rodríguez Glowinski, agent Chicago bag (USA), explains in dialogue with Scope That, as Morgan Stanley says, Argentina has high chances of returning to the MSCI. This, as analyzed, is due to the fact that several of the key and multisectoral requirements, such as the fiscal stability, zero deficit, country risk reduction and the alignment with the central economies, they are almost fulfilled by the current government.

So from a general macroeconomic perspective, everything suggests that Argentina It is in conditions similar to those before being degraded (border market). However, as Rodríguez Glowinski argues, “this improvement is not reflected in certain critical social indicators, Like poverty and unemployment“, which still have significant challenges.

The return to the emerging club, when will it be?

Ezequiel Fernández, Corporate Research Director at Capital Balanzevaluates in statements to this medium that the “timing” for the return to the emerging group is a bit uncertain and depends on an evaluation “partly subjective”On the part of Morgan Stanley, who manages the index.

For Fernández, “as early, It could happen in the indices review of the second half of 2025 and should be conditioned to lift stocks”, He warns. Although it slides a very likely “more likely” panorama in the first half of 2026.

In this regard, Rodríguez Glowinsk is more optimistic and bets than re -entry into Emerging Club It is given in the month of June. On this point, it should be remembered that the president Javier Milei He assured that with the obtaining of new funds to strengthen the Central Bank (BCRA), the stock exit would accelerate, Although the speed will depend on the amount and the structure of the agreement.

Because Morgan Stanley is emphatic that the standardization of the exchange rate and The lifting of capital controls They will be key conditions for an eventual reclassification of Argentina within the MSCI indexes and that if completed, the country could represent approximately 5% of the MSCI Latam index, which would exceed the current participation of Colombia.

Argentine Actions: How much could you enter the Argentine market?

Morgan Stanley ensures that in case of a reclassification of the MSCI index of Argentina to the standard category, he estimates: “A possible capital entrance of approximately US $ 1,700 millions. It should be noted that we assume that Solo YPF, Grupo Financiero Galicia (Ggal), Vista (VIST), Banco Macro (BMA) and Pampa Energía (PAM) could be added to the reference index, given the current size of the market ”.

In this regard, Fernández is categorical: “Reclassification, with value and liquidity to today, could bring indexed flow of between US $ 2,5 billion yu $ 3,000 million that would go to the S&P merval. And he anticipates that although this configures a driver to follow closely because he could help motorize the results of the Byma index, “Upgrade’s expectation is already solid and perhaps at least partially in prices.”

Morgan Stanley 2.png

For its part, Rodríguez Glowinsk asserts that for both the Argentine market and for investors, they are very positive news. “The doors would be reopened to many world financial institutionsthat due to their type of regulations they cannot invest in countries outside this index, ”he says. On the other hand, financial markets become more competitive, with greater liquidity and, consequently, an increase in the volume of operations.

And although returning to the group of emerging markets offers benefits for both financial markets and capital investments, the government faces two key challenges. “First, in the short term, it must address the elimination of the stocks. It would not make sense to be part of the MSCI without lifting this restriction, since the lack of freedom for capital exit would prevent the entry of investments, particularly speculative, ”says Rodríguez Glowinsk.

And secondly, towards the medium term, it will be crucial to solve the issue of legal certainty, “an aspect that still does not work properly in the country and that is essential to attract long -term capital investments,” concludes the expert.

Thus, the potential Argentina’s re -entry to the Morgan Stanley emerging club represents a significant opportunity to boost both financial markets as capital investments. However, this advance will depend on the rigor of the elimination of the stocks, because in the market memory there is still the degradation of to the category of “standalone” in 2021 due to restrictions in accessibility to the market.

Source: Ambito