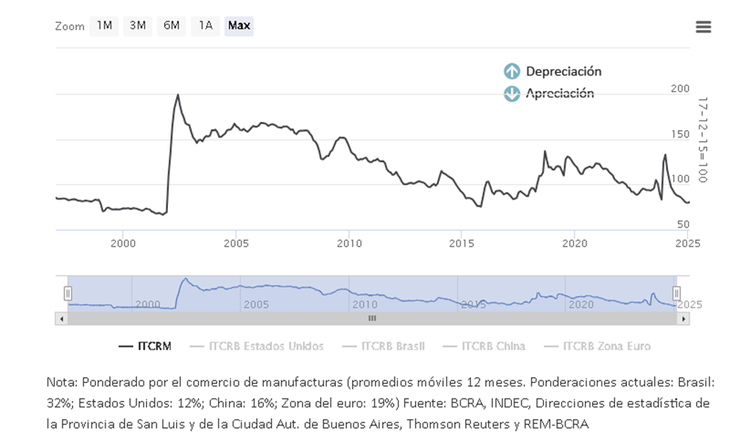

Credit card consumption In dollars in January 2025 a total of US $ 865 millionmarking the highest level recorded for this month in recent 16 yearsaccording to the data of the Central Bank of the Argentine Republic (BCRA). This figure, extracted from the organism’s statistical series, constitutes an unequivocal sign that the official exchange rate does not reflect the economic reality of the country.

image.png

January 2025 registered the highest card expenses of at least the last 16 years 2009.

Christian Buteler with BCRA data

Distortions in the exchange market

The BCRA, in its report “Evolution of the Mercado de Changes y Balancia exchange”, revealed that in December 2024 the net balance of the account “Trips and other payments with cards“He threw a deficit of U $ 456 million.

The Minister of Economy tried to relativize this situation by stating: “I heard many people say: it cannot be that people Veranee in Brazil. How cannot be that people in Brazil, it is a luxury that people Veranee in Brazil, that should be normal. ” However, the problem does not lie in the destination chosen to vacation, but that It is cheaper to travel abroad than enjoy internal tourism.

This distortion occurs in a Context of recession as lived last yearwith Fall salaries for four of the last six years, What limits consumption, and that does not end in the choice of where to vacation but includes the acquisition of goods that are more accessible outside Argentina. So, rows of up to 12 hours at the border with Chile To make purchases, which shows the lack of competitiveness of local prices.

Accelerated growth in dollars

He 166% increase in it Credit card consumption in foreign currency between January 2024 and January 2025 – even the records of January 2018, when there were no exchange restrictions – show that the current exchange scheme Incentives the output of currencies. It should be noted that this data excludes payments made with debit cards and virtual wallets, increasingly used for transactions in the neighboring country.

According to the BCRA, 60% of these expenditures are financed with own dollars, while the 40% remaining is paid in pesoswhich in practice is equivalent to a currency purchase from the Central Bank. That 60% that can be contributed with savings or dollars bought at the MEPwhere there is also an indirect BCRA intervention with the Blend dollar and direct when it operates in the market to lower its price, it also means a foreign exchange output.

Exchange of exchange backwardness

The growth of foreign currency spending with a credit card such as the record in tourists, December 2024 had a 50.6% more broad tourism That the same month of the previous year is only one of the signs that are seen on the exchange delay.

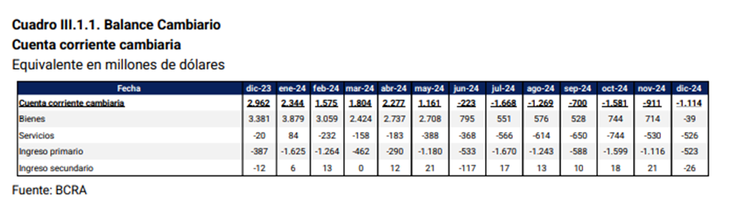

He Real multilateral exchange rate (ITCRM), Despite the appreciation of the Brazilian real – the currency with greater weighting in the reference basket – is within the lowest levels of the last 28 years, registering 80.62 points.

image.png

The actual multilateral exchange rate (ITCRM) is within the lowest levels of the last 28 years.

In parallel, the current exchange account accumulates seven consecutive months of deficit, reflecting a deterioration both in the balance of services and in the trade of goods.

image.png

The exchange current account accumulates seven consecutive months of deficit.

BCRA

A positive factor within this panorama is the evolution of the energy sector, that, thanks to the development of Muerta Vaca and the implementation of the gas pipelinehas reversed its structural deficit. It is projected that in 2025 the energy surplus will reach the U $ S5,000 million. However, although this improvement contributes to mitigate the output of foreign exchange, it does not counteract the negative effects of importation of imports, which affects local production and employment.

The risk of sustaining an artificial exchange rate

The appreciation of weight does not respond to a sustained income of foreign investments nor to an increase in productivity, but to the arbitrary determination of the exchange rate by the government. This scheme ignores the evolution of internal prices and the dynamics of the dollar internationally. The more the correction of exchange mismatch is postponed, the greater the cost of its eventual normalization.

Argentina does not simply need to devalue under the current regime. The urgent thing is to move towards a free and flexible exchange rate, determined by supply and demand. While the exchange restrictionsthe imbalances will be deepened and the eventual market unification will be increasingly expensive. If corrective measures are not taken in time, the combination of exchange delay, currency output and weakening of national production could lead to a new financial crisis with severe consequences for economics and employment.

Source: Ambito