Provinces face debt maturities in dollars

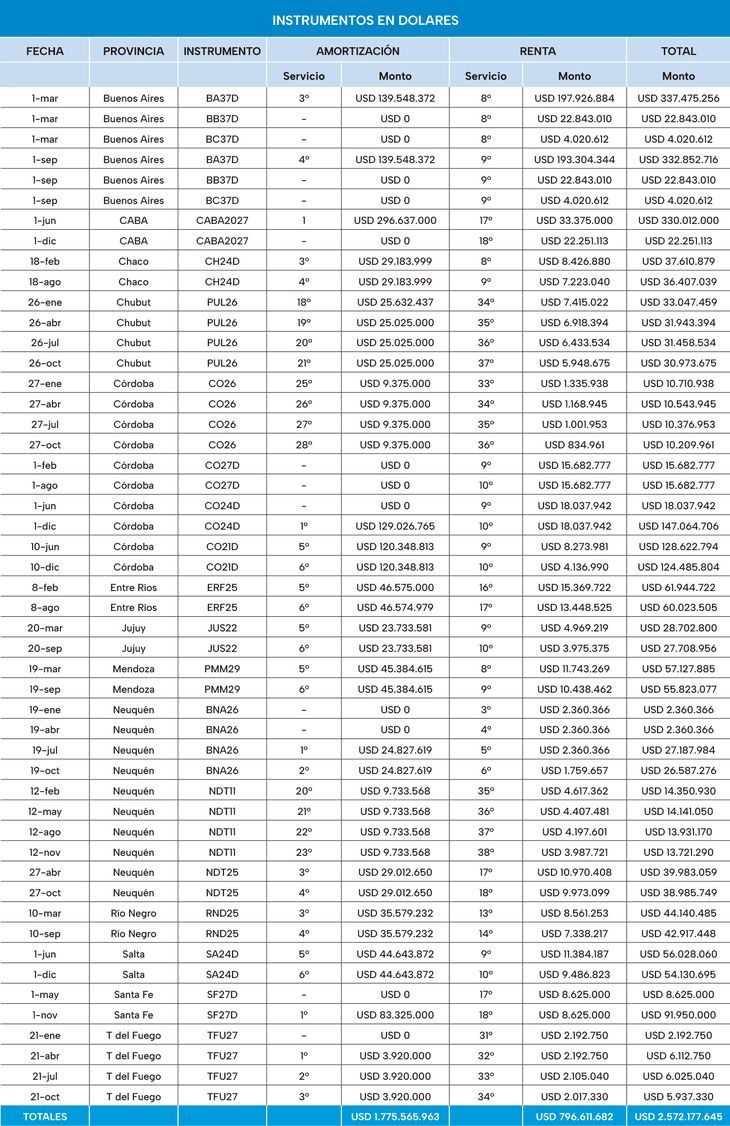

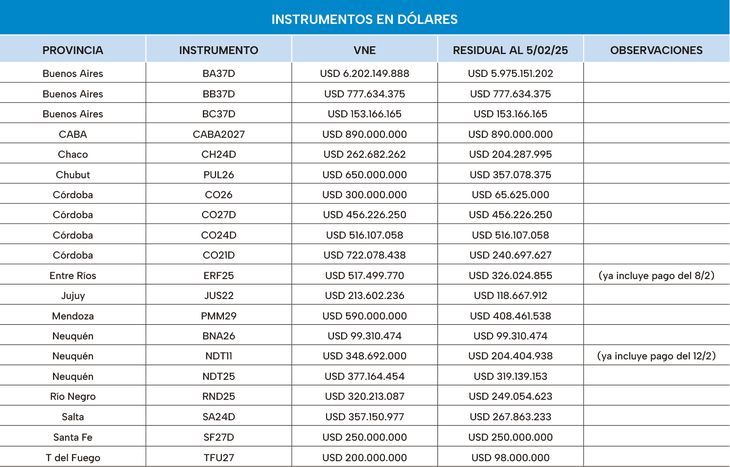

Specifically, CABA, Buenos Aires, Mendoza, Salta, Entre Ríos, Jujuy, Río Negro, Chaco, Santa Fe, Chubut, Córdoba, Neuquén and Tierra del Fuego, Antarctica and South Atlantic Islands (TDFAEIAS) They are administrations that have dollars debt. The latter four have already faced maturities in January, opening the official calendar.

In the Chubutense case, it was the PUL26 bonus, issued in 2016 under foreign legislation and restructured in December 2020. In January 2025, it paid the 34th Income Service and the 18th Capital Amortization Service for a final total of US $ S33.965.048 (amortization for 3.85% of the VN and annual nominal interest rate applied 7.75%).

Foreign debt.jpg

Chaco Politikón data.

Cordovameanwhile, disbursed US $ 10.7 million, in interest for titles issued in 2016 and 2017 for trunk gas pipeline financing. It was the 33rd service of local debt titles at 7.125% with expiration in 2026, corresponding to US $ 9,375,000 of capital and US $ 1,335,937.5 of interest, totaling an amount of US $ 10,710 .937.5.

As for their financial conditions, they were issued with a coupon of 7.125%, pay interest and amortizations in a quarterly form and have expiration in October 2026.

At par, Neuquén paid the third rental service for a final total of US $ 2,360,366 (annual nominal interest rate 9.45%) of the BNA26 letters, issued in 2023 under local legislation.

Finally, Tierra del Fuego faced the 31st rental service for a final total of US $ 2,192,750 (annual interest rate applied 8.95%), of the TFU27 bonus, issued in 2017 under foreign legislation and restructured in January 2024.

“The total effectively paid in foreign currency (dollars for all cases) during this month of analysis was for USD 48.311.512 and the weight of maturities in foreign currency over the total of the month was 16%,” They pointed out from Politikón Chaco.

Projections-01.jpg

Production of scope based on data from Politikón Chaco.

Various provincial economy ministers consulted by Scope They agreed that the cheap dollar foster the acquisition of stock by the districts. “At the current official exchange rate, the payment of debt in dollars is easier to face the collection in pesos,” One of the voices pointed out.

The Fueguino case, however, is different. Its debt is guaranteed by hydrocarbon royalties, which are deposited in a trust; With the tank, dollars are acquired. For this reason, the variation in the price of the foreign currency does not impact as it does happen in other provinces. Similar system use Patagonics Chubut and Neuquén.

This year, in addition to the US $ 2,192,750 paid in January, TDFAEIAS will have maturities in April, July and October for a total of US $ 18,075,120.

In February, meanwhile, the calendar will continue with more disbursements: Córdoba, US $ 15,682,777; Entre Ríos, U $ S61,944,722; Neuquén, US $ 14,350,912; and Chaco, US $ 37,610,879.

Projections-02.jpg

Production of scope based on data from Politikón Chaco.

For its part, The province of Buenos Aires will have three maturities in March of US $ 337,475,256, US $ 22,843,010 YU $ S4.020.612, rounding a total of US $ 364,338,878.

Then, in September, another trio of commitments will reach US $ 359,716,338. In this way, the district will be the one that will pay the largest amount of debt in dollars in 2025, with US $ 724,055,216.

That podium completes it Cordovawith US $ 490 million and the Buenos Aires Citywith US $ 352 million. They are followed Neuquén (U $ S151 million); Chubut (US $ 126 million); and Entre Ríos (U $ S122 million).

Provinces improved credit qualification

In January, Moody’s consultant raised the credit rating of different provinces: City of Buenos Aires, the provinces of Córdoba, Mendoza, Santa Fe, Chubut and Tierra del Fuego.

The firm considered that improvement “It derives from the flexibility of government restrictions to cross -border payments, increasing liquidity in foreign currency and reducing the risks of transfer and convertibility, despite the still limited opening of the capital account.”

In Mirror Standar & Poors Global Ratings on Thursday, the credit ratings of a global scale, in local and foreign currency A ‘B-‘ of ‘CCC’ of CABA, Mendoza, Salta, Neuquén and Jujuy, For their sustained capabilities to fulfill their financial obligations, even in a context of economic pressure and cuts in national transfers.

Embed – https://publish.twitter.com/Oembed?url=https://x.com/meconsalta/status/18789316781233777?

Specifically, in the Salta case it was stressed that “The accumulation of liquidity in recent years allowed the province to face moderate debt payments without compromising essential services.”

The stable perspective suggests that, if these responsible policies are maintained, the province could continue to improve its credit profile. This international recognition reinforces the confidence in the economic management of Salta, demonstrating its resilience against macroeconomic challenges.

Source: Ambito