The prices of the future dollar increased in the first week of February, however the market does not foresee exchange jump until after the October elections.

The market adjusted its expectations about devaluation after the latest government statements. According to the survey of market expectations (REM) of the BCRA, LEconomists foresee a 17.6% increase in the exchange rate between December 2024 and the same month of 2025, Figure even higher than the monthly devaluation rhythm of 1% established by the Government.

The content you want to access is exclusive to subscribers.

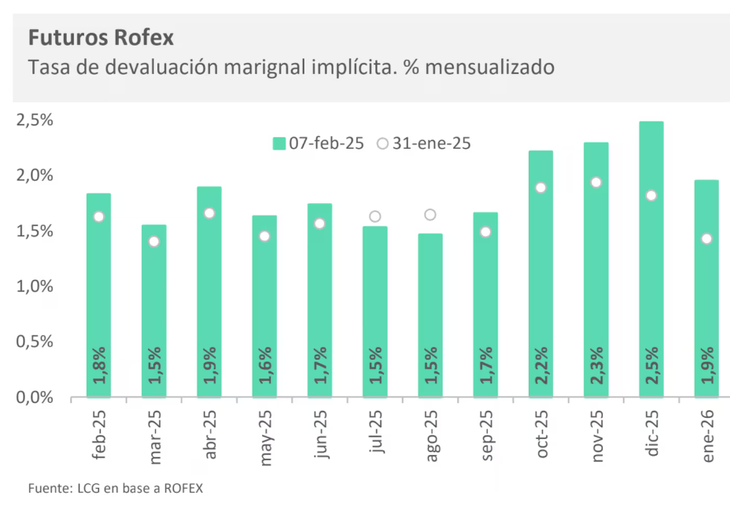

In addition, the prices of the future dollar increased in the first week of February, especially for the deadlines from April, which reflects expectations of a devaluation greater than that projected by the Government, exceeding 2% monthly in the last quarter of 2025, according to the LCG consultant.

Outlier analysts pointed out that, although future dollar prices increased in long -term contracts, they still have little volume, and the increases coincided with rumors about possible Devaluation orders by the IMF. According to the futures market, The Government is not expected to lift the stock before the October electionswhich generates expectations of an accelerated devaluation at the end of 2025.

Future dollar contracts for October, November and December rose in the last week, with a dollar projected to $ 1282.50 in December. However, if the government maintains a devaluation of 1% monthly, the wholesale dollar should be around $ 1152 in Octobersuggesting that the market anticipates a jump in the exchange rate.

On the last business day of this week, future dollar contracts operated up. The market price an average monthly adjustment of 1.6% for the next six months. For the middle of the year a dollar is expected at $ 1,143.

The specialists argue that this divergence occurs more due to global uncertainty, which is harming the coins of the world, although they see that as the official exchange rate is key in the 1% increase, ROFEX contracts will accompany.

What is the future dollar and how it works

In future dollar contracts, they are negotiated in pesos and pay the official exchange rate at the expiration. The seller undertakes to deliver an amount of dollars to an agreed exchange rate. At the expiration, if the official exchange rate is different from that agreed, The difference is compensated: if the officer is higher, the seller covers the gap; If it is lower, the buyer pays the difference. This compensation is carried out daily through the liquidation of differences.

Screen capture 2025-02-09 134647.png

Source: Ambito