The debate about the assumption Dollar delay or price advance has taken the economic agenda of the last weeks. Those who use the idea that with the current exchange rate Argentina can work correctly consider that “There is a regime change” that is based on the fiscal surplus.

What is mentioned in these cases is the “Systemic competitiveness” of the economy, which then forces the government to lower taxes to reduce production costs, among other aspects. The problem for those who support this theory has to do with the speed at which the changes are applied, since according to previous experiences in the country, they delay or do not arrive.

One of the elements that is most present on the government agenda is The question of Argentine tax pressure. In effective terms it is historically between 31% and 33% including national, provincial and municipal taxes, which is equivalent to that of countries of the Organization for Economic Cooperation and Development (OECD).

The problem The quality of Argentine taxes is that some of the most important are distortive and to eliminate them, without carrying out an integral tax reform, it can take up to more than 10 years.

PRESSURE-FISCAL-IAF.PNG

The Argentine Fiscal Analysis Institute (Iaraf) It maintains “if you want to lower or eliminate taxes, financed with less public spending, it is necessary Tax pressure ”.

He says that “since there is considered no room To continue with real -registered casualties of public spending, the way to finance tax reforms via expense is from a lower participation of public spending in the economy ”. That is, a freezing in relation to the size of the GDP. The report raises the objective of the May Pact of reducing the total public spending of Argentina to an equivalent of 25% of the gross internal product. To do this, the Government should keep the expense per inhabitant frozen.

Expenditure-Project-iaraf.png

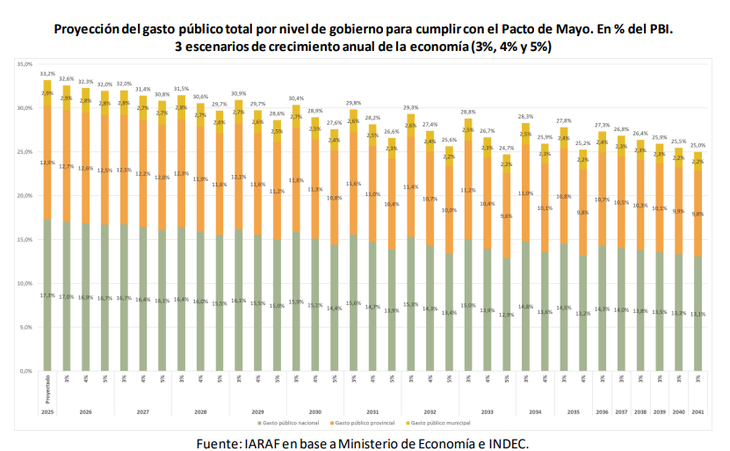

“In 2025, projected consolidated spending is 33.2% of GDP and the consolidated tax pressure of 30.5% of GDP “says the private report. It indicates that “when the PBI 3% in the year 2026real expenditure increases 1.2% and real collection by 1.35%; Both the relative weight of spending and collection decrease, in this case, 0.6 points of the GDP and 0.4 points of the GDP, respectively. ” “When this situation is repeated year after year, In 2041 the public spending level closest to 25% of GDP would be achieved, With an effective consolidated tax pressure of 23.4% of GDP, ”adds the report.

Yes same progression would occur with a 4% annual growth convergence would be achieved in 2035. Meanwhile, if the economy Annual 5% grew that “the objective level of the May pact expenditure would be reached in a smaller number of years, specifically in 2033”. “In this case, consolidated public spending would be 24.7% of GDP and the effective tax pressure of 22.9% of GDP,” the study adds.

What would be the taxes to eliminate?

The report sets on your attention to the Export rights and check taxthe provincial taxes of Gross income and stamps tax and the municipal safety and hygiene rate They add an effective tax pressure of 8% of GDP and therefore, the reduction of spending to eliminate them should be of that magnitude.

The work concludes that just “With 9 years of growth of the economy at 5% annual, and a public spending that grows to the population’s rhythm, could be eliminated “ Those taxes. “In the other growth scenarios, of 3% and 4% per year, obviously the fiscal space generated is lower. In the first case, 18 years are required and in the second case 12 years, for the elimination of the five most distortive Argentine taxes, ”explains the Iaraf.

Why isn’t today comparable with that of the 90s?

The economist Jorge Colina, director of the Argentine Social Development Institute (IDESA) Consider that the debate in Argentina has to focus on taxes and not on the dollar. And ensures that President Javier Milei’s arguments that the exchange rate are not correct. “Compare the current level of the exchange rate with the historical average or with some particular time is an incorrect approach since the current conditions are very different from those of the past, ”he says in an IDESA report. In that sense, he states that:

-

The check tax in the ’90 did not exist, in 2024 it generated 1.6% of GDP.

-

Export rights in the 1990s represented 0.01% of GDP, while in 2024 they put a tax pressure of 1% of GDP.

-

With gross income, the provinces raised in the ’90s 2% of GDP, while in 2024 they raised 4% of GDP.

“These data show that, in terms of Distortive taxes, which are those that destroy competitiveness, the ’90s was very different from the current one, ”says the study.

Source: Ambito