If the government’s decision is not to devalue the peso against the dollar in 2025, Based on the idea that an economy in recovery tends to appreciate its currency, then to avoid the competitiveness of companies exposed to importation or exporters, it will be obliged to make a public spending correction.

To be able to keep this year The relationship between public spending and the new dollar that will adjust to 1% monthly, The Executive will need to make a correction of at least 5% real about the non -indexable component of the sameaccording to estimates of the Mediterranean Foundation.

As it happened at other times of weight appreciation and given the impossibility of altering the price of the dollar (more than anything in an electoral year) the Government of the moment is obliged to hurry some cost reduction via taxes, And for this it is necessary to lower the expense.

The report says that The spending of the National Public Sector of 2024 measured in official dollars last December was the lowest since 2012. That year it reached the U $ S166.6 billion. The maximum was in 2015, with US $203,900 million, and the lowest point was Last year with US $ 94.9 billion.

Expenditure-in-Dolass.png

Jorge Vasconceloseconomist of the Mediterranean Foundation, states that “the primary expenditure of the national public sector closed 2024 in a figure of US $ 94.9 billion with a Topy no less than 28% compared to US $ 131.6 billion of 2023 ”.

“This indicator shows a crucial difference with the government transition from 2015 to 2016, When public spending in dollars It adjusted 14.5 %, to be at a level of US $174.4 billion “add the text.

Work adds in that sense that “The fiscal policy of the current management looks much more consistent with macro balances that those experiences, but the task just begins. ”

“Public spending dollars shows the existing pressure on the economy sector that produces export goods and competes with imports, and 2024 data They reflect a much less heavy ballast in relation to the entire period of stagflation that began in 2011 ”, Explain Vasconcelos.

What is the adjustment that Javier Milei should apply this year?

Although the government avoids its importance, During the past year the actual multilateral exchange rate (TCRM), which is the result of a basket of a dozen coins from countries with which Argentina trades, It is 29% appreciated with respect to the average of the last 28 years.

CORRED-BCRA.PNG

The economist indicates that so that public spending measured in constant dollars is maintained at that level, that is, so that it does not get worse, this year “You have to make additional adjustment of 5.3 % in real terms in non -indexed items.” “The budget items subject to that restriction are the corresponding to personnel, economic subsidies, investment and discretionary transfers to provinces. This is because for indexed items, which include retirement, that year there will be an increase in real terms of 11.6%, due to the inertia of the formulas, ”says the report, based on calculations from another Mediterranean economist, Marcelo Capello.

Even with the adjustment it can be insufficient

The report warns, however, that Even with the decline of public spending measured in official dollars, it may not be enough, Because in reality, although the gap with free dollars can be maintained at 15%, reality indicates that There is no unique price for the currency. And that is checked with the balance of the current account, that is, what remains after the economy makes all its dollar charges and makes all its payments.

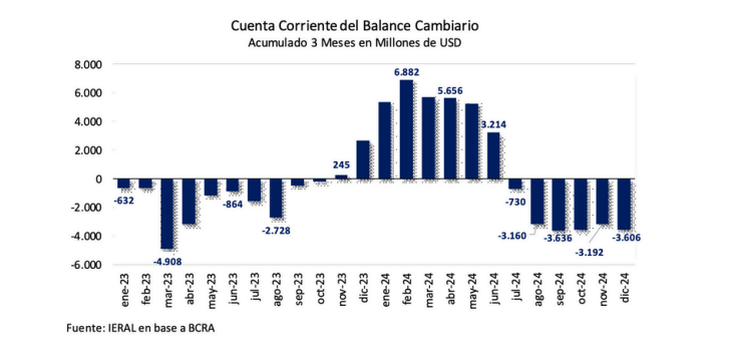

“A proof of the complexity that arises from the interaction between the different variables It is what happened in 2024, When the exchange rate of 2% monthly did not prevent public spending from accommodating the drop in dollar measurement and, even so, the current account of the exchange balance will enter the negative terrain in the second semester ”, remember.

The report indicates that “This key indicator of the external sector went to an average monthly deficit of US $ 1,200 million in the last quarter in the Base Base Measurementa red that does not have signs of reversal at the start of 2025 ”.

“The current account deficit is being financed by the value of the dollars deposited in the local banking system (of strong increase with the money laundering), through loans in argenundos and the subscription of obligations Negotiable of leading companies ”adds the work which he considers that margin still has the government to continue with that scheme until the middle of this year.

Source: Ambito