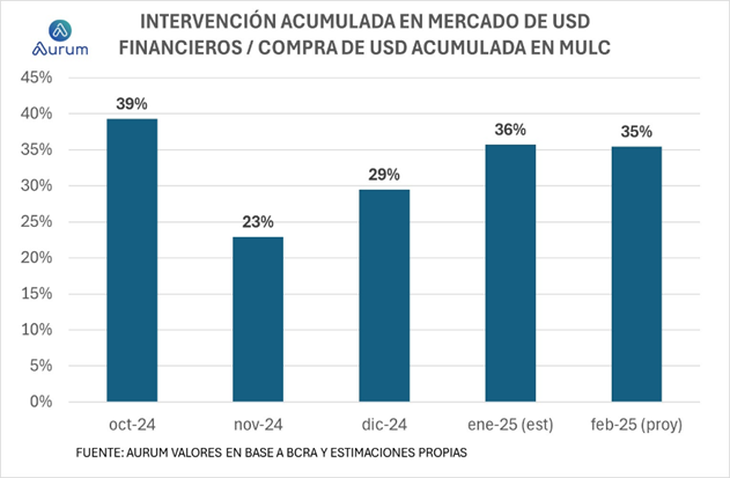

The main objective of the government is to preserve exchange stability so that inflation follows its downward trend. However, according to analysts, This calm is being mainly supported by the interventions of the Central Bank, That by sale of reservations in financial dollars markets, it seeks to control the quotes, avoid abrupt fluctuations and reduce the exchange gap.

In January, according to Aurum Securities estimates, the Banco Central would have sold around US $ 850 million of its reservations to stabilize the quotes of financial dollars. For February, with lower exchange pressure, It is estimated that the intervention amounted to about US $ 550 millionadding a total of U $ 1,400 million in reservations sales so far this year.

From the announcement of this scheme in July 2024, the accumulated sale of foreign exchange by the Central Bank touches the U $ 2,700 million. At the same time, the entity has accumulated net currency purchases in the official market for almost US $ 700 million, which means that sales in financial markets They represent about 36% of the acquisitions made.

In relation to gross international reserves, which at the end of February are located at US $ 28,712 million, the amount destined for exchange interventions since July 2024 is equivalent to almost 10% of the total reserves.

UNNemed.png

Since the announcement of this scheme in July 2024, the accumulated sale of foreign exchange by the Central Bank touches the US $ 2,700 million.

UNNemed (1) .png

In relation to gross international reserves, which at the end of February are located at US $ 28,712 million, the amount destined for exchange interventions since July 2024 is equivalent to almost 10% of the total reserves.

So far this year, the MEP and CCL dollar registered increases of 3.4% and 2.8%, respectively, below accumulated inflation. Meanwhile, the Dollar Blue, which depends largely on the price of financial dollars, remains stable at the levels with which the year began.

This maintained the gap between the official wholesale exchange rate and parallel contributions around 15%. When this difference is broad, The operators ensure that the Central Bank reinforces their interventions to avoid even greater mismatch.

Since July of last year, the Central Bank has been implementing a scheme of intervention in financial dollars markets, selling the reserves acquired in the official market to reduce the circulation of weights and contain the pressure on the exchange rate.

Dollar: The intervention of the Central Bank increased in recent days

Portfolio Personal Investment analysts (PPI) point out that, given the remarkable increase in the negotiation volumes of the most used financial instruments to operate the MEP and CCL dollars, the Central Bank would have recently intervened in this segment for stop the bullish pressures on quotes.

For example, last Monday, The volume of operations in the bonds at 30 and GD30, in species “C” and “D” to be liquidated in 24 hours (the preferred modality for the intervention of the BCRA), reached US $ 97 million. The next day, this volume rose AU S130 million, considerably exceeding the daily average of US $ 60 million registered between July and November of the previous year.

However, the broker emphasizes that the volume operated on Tuesday was lower than the previous week, when US $ 153 million YU $ S167 million in the two days after the scandal related to the $ LIBRA cryptocurrency were recorded. Despite the intervention, financial dollars only rose 0.4%.

On the other hand, Outlier analysts highlighted an interesting behavior in the middle of last week: the Bonus A30, one of the key instruments to operate in dollars, showed a movement contrary to the rest of the sovereign bonds in dollars. “The price of the AL30 closed upwards, which is usually an indication of a more significant intervention by the Central Bank in the MEP dollars and counted with liquidation. This movement was not only opposed to prices in the international market, but also to the behavior of other local bonds, “experts said.

Source: Ambito