Menu

Living: Interhyp: 90 percent of the loans for user properties

Categories

Most Read

Housing and the economy: Ifo: High new rents are bad for economic growth

October 13, 2025

No Comments

Precious metals: Gold resumes record hunt – customs dispute in focus

October 13, 2025

No Comments

World trade: China’s foreign trade increased unexpectedly sharply in September

October 13, 2025

No Comments

Cash: Only cash is real in Europe. The situation in the morning

October 13, 2025

No Comments

World trade: China’s exports and imports increased significantly in September

October 13, 2025

No Comments

Latest Posts

Manuel Neuer: Should he return to the national team?

October 13, 2025

No Comments

Pros & Cons Should Manuel Neuer return to the national team? In 2024, Manuel Neuer left the goal of the DFB team. But now there

Hamas frees last 20 Israeli hostages alive after two years in captivity

October 13, 2025

No Comments

October 13, 2025 – 07:25 Among those released there are three Argentines. The delivery of the bodies of the 28 deceased hostages who still remain

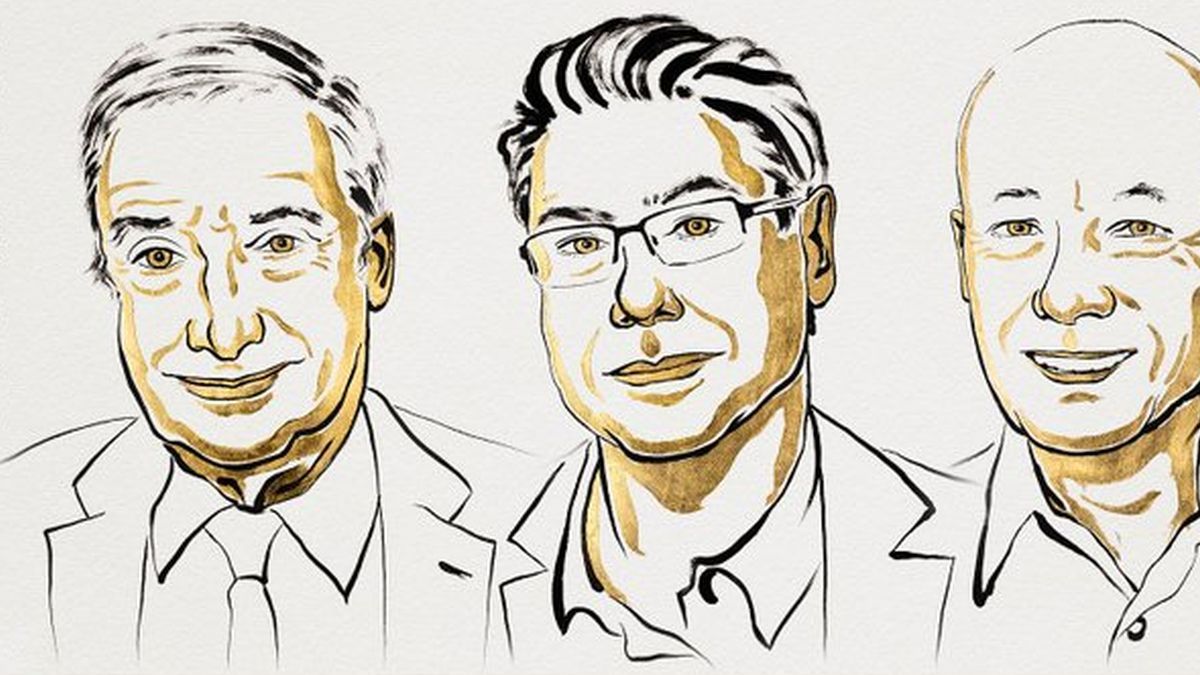

The 2025 Nobel Prize in Economics was awarded to Joel Mokyr, Philippe Aghion and Peter Howitt

October 13, 2025

No Comments

October 13, 2025 – 07:20 The economists receive the award “for having explained economic growth driven by innovation.” The 2025 Nobel Prize in Economics was

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.