It happened despite the fact that there was an improvement of the FDI regarding the second quarter of last year. Also, the investment stock exceeded US $170,000 million.

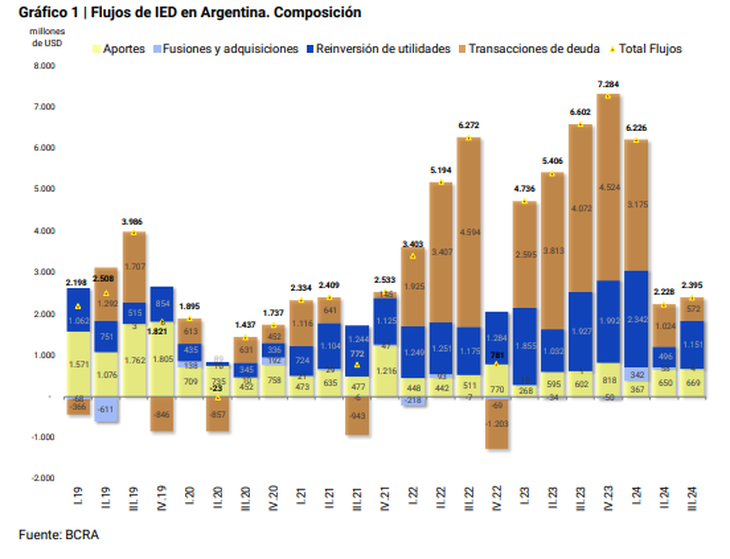

The flow of Direct foreign investment (FDI) reached US $ 2,395 million in the third quarter of 2024. Although it meant an improvement with respect to the previous quarter, In interannual terms it exhibited a contraction of almost 64%while the government awaits the arrival of more projects within the framework of the Incentive regime for large investments (Rigi).

The content you want to access is exclusive to subscribers.

This was reported by the Central Bank (BCRA) through a survey published this Thursday. That flow was explained by a Equivalent utilities reinvestment Au $ 1,151 millioncapital contributions for US $ 669 million, net income due to debt transactions for US $ 572 million and mergers and acquisitions for just US $ 4 million.

image.png

At the sector level, two thirds of capital income was explained by “Deposit collectors, except the Central Bank”. Although this was the main factor that promoted FDI, it also had a decrease with respect to the third quarter of 2023.

IED stock grew, with a strong weight of the automotive industry

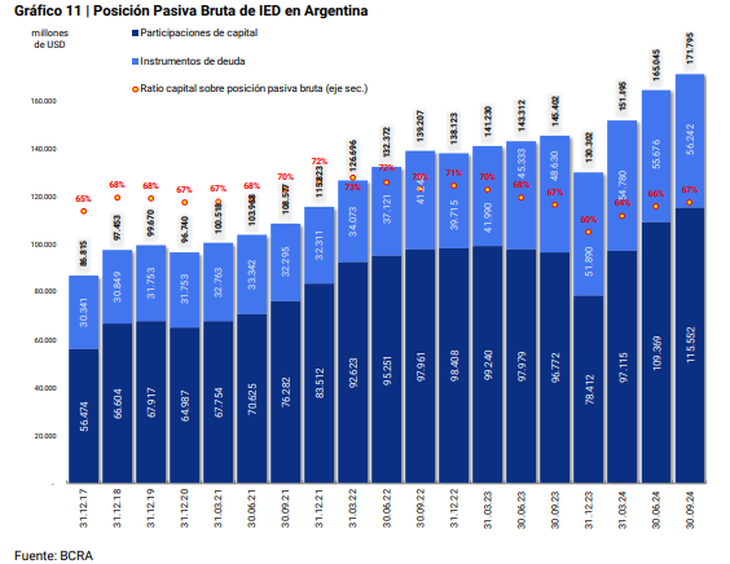

In addition, IED’s gross stock reached US $ 151,795 million as of September 30 of last year, with capital participations of US $ 115,552 million, and debt instruments for US $ 56,242 million. The capital ratio on raw passive position amounted to 67%, slightly below the average of the series, but above what is recorded in the previous quarter.

image.png

In relation to the June 30 stock, a increase of US $ 6,750 millionexplained mainly for the concept of other variations (US $ 4,354 million), while financial transactions generated a rise in the US $ 2,395 million position.

It is worth noting that the account “other variations” groups the differences between FDI positions at the end and at the beginning of the period that cannot be explained with financial transactions. It is the result of Modifications in prices, in the exchange rates of currencies and changes in volume.

Between the manufacturing industrymining and trade explained more than 70% of the investment stock. Within the industry were the automotive sector, food and chemicals the most relevant.

The Government awaits the effects of rigi

It should be remembered that on June 28 the Congress approved the Rigi. Since then they were received Ten investment projects, almost all corresponding to commodities -producing sectorsmore precisely the energy and the miner.

One of the most important projects is the Vaca Muerta Sur Pipeline. There a consortium led by YPF was formed, with a state majority, but where companies participate Pae, Vista Energy, Pampa Energía, Chevron, Pluspetrol and Shell.

Source: Ambito