In the City everyone looks reservations And comment on the different scenarios on a negotiation with the International Monetary Fund, of which there are still no major details. Within that framework, the Doubts about the future of the exchange scheme. The significant falls of Argentine financial assets during February reflect it. Also the biggest pressures on him dollar registered so far this year, which led to Central Bank to expand its direct intervention despite the continuity of the “blend.”

In fact, a private report showed that, In 2024, each “genuine dollar” that entered the country by commercial surplus of goods was used to contain the gap. Before the collapse of the commercial balance caused by the appreciation and the importing opening, that phenomenon was accentuated in the beginning of this year. This Friday, the BCRA He informed that In January he spent US $ 984 million to intervene directly over the MEP and CCLa record amount in the management of Javier Milei that adds to what the “blend” contributed.

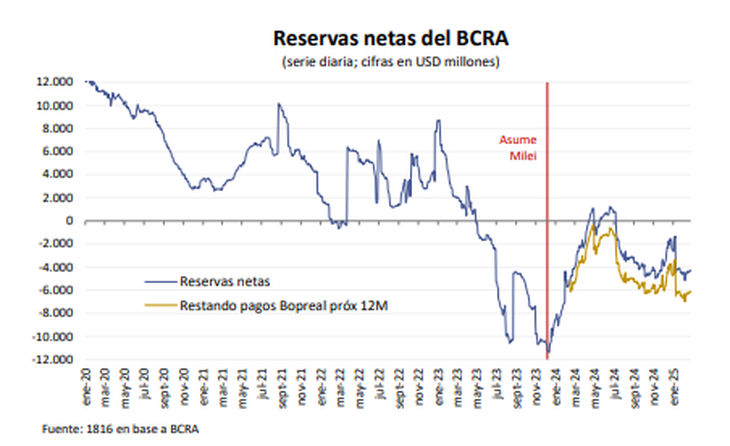

The truth is that The exchange scheme is under the magnifying glass. The Government clings to the “Tabit” to try to reach the elections without inflationary shocks. With net reserves in very negative terrain, Luis Caputo Bet on the background to release new indebtedness but the agency intends a greater rhythm of devaluation. Meanwhile, warnings on the impact of exchange assessment abound and The market began to look sideways at the overendary negotiation with the IMF.

The minister did not travel to the G20 meeting in South Africa to meet with authorities of the agency, as expected. But on Friday afternoon, the number 2 of the Fund, Gita Gopinath, announced through its social network X a virtual meeting held with Caputo and the president of the BCRA, Santiago Bausili, at the request of Argentine officials. “Very good advances in negotiations for a new program are being achieved,” Gopinath said in the usual IMF jargon. Nothing else.

In any case, Many in the City believe that the agreement itself will decant in a modification of the exchange schemeno later than the elections. About that one of the largest banks in the United States, the Bank of Americapublished a recent report in which projected a dollar to $ 1,400 to the end of the year. Beyond the government denies a devaluation, the report hit the expectations reflected in the future dollar market: The contract in December rose 1% between Thursday and Friday to $ 1,302, a level that already exceeds in more than 10% the rise promised by the Government with the “table” of 1% monthly.

Dollar: The intervention on the gap grows

The economic team tries that expectations are not completely disagree. To sustain the BCRA purchase rhythm in the official market, he decided to partially make access to access to Credit in dollars For non -exporters (a questioned measure, as expected) and stimulates the “Carry Trade”. He also needs the gap to expand and, therefore, Increase your direct intervention on financial dollars.

A report of the CP consultant estimated that last year the government channeled the bond market about US $ 21,743 million Among the different routes of intervention, direct and indirect. And the relevance of that amount measured: “It is about equivalent to practically the entire commercial surplus of goods of 2024 (96%) “. The firm led by Federico Pastrana and Pablo Moldovan reached that percentage when comparing it against the exchange balance of goods in the official market, added to exports to the CCL minus commercial debt. On the other hand, if compared against the accrued goods that the INDEC reported, the intervention represented 115%.

Image.png

CP also compared it to another phenomenon: the formation of external assets (FAE or “leak”) of the Mauricio Macri government. “The economic team led by Caputo sells today through the financial markets an amount similar to what it sold as FAE in its first management (U $ 22,775 million in 2017), ”he warned. That year it was also marked by an exchange rate appreciation, which was drastically reversed in 2018.

The main via of indirect intervention is the “Blend dollar”the mechanism that derives 20% of export settlement to the CCL market. To that are added the dollars of receptive tourism that are paid to the financial dollar. When none of this is enough to contain the gap, the BCRA directly intervenes with the sale of reservations in the bond market.

The truth is that, in recent months, direct intervention increased. The BCRA reported in the last hours that, In January, he spent US $ 984 million of the negative reserves to contain the gap. A record amount, which joined the Around US $ 1,500 million that were settled to the CCL for the “Blend” scheme. As he said, the estimates of the City operators realize that in February the central continued to spend currencies almost constantly.

As a comparison point, In January the commercial surplus accrued of goods that INDEC was reported just US $ 142 million and the net currency income per VIEs through the official market of changes (difference between exports liquidated in this square and import payments) was US $ 425 million. In both cases, well below what the BCRA sold to intervene over financial dollars.

“While an amount equivalent to the generation of ‘genuine’ dollars of the economy is aimed at supplying the containment of parallel dollars, The official dollar market maintains its positive balance thanks to the contributions of private indebtedness. The result of the official market has become Extremely dependent on the ‘Carry Trade’ cycle that triggered the money laundering, ”he warned CP.

Beyond that net reserves are negative today, the BCRA has liquidity to continue intervening. According to its monetary rule, inaugurated in July 2024, whereby the BCRA announced that it would intervene in the MEP and the CCL with the equivalent of the weights issued to buy currencies in the official square, the consultant PXQby Emmanuel Álvarez Agis, he estimated that he would still have a remnant close to the U $ S5.3 billion.

Image.png

The missing currency of 2025

The January exchange balance published by the BCRA on Friday left the confirmation of another worrying fact, which accounts for the impact of the strategy of deepening the exchange appreciation. In the first month of the year, US $ 112 million left the country for travel and other payments with an abroad abroada level that was not seen since January 2018 (US $ 1,339 million), shortly before the outbreak of the crisis of the Government of Mauricio Macri. In total, the balance of services was deficit at US $ 1,187 million.

According to the BCRA, around 70% of the dollars in dollars by card abroad were canceled with customers’ own funds (generally bought through the MEP). The remaining 30% paid with pesos to the “dollar card”, that is, was the portion that directly left the reserves. However, the payment with its own currencies also increases the demand in the MEP and is one of the reasons why the BCRA increased its direct intervention, so it also somehow affects the reserves.

However, economists get accounts about the livelihood that the government will have to defend their exchange scheme. The conclusion: According to consultant 1816, this year he will lack many currencies if he does not get a new bridgesuch as the one contributed first the calendarization of import payment and then laundering. How many? According to their calculations, I would need to get US $ 9,000 million to pay external debt maturities without losing gross reservations. If the bridge is finally the IMF, it will not be exempt from conditioning, especially in exchange matters.

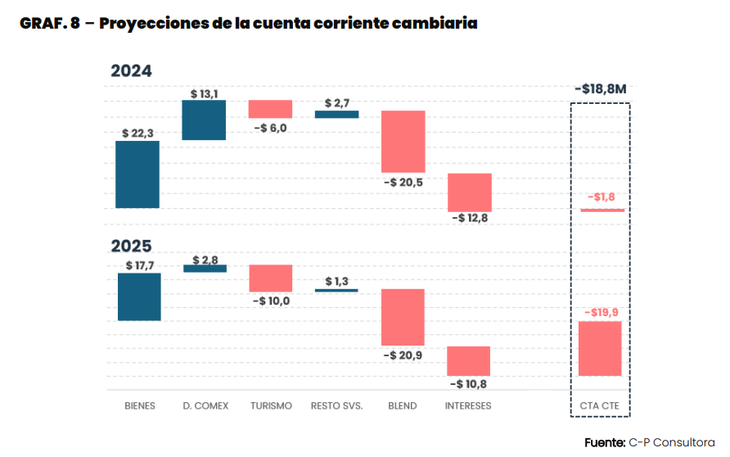

The CP consultancy estimated a superior missing. He projected a current exchange account (the flow of goods, services and interests, among others) deficit at US $ 1900 million, which would be partially compensated by a financial account exceeding US $ S6.2 billion. In that scenario, he would have to cover a hole of more than U,13,000 million.

Image.png

Source: Ambito