The last data of the monthly economic activity estimator (EMAE) of Indec showed that the accumulated drop of 2024 was 1.8%, somewhat lower than what was expected. In December the economy registered its eighth consecutive monthly improvement and exceeded the level of August 2023month in which the recession began.

image.png

Juan Manuel Telechea He stressed that the recovery of economic activity was “extremely fast”, in relation to previous recessions, although he clarified that it was very “heterogeneous”. “In particular, three of the largest sectors (both in terms of production and employment) and industry, trade and construction not only remain below last year (9%, 7%and 18%, respectively), but in recent months their recovery was stopped and showed down again,” he deepened.

In addition, the specialist stressed that both the decline in inflation and the recomposition of the activity, important increases in employment and real income did not.

For its part, the echogue analyst, Alan Versallihe highlighted in dialogue with Scope that “for the most important segments of EMAE, Recovery occurs more quickly in export sectors (agro-mining), as well as financial intermediation by credit growth. “

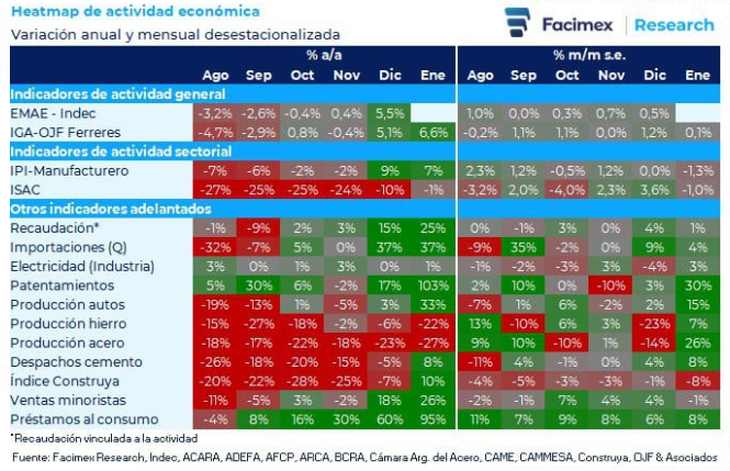

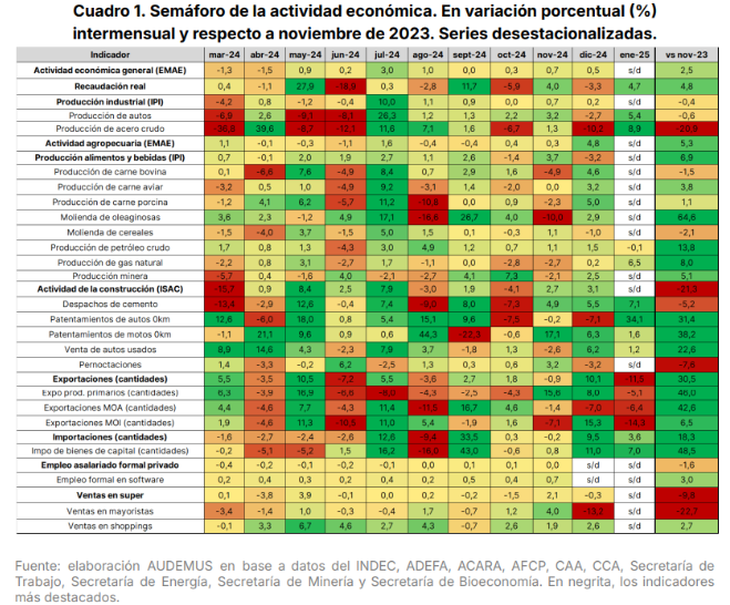

At the beginning of 2025 the disparity was maintained in the economic activity indicators

The first 2025 data showed a disparate dynamic between the different items. As for the manufacturing industry and construction, in January they were observed Monthly negative variations in the INDEC Industrial Production Index (IPI) and in the synthetic indicator of construction activity (ISAC)although there were increases in the production of cars, steel, and in cement offices, according to data from the consulting firm, Audemus and the Facimex Stock Exchange Society.

image.png

Meanwhile, Gas production grew and credits to the private sector again showed a new advance and remain one of the main engines of the Argentine economy. Within that framework, the patents of cars rose, although the deeds of real estate in the Autonomous City of Buenos Aires (CABA) sank strong.

image.png

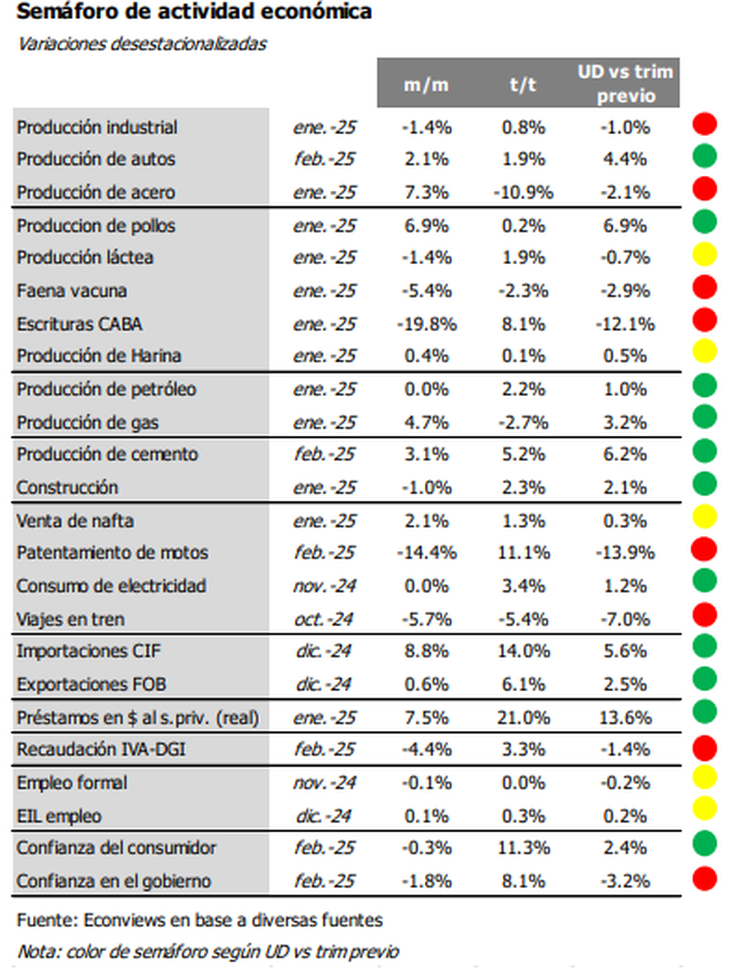

The advanced data of February, still scarce in quantity, also showed disparities. While Econviews reported increases in the production of cars and cement, of 2.1% and 3.1%, respectively, the unstacilities of Eco Go showed falls in both indicators. About this divergence, Pamela MoralesEconomista de Econviews, said it could have its root in methodological differences to evaluate the seasonal effects of measurements; While some consultants contemplate, for example, the amount of business days in the Argentine calendar, others do not incorporate it into the measurement.

In addition, Econviews exhibited a lies in motorcycle patents and trust rates of the consumer and in the government.

image.png

What is expected for economic activity in the coming months?

Among the sectors with better perspectives for what is coming, Morales sees a Pujante production in the mining and energy sectors, a year that “will not be bad but not extraordinary” for agriculture and a “good recovery” in commerce in general (not in supermarkets).

At the far end, It was not optimistic about the future of construction since “public works will not be a government priority this year and the costs of dollars are still at high levels“. On this last point they also coincided from Eco Go.

As for the industry, Morales sees greater uncertainty since there are factors that play in favor and others againstso it is not known which ones can weigh more. “The Import opening It benefits the items that need input and machinery to increase their production (for example, the automotive industry), and harm the items that will receive direct competition (for example, clothing), “he explained as an example.

On the other hand, he pointed out about elements that erode the competitiveness of Argentine products, such as Exchange rate appreciationdespite government advances in the Elimination of “unnecessary regulations”. In parallel, glimpse “a great opportunity in the Credit growth to the private sector since, with financing, it can be invested in machinery and thereby increase production. “

In summary, on the one hand it is almost inevitable that the Gross Domestic Product (GDP) closes with an increase compared to 2024, given the low comparison base. In addition, beyond this “rebound”, There are some sectors that can make even true growthsuch as those that have weight in the export basket (although affected by the exchange delay) or those benefited by the expansion of the credit.

On the contrary, Other activities, generally dependent on the domestic market, do not have too many “drivers” that give it impulsein a context in which the mass of income of the population and employment does not accompany the decline of inflation and improvement, in general terms, of the economy.

Source: Ambito