After clarifying that the fears on the external scenario cover everyone including emerging markets, but in the Argentine case it adds “exchange stiffness” that “in this scenario can affect it more from the commercial point of view (and financial when the stocks are eliminated)”.

He considered that they will play in favor of expectations the signing of a new agreement with the IMF, if the government achieved a good result in the mid -term elections and could continue advancing with structural reforms.

International Monetary Fund

“The key is that the program agreed with the IMF contributes to dilute the perception of a” day D “for after the October elections,” held Jorge Vasconcelos. Within the framework of an organized meeting on Monday by the Ieral – Mediterranean Foundation, the economist also said that “Structural change has begun, but reforms are needed that accompany and channel that phenomenon.” In this regard, he pointed out that “Winners and losers of the new scenario begin to be outlined, but the companies involved have very few instruments to face the conversion.”

Vasconcelos considered that phase II of the Government’s economic program “Demand being oxygenated.” From this point of view he said that he persists a great gap between currency purchases in the official market and the accumulation of reservesdue to the lack of rollover of debt maturities. And he added that in “the start of 2025 they are observed Greater interventions of the Central Bank on the Seller Punta on the free market to avoid the expansion of the exchange gap, a resource that can only be temporary ”.

Table 1.Png

Payments

When analyzing the agreement that the Government negotiates with the International Monetary Fund, the Economist of the Mediterranean Foundation was questioned “Can it be taken for granted that Congress will not reject the DNU? ” given that, He said“The relations between the Executive and the Parliament are not going through the best moment, precisely.”

He estimated that, for the period of grace for the payment of anticipated capital in the DNU, the fraction destined to refinance maturity could exceed the 14.0 billion dollarsto what An yet amount would be added without specifying for the treasure to rescue a part of the non -transferable letters that are part of the Central Bank asset (In total, equivalent to about 23.0 billion dollars).

He emphasized that “The key is that the program agreed with the IMF contributes to dilute the perception of a” day D “for after the October elections,” since “With” Day D “expectations, macro management will not be simple in the next quarters, regardless of reinforcement in reserves that includes the agreement with the IMF”.

Crawl

In his presentation, Vasconcelos also analyzed If the 1% monthly 1% monthly adjustment of the official exchange rate or if it will be replaced by narrow intervention bands will follow. He said that 1% crawl would be consistent with the continuity of the nominal freezing of the wide monetary base. But he also said that “This scenario would keep many questions open about the” arrival point “of the transition”.

He considered that the argument of “making few weights is relative”, since the broader monetary aggregates continue to expand, being that, currently, the m3 plus the debt in treasure pesos in private hands exceeds 120 billion dollars to the free exchange rate. “Actually –affirmed- The frozen monetary base is a concept consistent with the “endogenous dollarization” approach. In the event that the program maintains uncertainty about the point of arrival of the transition, this will inevitably be reflected in the ROFEX, the exchange gap and the interest rate ”.

Warned that “If the problem of” Day D “is not solved, the” Rofex dollar “will impose a higher floor to the interest rate, a bullish trend that also contributes the increasingly tight liquidity of the banking system”.

Interest rate

Vasconcelos considered the issue of the interest rate in pesos as very relevant not only for the dynamics of the level of activity, but also so that the “rollover” of the domestic debt of the treasure can be carried out with the least possible turbulence. From this perspective, he said that, PThat to the operations of exchange at the beginning of the year, the maturities of domestic debt between March and June exceed 4.5 points of GDP, in a context of sustained drop in demand for public titles by banks (due to the expansion of credit to the private sector).

In your vision, when the program is announced It should have bassist impact on the country risk premium, so that Argentina can return to the external market on a reasonable horizon, taking into account that this factor will also have to influence the “demanding” Rollover of domestic debt to be fulfilled between March and June.

And insisted that “It would help in that sense that the program manages to dilute the expectations linked to an eventual” day D “for after the elections, an objective for which a scheme of exchange bands would be more functional than the continuity of the 1 % crawl and the wide frozen monetary base.”

Blend dollar

Vasconcelos argued that, inevitably, the program must also include a definition of the “blend” issue, the scheme by which exporters liquidate 20 % of their operations in the market free market.

In this regard, he considered that “If there were a “phase III” of the program, it would make little sense that the exchange band was established with intervention margins of 4 % or 5 % above and below the current official exchange rate. The logical thing is that the center of the eventual intervention band is higher than the current price of the dollar in the official marketso that possible interventions of the central in the seller tip do not insuum too many dollars of their reservations. ”

In this scenario, the instrument of the frozen monetary base would be abandoned, and monetary and exchange policy would enter more conventional land. He estimated that “it would still be transition (intervention bands as a permanent mechanism do not register good experiences), but would be presenting some advantages over the current scheme.”

Winners and losers

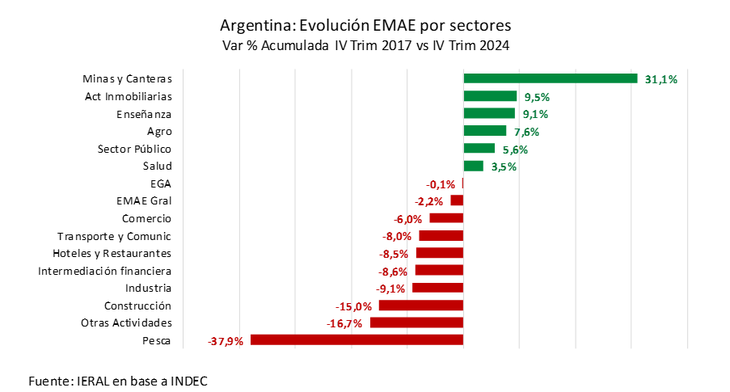

When analyzing the march of the real economy, Vasconcelos said that “although it is true that the micro changes that are announced day after day are improving the operation of the economy, it is warned A remarkable disparity in the trajectory of the different productive sectors. The structural change has begun, but reforms that accompany and channel that phenomenon are needed. Winners and losers of the new scenario begin to emerge, but the companies involved have very few instruments to face the conversion. ”

Table 4.Png

After specifying that A good part of the sectors are still well below the 2017 reference, warned that The activities are trapped “due to long -standing structural problems”. In this sense he indicated The weight of distortive taxes, the persistence of centralized labor agreements, that penalize interior activities and SMEs, the trial industry, a financial system and a capital market still too limited by short -term and the weight of financing to the public sector.

Also the limitations imposed by infrastructure. The deregulator effort, with almost 40 measures since the end of 2023, is contributing to more flexible to the economy on the supply side, but considered that It is not a substitute for reforms such as tax, labor, financial and eradication of the trial industry.

In infrastructure, Merm in public works has not yet been replaced by private ventures and in competitiveness rankings Logistics is a ballast for Argentina (56th in infrastructure, according to the IMD).

Rigi

As for the Incentive regime to large Lrigi investments) He considered it a good instrument (much better as an industrial policy than the application of discriminatory tariffs), “But limited by sectors and size of companies and, more than once, misunderstood federalism continues to operate as an obstructive and generator of” interior customs. “

After stating that The recovery is supported and the GDP could advance to a “cruise speed” around 5 % per year, He warned that “There are limitations to achieve full power of some of the most important engines, a phenomenon partially compensated for the reappearance of credit to the private sector.”

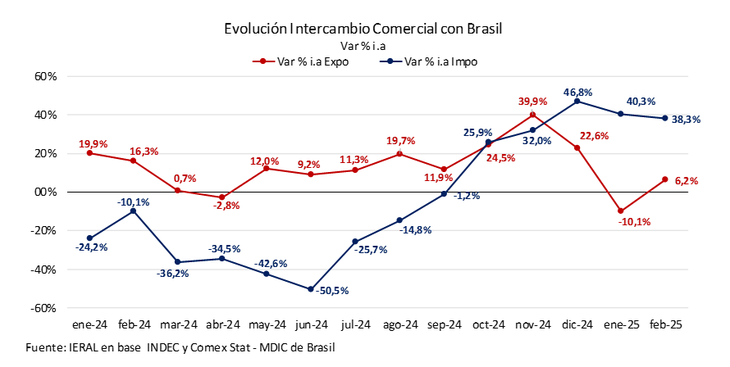

In the industrial case, he indicated that external competition, particularly the one originated in Brazil, is removing important market to the local offer. In recent months, Brazilian imports are increasing at a rate close to 40% year -on -year, while Argentina’s exports to the neighboring country are virtually stagnant during the first two -month period. It is a predominantly industrial products trade.

Table 5.Png

Tight numbers

In relation to the agricultural sector, he said that the numbers look more and more tight: The price of soybean to the producer (net of withholdings), which in March is ranging around 324 thousand pesos per ton, shows a decrease in the internal purchasing power of 13 % compared to the average of 2024, a fall that is accentuated at 40 % when compared to the average of 2021/23always considering purchasing power in the domestic market in real terms.

In the construction sector, the change of public works/private work takeswhile Relative prices seem to affect the dynamism of residential projects: the cost of construction in free dollars has increased around 50% between the average of 2021/23 and the latest datato currently place something above $ 900 a square meter.

And this phenomenon, Vasconcelos concluded, is activating a growing demand for imported supplies, in an industry traditionally made up of local value chains. On the other side of the counter has a healthy and sustained Mortgage credit recoveryalthough still with a limited weighting.

Source: Ambito