As stated by the Minister of Economy, Luis Caputoclothing and footwear taxes will drop from 35% to 20%, while for fabrics the contraction will be from 26% to 18%. Also, for the yarns the current 18%tariff will be passed, to new 12%, 14%and 16%, according to the type of product.

Based on a preliminary analysis of the effects of the measure, Gustavo LudmerDoctor of Economic Development and Researcher of the textile and clothing sectors, estimated that the tariff cut It could imply a decrease of just 0.2 percentage points in the consumer price index (CPI) of Indec In parallel, The direct destruction of labor sources would reach 47,500 workers.

How can you impact clothes tariffs on inflation?

Regarding the contribution of this policy to the slowdown in inflation, the economist warned four channels. The most important would be a 11.1% drop in the price of clothing that are already imported today.

For the calculation, a “Mark-Up” equivalent to five times the cost of the nationalized garment (similar to that of the world) was taken as assumption. Besides, It was taken for granted that all tax decline will translate into a benefit to the consumersomething that probably does not happen as the chain members themselves affirm.

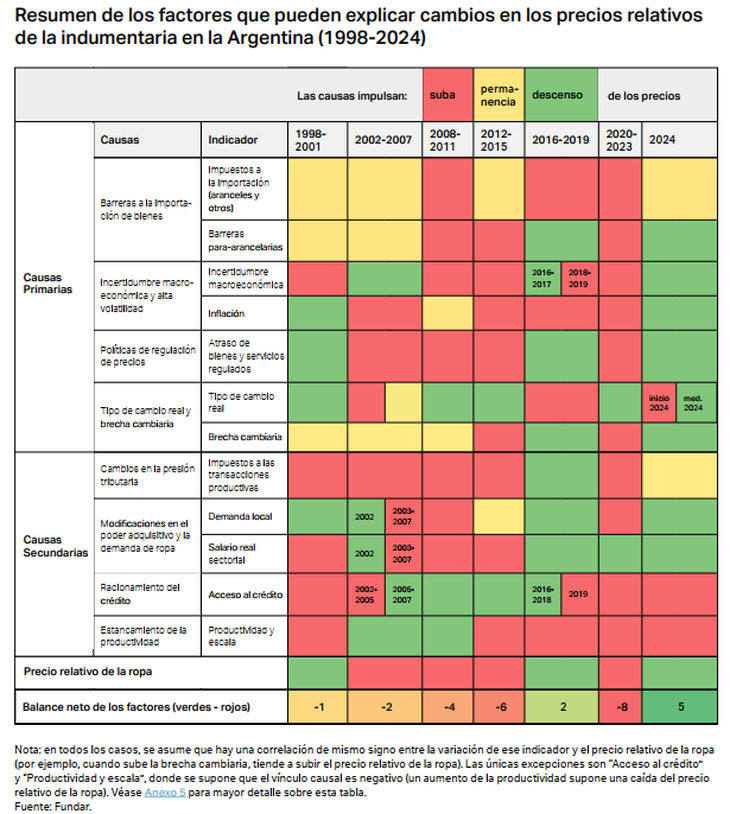

image.png

The second channel is the replacement of garments that are manufactured today in the country for new imports. At present, approximately 15% of the clothes that are marketed in Argentina have origin abroad; This percentage is 30% in the formal segment, 10% in neighborhood shops supplied in flowers and 5% in saladitas and manteros, which are provided in the salty.

Considering that the “import” of imports would be duplicated in each market segment for the lowering of foreign products (and that each segment currently represents about one third of the total market), the effect on prices would result in a average drop of 2.7%.

image.png

The third channel underlined by Ludmer would be the Drawing inputs Used for local production, which represents approximately 50% of the final product in the textile link and 40% in the preparation. The specialist explained that here the effect is less because the decrease of tariffs is less than for garments and because there are many intermediaries that hinder the transfer at prices. Therefore, the exercise resulted in a decline of just 1% In prices by this route.

Finally, a 1.2% decline in local production prices due to the highest competitive pressuremainly in the formal segment. However, Ludmer warned that in these cases the adjustment usually occurs more due to quantities (bankruptcy of companies and employment destruction) than for prices.

Black present in the textile industry: the activity and the sector falls “Employment Destruction”

Specialists warn that the progress of imports would generate a destruction of 30,150 jobs in preparation and 17,350 in textiles.

How many jobs puts the progress of clothing and textile imports at risk?

Precisely, the loss of jobs is what most worries about the official measure. Assuming that today there are approximately 171,000 jobs in preparation and 98,300 in the textile category, the advancement of imports It would generate a destruction of 30,150 jobs in clothing and 17,350 in textile.

“This exercise is sensitive to the cases used. I checked them several times with colleagues and connoisseurs of the chain, but the same should be considered as a first estimate. Take it as a first pore to contribute to public exchange,” said Ludmer, at the same time He invited to discuss the numbers with government officials.

As soon as the announcement of Caputo came, the researcher had already questioned him for three fundamental reasons: 1) the Lack of complementary measures such as the remove of distortive taxes or the facilitation of credit lines for the affected sectors, 2) the evil timming, since the current context encourages to bring products from abroad by the exchange delay and 3) what This measure hits those who “better do things” in tax matters (since the formal segment is the most exposed to external competition) in exchange for lowering prices to the richest (which represent a greater proportion of consumption in the formal segment with respect to flowers and the salty).

Other voices on the decline of tariffs in the textile and clothing sectors

Both from the Federation of Argentine Textile Industries (FITA) as from Argentine SMEs Industrials (IPA) They criticized the government’s decision with hardness since it is not taken within the framework of a comprehensive strategy that seeks to improve systemic competitiveness of the local industry. “Prioritize the reduction of tariff“Fita said in an official statement.

“It is necessary to match the conditions against imported products produced in contexts with Less taxes, modern labor laws and access to credit for production. From Fita we ask the Government to reconsider this measure and make ourselves available to work together in a development plan that guarantees conditions of equity and sustainability for the national industry and workers in the sector, “the entity deepened.

According to Jidokacompany specialized in foreign trade, a growth of at least 30% in clothing imports by 2025 is expected due to the removal of regulations and the decline of tariffs. “The release of barriers, as well as can be beneficial for the sector, also invites producers, employees, and all who are part, to take certain collections and measures to preserve the industry”Said Gabriel Salomón, general director of Jidoka.

In that scenario, from the company they suggested taking Measures to defend the competitiveness of the local industry As the investment in technology, the promotion of innovation, the development of own brands to differentiate from imports, the exploration of alternative markets abroad, the implementation of marketing strategies and intersectoral cooperation.

Source: Ambito