The year 2025 looks “challenging ”For the industrial sector. This is defined by the organization Productive mission, that announced a report where it warns that last year Argentina was the country with the greatest industrial fall in the world.

The reactivation starts from a very low floor for the industry. The data of the United Nations Industrial Development Organization (UNUDI) They warn that, in a sample of 79 countries, Argentina was the one that More contracted in terms of industrial production. The average fall was 9.4% during last year Regarding the previous period.

The analysis of information arises from productive mission, an organization defined as a “network of professionals that drives the debate on development, production, innovation and quality use.”

However, the raw material follows from Global monitoring of industrial variationswhere the Argentine average was “The worst registered between economies from different regions of the world”, Including developed and emerging.

According to the productive mission report, industrial contraction in the country was widespread, highlighting deep declines in sectors such as Non-metallic (-24.3%), furniture and other manufactures (-18.6%) and equipment and equipment (-18.6%). The only exception was the oil refining block, which grew 2% in the year.

8EF86DAC-AA12-43EE-BE26-122CA24F91E9.jpeg

Consulted by scope, Paloma Varonaeconomist of the organization, ensures that it is “worrying” the installation of a “anti-industrial” discourse that “naturalizes the destruction of productive capacities”

“The industry is not a ballast: It is a key component of development, innovation and quality use, ”says the specialist.

In that sense, consider that “Recover industrial capabilities for years“But” losing them can happen in months. “

The keys that explain industrial deterioration

How do you explain this setback in the industry? Productive mission focuses on the fall of the Internal demandin a context of Loss of real salaryespecially during the first half of the year, and the contraction of activities that traditionally traction to the industry, such as construction.

In addition, they detect a “significant disarmament“Industrial policies: during 2024 financing lines for SMEs, sectoral promotion programs and technological development tools were eliminated. Although these measures taken by current management are not the root of the setback, they do contribute to consolidate a” less favorable “environment to produce.

Elio del Re, head of Adimraunderstand that the metallurgical sector is one of the most impacted by the deterioration of the industrial framework. In dialogue with this medium, he says that “We are living a context of centralization of industrial production with a clear replacement for imported products ”.

In that sense, warns the registration of a 50% year -on -year increase in imported machinery and equipment and more than one 30% in what is parts and pieces.

According to the latest report of the entity, during February the metallurgical activity registered an interannual variation of 5.3% and a 1% increase with respect to January, although it showed important casualties in sectors such as Foundry (-14.1%) and auto parts (-3.9%). The situation of the foundry, in particular, reflects a more prolonged process of contraction that continues to affect the whole sector.

For example, and as opposed to companies linked to agricultural activity, the companies providing the automotive industry maintain a negative trend, with interannual falls that reflect the contraction in this sector.

“The slightest demand for auto parts and components continues to affect suppliers, limiting the possibilities of recovery in the short term,” concludes Adimra.

The study of the UIA that warns of imports without the “level court”

In this context, the industrial sector warns of the framework in which the Government promotes a greater commercial openingwhere the strong appreciation of the exchange rate, the consequent rise of the costs in dollars, and the weight of logistics will weaken the manufacturing framework.

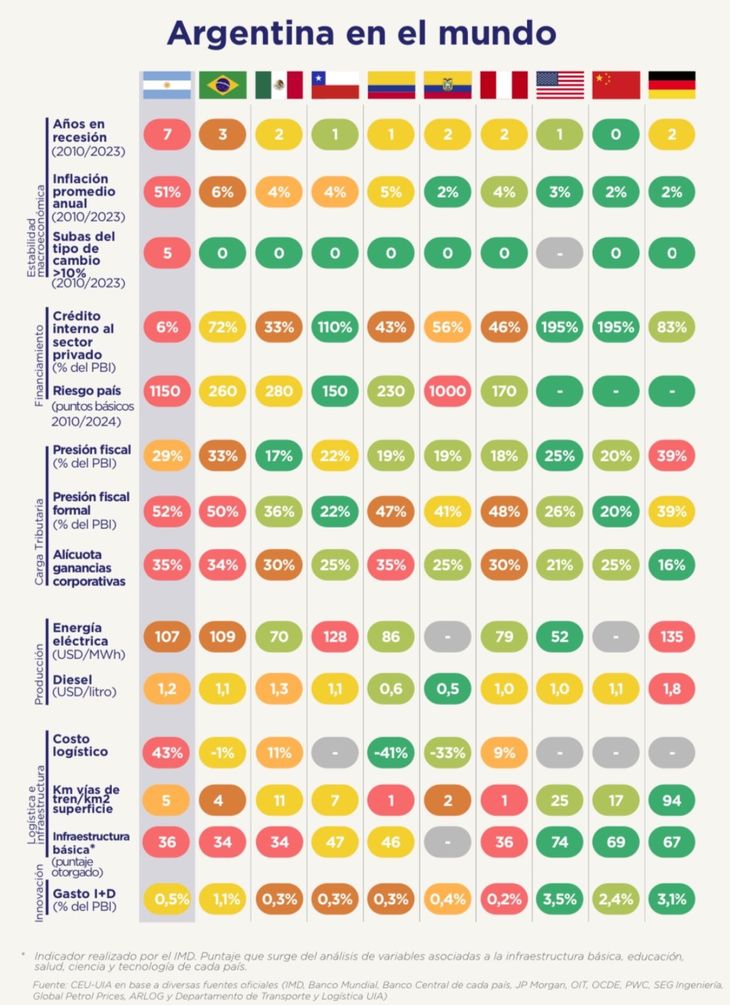

The Argentine Industrial Union (UIA) marked in its latest competitiveness study that Argentina maintained between 2013 and 2023 a inflation average of 51%while in Brazil it was 6% and Italy 4%. In turn, among other variables, he points out that the Credit to the private sector in PBI percentage in the country is 6%; while in Chile it is 110% or the United States 195%. About the exchange rates, Argentina seems like the only country among the analyzed it suffered devaluations over 10% in 13 years.

8235FEAF-9665-41DE-92E5-97A53DBFE9D5.jpeg

Source: Ambito