Menu

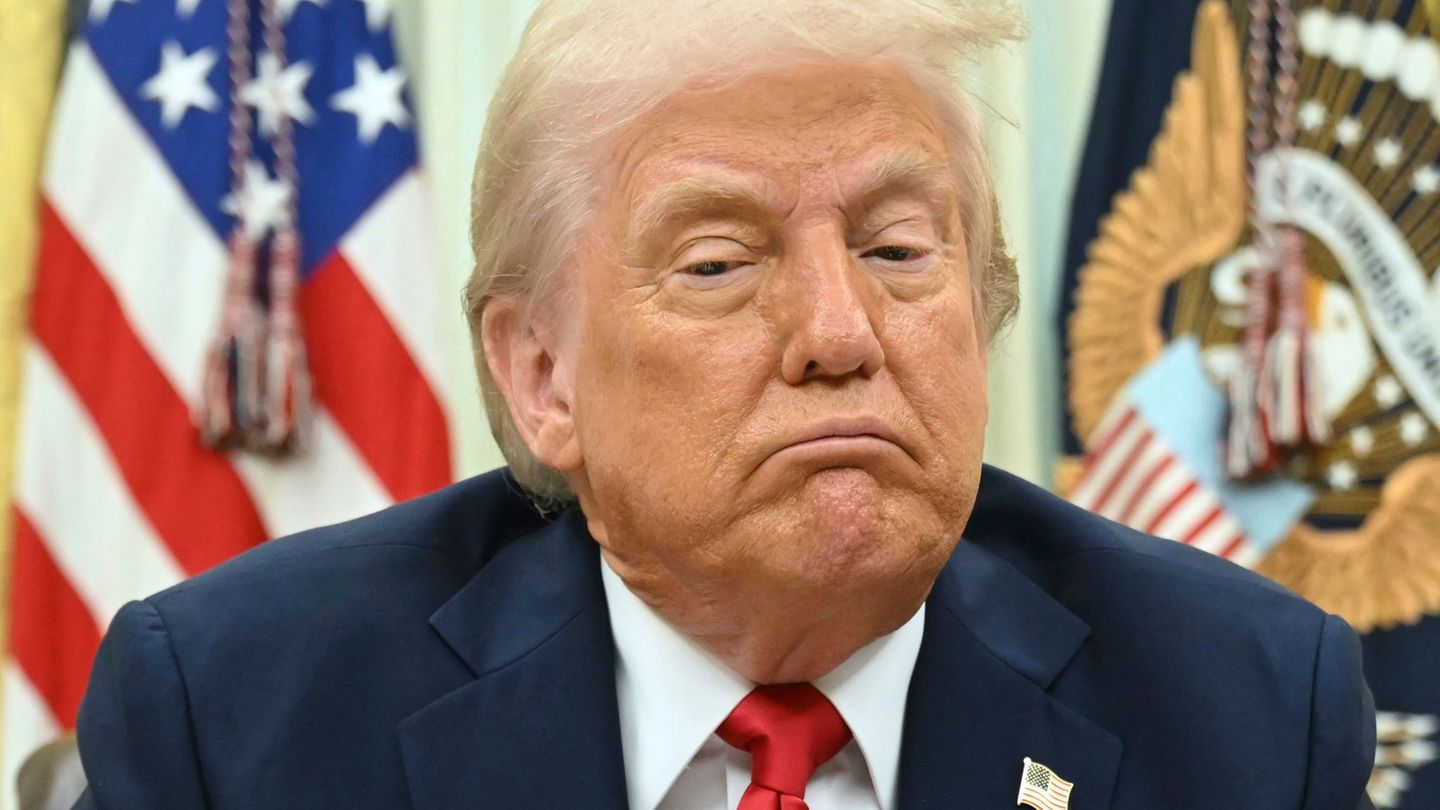

Commercial dispute: Great uncertainty – which Europe fears with new US tariffs

Categories

Most Read

Beijing’s export controls: China accuses the USA of scaremongering in the trade dispute

October 16, 2025

No Comments

Missing apartments: Interhyp survey: Growing frustration with the housing market

October 16, 2025

No Comments

Nestlé cuts 16,000 jobs despite rising sales

October 16, 2025

No Comments

Save with your pension card: You get these discounts

October 16, 2025

No Comments

Self-assessment: Millions of people don’t have enough money for heating

October 16, 2025

No Comments

Latest Posts

German economy: Bundesbank is becoming more pessimistic about the economy in the summer

October 16, 2025

No Comments

AngelicaI am an author and journalist who has written for 24 Hours World. I specialize in covering the economy and write about topics such as

Beijing’s export controls: China accuses the USA of scaremongering in the trade dispute

October 16, 2025

No Comments

AngelicaI am an author and journalist who has written for 24 Hours World. I specialize in covering the economy and write about topics such as

Missing apartments: Interhyp survey: Growing frustration with the housing market

October 16, 2025

No Comments

AngelicaI am an author and journalist who has written for 24 Hours World. I specialize in covering the economy and write about topics such as

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.