In disaggregated by item, the agricultural sector had an important influence on the improvement of figures. Patent agricultural machineryA 109.8% year -on -year grew strongly, while the settlement of currency of the oil sector It rose 45.5%. In addition, increases were recorded in the sector Automotive (+13.1% AI), Cement offices (+7.9% AI), Index Build (+4.2% ia), Exports toward Brazil (+46.9% ia) e Imports from Brazil (+53.9% AI). And for the first time the electric power consumption of large industrial users (+2.2% AI) After 24 months of decline.

UIA.JPG activity data

According to the report, the Industrial Sector “faces a challenging panorama added to greater competition against the importation of finished goods”. According to the fourth trimester and perspective results by the SME Observatory Foundation “there is an increase in the importing threat and market loss against imported products”, with China and Brazil as the main countries of origin.

Given the context of exchange appreciation, 18% of SME replaced local inputs for imported during 2024. In addition, 7% replaced its own production with imported. “In terms of expectations by 2025, they show that 30% of companies expect to increase their import imports and 18% of finished products”they pointed out.

During the first bimester, the accumulated commercial result was US $ 389 millionjust 18% of the US $ 2,193 million that were recorded in the same period of 2024. “While exports grow (+9.9% accumulated), the deterioration of the commercial result is due to imports of imports (+33.0% accumulated) as a consequence of the appreciation, the rebound of the activity and the commercial opening,” they explained from the CEU.

Concern for increased imports and production costs

In February of this year, within the subgroup of exports the rise of the Manufactures of industrial origin (MOI) With an increase of 15.4% year -on -year, pushed mainly by Terrestrial transport material. However, the increase in imports from other items such as “consumer goods”, with a rise of 77.4% AI, and “rest”, for a rise of 174.4% AI, a category that includes goods dispatched through postal services – Courier.

“These figures exceed the observed in Intermediate goods (13.4% AI), which shows that imports recover faster than production “, added from the Center for Studies of the UIA Likewise, there was a change in the country of origin of the Purchases abroad: Imports from China rose 104%. They jumped from 17.7% in February 2024 to 25.4% in February 2025 over the imported total.

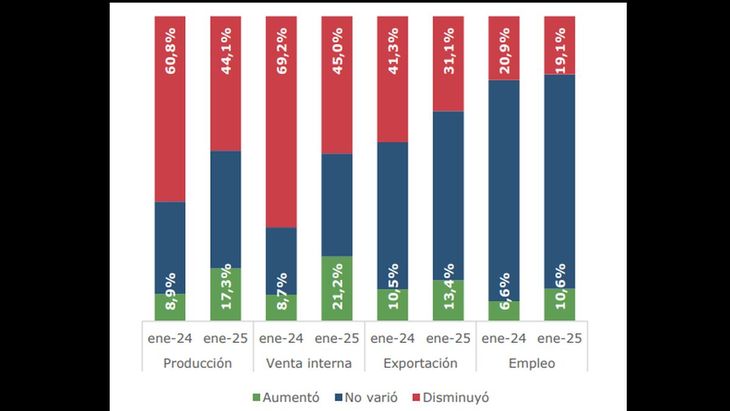

With respect to Industrial Performance Monitorthe index that anticipates the cycle of industrial activity, was placed again for the tenth consecutive time in the contraction zone: 42.2. “However, the result should not be strictly interpreted as a contraction of industrial activity due to the high seasonality of the month of January, characterized by vacations and plant stops,” they explained. The indicator was 6.8 percentage points below October 2024, although 12.3 pp above January 2024.

In the disaggregated analysis of the main variables of the MDI It is observed that Most companies recorded falls. 42.3% indicated a contraction in its production. Just 18.3% registered increases. Also, 44.8% of companies reduced their sales, while only 22.2% of them increased them. As for employment, Only 11.5% of companies increased their staffing in January, compared to 17.6% that reduced ita contrast regarding the last survey, when the companies that hired were superior to those that fired.

graph uia.jpg

“Production costs were located as the main concern among companies, with 40.6%, and displaced the fall in demand, which had occupied the first place in the two previous reliefs,” they added from the CEU.

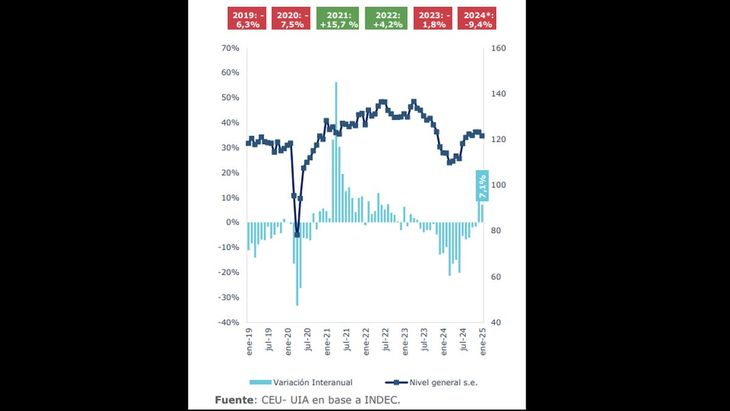

Industry: January production grew 7.1%, but still below 2023

The report released by the center of the UIA reported that During January the industrial activity was 7.1% above the interannual level, according to INDEC data, so it was the second month of year year after 18 months of consecutive fall. However, the CEU clarified that, despite the improvement, 6.1% is still under January 2023. In monthly terms it decreased 1.3% compared to December, one month without seasonality.

The Recovery of the activity level is significantas indicated in the report, Although just five sectors managed to return to January 2023 levels. These are other transport equipment (+28%), tobacco (+25%), clothing, leather and footwear (+4%), oil refining (+3%) and the automotive sector, which remained stable. “Other sectors such as food and drinks (-2%) and chemicals (-3%) have not yet reached such levels, but are close to doing so,” they said. This data contrasts with sectors such as non-metallic minerals (-28%), metal products (-20%) and basic metals (-20%) that, they reported, show “a more important lag.”

GRAPH UIA 2.JPG

“At the eleven sectoral level of the sixteen sectors that make up the index, they registered increases in their production, including the good performance of machinery and equipment (+28.5% AI) driven by the productive improvement of agricultural machinery and domestic use devices. They also presented increases – in great measure due to the low level of comparison – the production of other equipment, devices and instruments (+50.7% ia), other equipment Transport (+29.2% AI), furniture and mattresses, and other manufacturing industries (+25.1% AI), and clothing, leather and footwear (+24.9% AI), the latter with a heterogeneous performance inside the sector due to the impulse of clothing (+35.2% AI), but with a decrease in the production of tan Indicates the report.

Source: Ambito