Benchmark aluminum on the London Metal Exchange (LME) It rose 1.6% to $3,183.50 a tonne, after hitting $3,236 on the day.

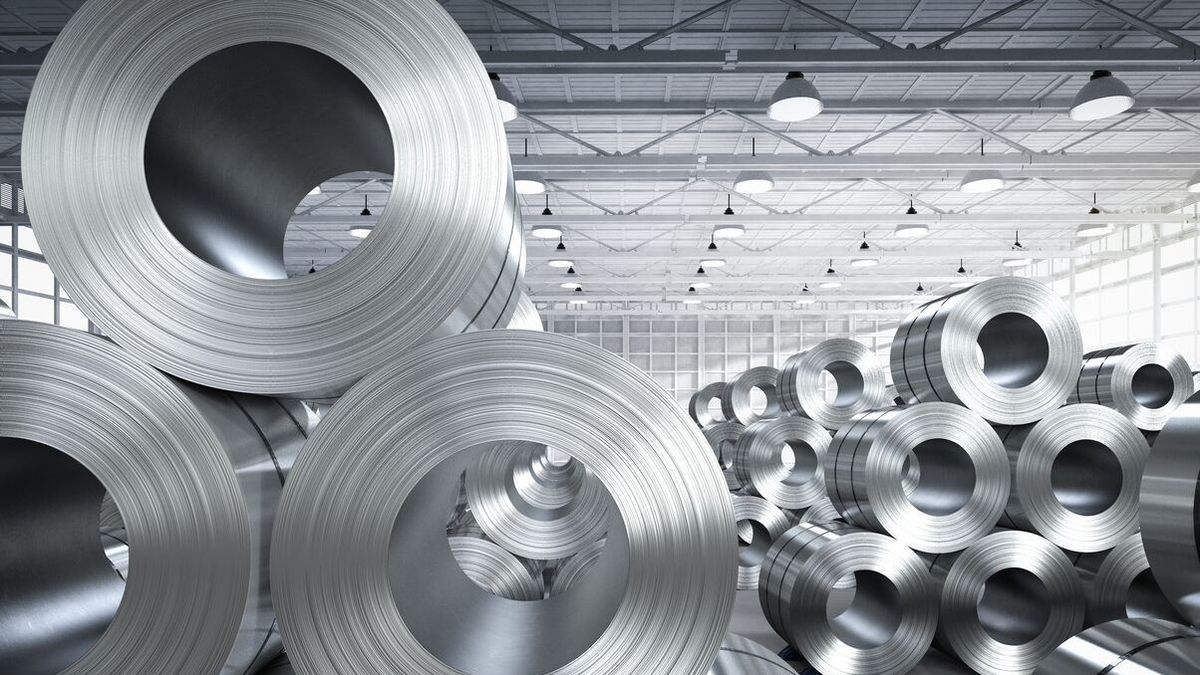

The light metal, which is used in packaging and transport, advanced 42% in 2021 and about 14% this year, as Chinawhich produces more than half of the world’s supply, restricted refining to reduce pollution.

Chinese smelters use huge amounts of electricity generated by coal-fired power plants.

“In the run-up to the Beijing Olympics, aluminum production has been greatly reduced to improve air quality,” said Nitesh Shah, an analyst at WisdomTree, predicting that increased demand would push prices up in the long run.

Adding to supply fears was an outbreak of Covid-19 in the Chinese aluminum-producing city of Baise.

Some production of alumina, the raw material for aluminium, has been affected by Covid-19 restrictions and producers have been hit by transport disruptions, according to government-backed consultancy Antaike.

Aluminum stocks in LME-registered warehouses have fallen to the lowest level since 2007with 767,700 tons, compared to almost 2 million tons last March.

In other base metals, copper in London was up 0.1% at $9,791 a tonne, zinc fell 0.7% to $3,601.50, lead was up 0.6% at $2,207.5, Tin fell 0.3% to $42,810 and nickel sank 3% to $22,690.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.