Back to Germany?

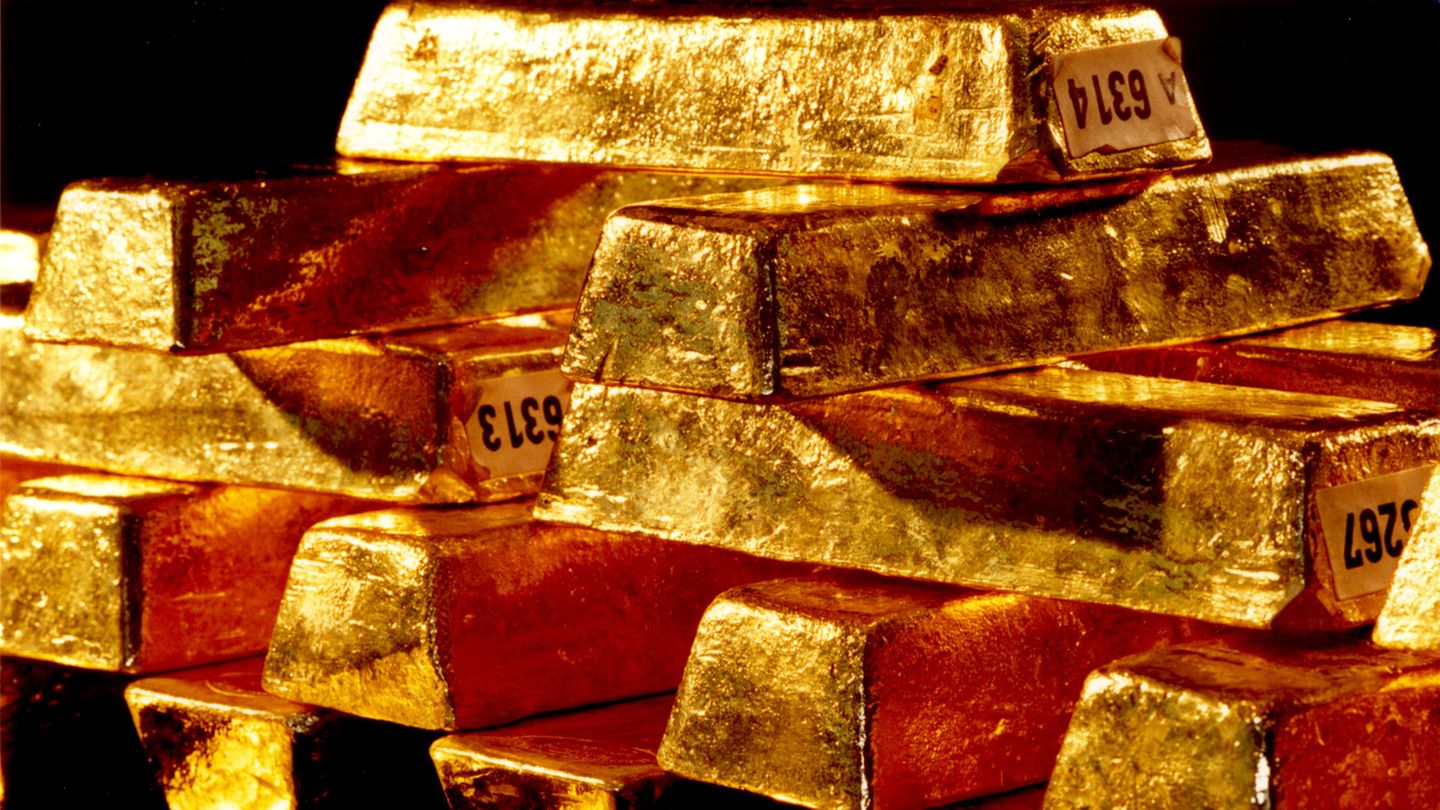

Care for German gold reserves in US safe

Copy the current link

Add to the memorial list

Germany has the second largest gold reserves in the world. Part of it is in New York – for crisis cases. But now worries about the gold billions are being loud.

3,351,546,9356 kilograms – or in other words: 3351 tons. That has so much gold. Germany has the second largest gold reserves in the world after the United States.

Some of the German reserves are located in the USA, in the safes of the Federal Reserve Bank of New York, also called “Fed” for short.

The Bundesbank stores 1236 tons worth around 113 billion euros there. That is more than 36 percent of German gold stocks. Most of the entire reserves, more than 50 percent, is located at 1710 tons in Frankfurt am Main. The rest is at the Bank of London.

These gold reserves should enable the Bundesbank to exchange gold in US dollars or British pounds in times of crisis or to repay. At the end of 2021, the value of the gold stock was around 174 billion euros. For comparison: In 2021, the expenditure of the federal budget amounted to around 498.6 billion euros.

Requirements for control of German gold in the USA

But around 1236 tons in the USA are now worried. Because since Donald Trump in the White House is in charge, there are concerns whether you can trust the United States when it comes to German gold. Trump’s customs threats and his desire for more control over the politically independent Fed have strengthened these concerns.

Politicians from the CDU and CSU are therefore calling to bring the gold reserves back to Germany or at least to discuss them.

Former CDU member of the Bundestag Marco Wanderskitz had already called for regularly checking or recovering German gold reserves abroad in the past. The newspaper recently told Wanderwitz: “Of course, the question is now asking itself.”

Similarly, long-time EU MP Markus Ferber (CSU) commented in the “Bild”: “I call for regular control of the German gold reserves. To do this, official representatives of the Bundesbank must personally count the bars and document their results.”

“Brings our gold home!”

Michael Jäger from the European Taxpayer Association even demands that German gold from the United States immediately bring back. He said the “Bild”: “At a time when I am discussed in Berlin and Brussels about immense new debt, we need immediate access to all gold reserves in an emergency.”

The former CSU communal politician therefore demands that German gold in the USA to be controlled and also “physically checked” the gold bars in New York. However, he would like to bring all the German gold reserves from the USA to Germany or Europe. “Our demand: get our gold home!” He told him.

These ten countries bought a lot of gold

|

capital

#10 Qatar

According to the product provider Bestbrokers, Qatar increased his gold reserves by 9.7 percent to 9.86 tons in 2024 to strengthen the national economy. The purchases serve as security against economic turbulence and as part of the country’s diversification strategy for its currency reserves. Qatar is one of the states with high gold reserves per capita – their stocks each correspond to about twelve gold coins per citizen

© Norbert Schmidt / Imago Images

More

Open the image subtitle

Back

Further

At the Bundesbank you obviously do not have these worries. President Joachim Nagel said in February that there was no doubt that the Fed New York was a trustworthy, reliable partner in storing gold stocks. He has “full trust” in the Fed and “No sleepless nights”. According to “Bild”, this attitude continues to apply.

Why is Germany’s gold in the United States?

The Bundesbank has brought gold back to Germany in the past. Until 2017, some of the German gold reserves were stored in Paris. The 374 tons stored there at the Banque de France were brought to Frankfurt. The Bundesbank justified this with the fact that France, like Germany, has the euro and that an exchange in one of the international reserve currencies does not make sense. In addition, Paris is not a trading center for gold such as London.

But why is there so much Bundesbank gold in the United States? Thorsten Polleit, chief economist at Degussa Goldhandel GmbH and professor of economics at the University of Bayreuth by 2023, told ZDF that this had historical reasons. After the Second World War, Germany exported more to the United States when it imported from there. This surplus was paid with gold.

“Then a gold bar was taken from the subject of the American central bank and placed in the subject of the Deutsche Bundesbank. This increased due to the export surpluses. A significant part of the gold is therefore in the United States,” he said. So the German gold was not brought there, it was always there.

Polleit is more difficult for the German gold to be difficult for German gold under the Trump government. “I’m not so dramatic,” he told ZDF. However, it is a “good and disciplined measure to subject the whole time to the revision”. The German taxpayer is guilty.

The German gold bars are inventorized annually at home and abroad. The Bundesbank even publishes a so -called, which lists its inventory, its weight and fineness in detail for each gold bar. There are also regular inventory controls at the three locations in Frankfurt, London and New York, as the dpa news agency writes in one. Johannes Beermann, a former board member of the Deutsche Bundesbank, said, according to dpa, that there were no complaints about any review.

Source: Stern