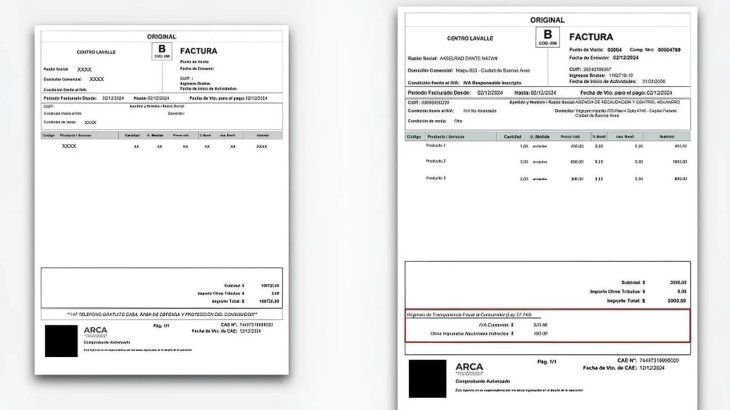

Companies must include a specific section in tickets where VAT and other taxes are broken down, within the fiscal transparency regime.

The government ordered that As of April 1all assets and services invoices must include the detail of the tax to Added value (VAT). The measure, implemented by the Customs Collection and Control Agency (ARCA)seeks consumers to know the impact of fiscal pressure on Final prices.

The content you want to access is exclusive to subscribers.

As reported, sellers must incorporate in their vouchers a section where the amount of VAT and other internal taxes are broken down. This provision reaches “The whole universe of taxpayers”, In line with the implementation schedule of the fiscal transparency regime established by ARK.

VAT (1) .jpg

VAT must be discriminated on in invoices.

Until now, the obligation to discriminate VAT only applied to large companies. However, those who used Arca electronic billing tools, such as mobile billing or online vouchers, already had the option to show the tax on their tickets. With this new regulation, the demand is extended to All merchants and service providers.

The main objective of the measure is that consumers can visualize more clearly “the fiscal pressure that affects the final price of the products“For this, vouchers must include a section entitled” Other Indirect National Taxes “, where VAT and internal taxes will be detailed.

From Arca they clarified that “The final consumer should not do any operation”, Since the breakdown will be only informative. In addition, the invoices must carry the legend:“Fiscal Transparency Regime to the Consumer Law 27.743”, With the corresponding tax discrimination.

Source: Ambito