After several months of recovery, Real wages in the private sector began 2025 with a stagnationaccording to the first indicators known in recent days. The decreasing nominal increases negotiated in parity, promoted by the Ministry of Human Capital, and a brake on the inflationary deceleration process They put in check the improvement of purchasing power.

This Friday, the INDEC reported that his salary index for workers registered in the private sector barely rose 0.1% in real terms during Januaryan identical variation that had been thrown in December. In this way, the salaries were 0.7% above the level prior to the assumption of Javier Milei as president.

Meanwhile, the average taxable remuneration data of stable workers (Ripte) showed a monthly advance of 0.4% For the first month of the year. However, it should be remembered that this indicator is questioned by many economists since, according to the Ministry of Labor itself, it was prepared as an input to determine retirement mobility but “does not necessarily reflect the evolution of wages” and excludes increasingly relevant components in a salary receipt such as non -remunerative payments.

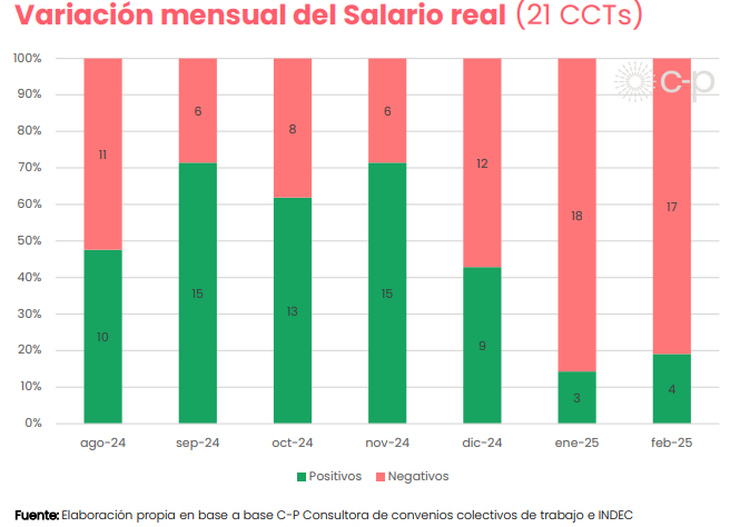

For its part, the CP consultant Build a salary indicator that is ahead of official data when evaluating the different increases agreed in a group of representative peers in employment. The same reflected that In February the second consecutive fall in purchasing power was seensince wages were negotiated, on average, 2.1%, against inflation that accelerated to 2.4%.

image.png

Why did real wages stop growing in the private sector?

“This situation is explained by decreasing salary guidelines with monthly inflation that fails to drill 2%. While in October and November 2024, most agreements contained increases above inflation, in January and February they only do less than 20% of the agreements, “explained the entity led by Pablo Moldovan and Federico Pastrana through a report. According to the CP index, The negotiated average salary follows 3.1% below the level of November 2023.

image.png

The economist of the Paternal Group, Juan Grañahe highlighted in dialogue with Scope that “the government’s strategy is clear to press the peers to anchor salaries as an anti -inflationary tool.” In addition, he added, as the February and March inflation will be above what was expected, there is a Double movement: lower nominal increase in salaries and higher price increases.

Looking ahead, the researcher sees that “if the macro is complicated, this dynamic will be a source of conflict in the coming months.” “We will have to see if the new negotiations show changes forward. The last truckers continued along the same lines as the previous ones (they agreed to increase 1% monthly)“He said.

Florence IraguiLCG analyst, explained before this media that January “is usually a month of few increases agreed while between February and May they usually have more annual joint openings. “

Even so, the economist clarified that “Do not lose sight of the fact that salaries come from historical minimums; It is not the same not to grow when salaries are already accommodated to the rest of the prices of the economy than not to do so when they were already late. “

Income from public employees and vulnerable sectors lose strong

It should be stressed that these analyzes are focused on the segment of workers with greater stability and more rights of the entire labor market. Very different is the situation of public employees, informal workers, and who receive non -salary income.

In the case of state workers, INDEC reported a monthly drop of 1.3% in January, so here the real deterioration of income during the Milei era was deepened to 16.4%. Meanwhile, for informal workers, the agency reported a real improvement of 4.2% in August 2024 (the data comes with an approximately five months lag), which would indicate a loss of 5.5% since November 2023.

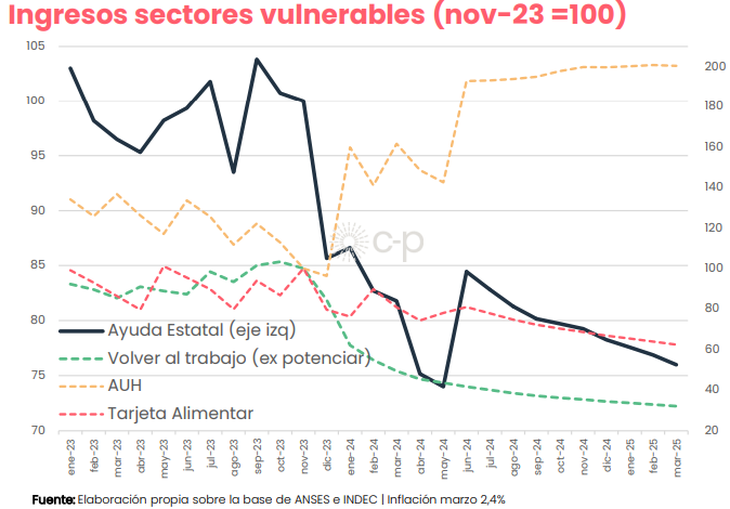

Meanwhile, The state aid index, prepared by CP based on data from ANSES and INDEC, contracted 1% monthly in February and 23% in relation to the level left by Sergio Massa’s management. “For March it is estimated that this deterioration explained by the fall of the feed card whose amount has been frozen since June and the program to return to work, frozen since January 2023. Likewise, If the March CPI is greater than January, the Universal Assignment for Son (AUH) would also fall in real terms for the first time in 10 months“The consultancy detailed.

image.png

In this context, it is expected that, If the government fails to calm doubts about the sustainability of exchange policy Through the agreement with the International Monetary Fund (IMF), new credit in dollars or some other “flying”, inflation costs to drill 2%. In front of that situation, The distributive bid tends to reheat this election year.

Source: Ambito