The confirmation that the new program with the International Monetary Fund will be US $ 20,000 million did not reach to reverse uncertainty. A financial sector consultant told Scope that the “Anti Carry Trade effect”: Importers took U $ 10,000 million in 20 days, while exporters relax the liquidation rhythm. The change in expectations reached prices, Inflation accelerated in March and in construction, which already has very high costs, The two -digit remarks returned.

The Government questioned its strict exchange rule. The Minister of Economy Luis Caputo did on March 18 in a television interview. From that moment on, what a renowned consultant defined this media began as the “Anti Carry Trade effect”.

The City economist who preferred to keep anonymity put it in this way: “Given the doubt, importers try to advance their payments, while exporters wait and finance in pesos”. The phenomenon explains largely that the Central Bank has had to sell more than US $ 1,6000 million in the last ten wheels.

WhatsApp Image 2025-03-29 at 18.32.20.jpeg

The “Anti Carry Trade” effect took considerable speed. Importers went from paying US $ 5,794 million throughout the month of February to more than US $ 695 in the last 20 days, according to Eco Go data. While, as anticipated scope, the settlements of the agro -exporters fell from about US $120 million daily to $80 million.

Inflation is requisitive

As usual in Argentina, volatility translates into price increases. Apart from March, it is a month with high seasonality, practically All price monitors detected an acceleration in the inflationary process with respect to February and particularly a relevant leap in mass consumption.

According to a survey of LCG Food inflation in the third week of March was 2.4% and became the highest variation in a year. The rebound came just at the same time that parallel dollars woke up. A classic. For the general level, the PXQ measurement estimates that this month’s consumer price index will close around 2.9%.

Bad news for the government that has the downward of inflation as its main electoral asset. For more, The new lists arrived at the WhatsApp from construction entrepreneurs who will start the week with a 13% increase in brickswhich had already risen 80%.

The construction is very expensive in dollars. About US $ 1,500 the square meter without counting the land. It rose between 50% and 60% in foreign currency since 2023, while lucky sales prices moved 10%. With these conditions, Many entrepreneurs are meditating their investment decisions in an intensive employment sector.

The other threat

The “Anti Carry Trade” effect also threatens the credits in dollars of the private sector. The mechanism used by the Central Bank in recent months to accumulate dollars. Since October the stock increased by US $ 7,000 million to US $ 13,000 million according to Eco Go data.

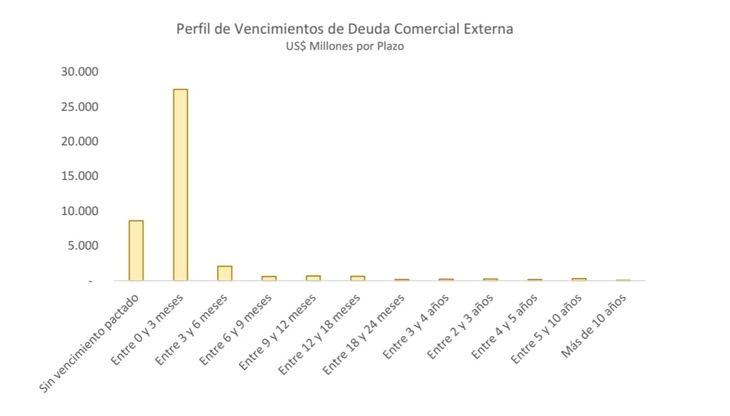

But there are more potential problems: private commercial debt. Pxq put it in figures: U $ 27.4 billion with expiration date between 0 and 3 monthsas he said days ago.

Whatsapp image 2025-03-29 at 18.31.24.jpeg

The consultant’s report led by former Minister of Economy Emmanuel Álvarez Agis says that “these liabilities grew as a result of a exchange/monetary scheme that is in doubt today.” Before the consultation of whether these positions could be disarmed in case it lasts, in the City they were sharp: “We are already there.”

Source: Ambito