Due to the thrust ofl Profit Tax I already improve it in VAT, the fiscal collection of March reached $ 12.8 billion, which rose a real annual. In this way, the Government managed to complete the first quarter with fiscal income in positive land.

This was reported this afternoon Customs Collection and Control Agency (ARCA). The March result also has to do with the low comparison floor of 2024 and because the fourth category income tax is currently governed that last year was not.

Collection-March-2025.png

According to Arca, a series of measures adopted by the government negatively influenced On the Treasury entries, although this could be compensated, partly by the greater activity, and by some tax changes. The collection agency indicated had negative influence:

How much each tax collected

He Net Value Tax RecYou could $ 4.3 billion and had an interannual variation of 55%. Tax VAT increased 65.0%, while customs VAT increased by 40.2%.

For its part, The Income Tax presented an interannual variation of 110.8%, with income for $ 2.2 billion. The result was due to INCREment of employee’s withholdings in dependency and retirees. This is due to a lower comparison base because in March 2024 the “tax ciedular to high income” was in force that affected only 2000 people.

According to official information, in the Tax on credits and debits were reached $ 942,729 million, with an interannual increase of 57%. “He negatively influenced that this month had three business days less compared to the previous year,” Arca said.

Meanwhile, in terms of Resources for Social Security, there was a strong rise which is related more than anything to the improvement of the income of registered employees, above inflation, and the low comparison base compared to March 2024. Revenue increased 99.1%, by adding $ 3.46 billion. Arca indicated that he also affected “the increase in the maximum limit of the tax base of employee contributions compared to the previous year.”

Regarding foreign trade, In export rights, $ 589,467 were obtained Millions with an interannual variation of 90.1%, a fact that is due more than anything at the rise of the exchange rate. The increase in purchases abroad this year in relation to last year also had an important effect. Tariffs entered $ 430,035 million with a variation of 80.3%.

Meanwhile, the Personal Assets Tax He showed the tax advance effect of the next five periods contemplated in the fiscal package. $ 31,225 million were reached, with an interannual variation of 83.3%.

How much each collection tax contributed in real terms

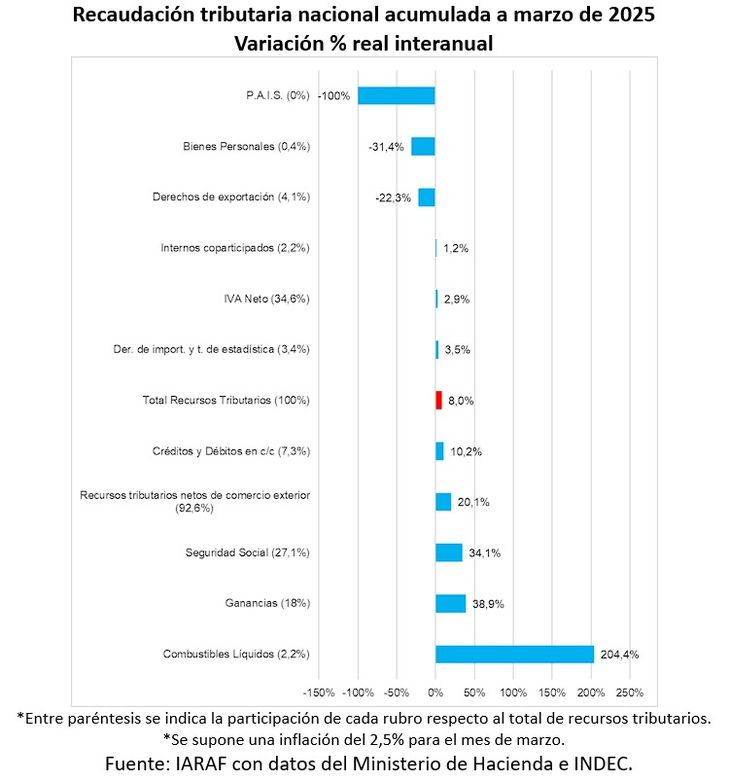

According to the Argentine Institute of Fiscal Analysis (Iaraf) the taxes of greater real year -on -year increase would be Liquid fuels with 134%, followed by profits with 37%and Social Security with 29%. In addition, with temporary reduction of aliquots, the largest liquidations would have made export rights grow 23.4% real in interannual terms.

The main tax from the collection point of view, VAT would have grown a real year -on -year during the month of March 2025.

How the quarter for ark closed

Tax collection national of the first quarter of 2025 would have increased 8% real interannual, Iaraf estimated. By excluding taxes related to foreign trade, the rise would be 20% year -on -year in real terms.

Iaraf.trimeste.2025.jpeg

Source: Ambito