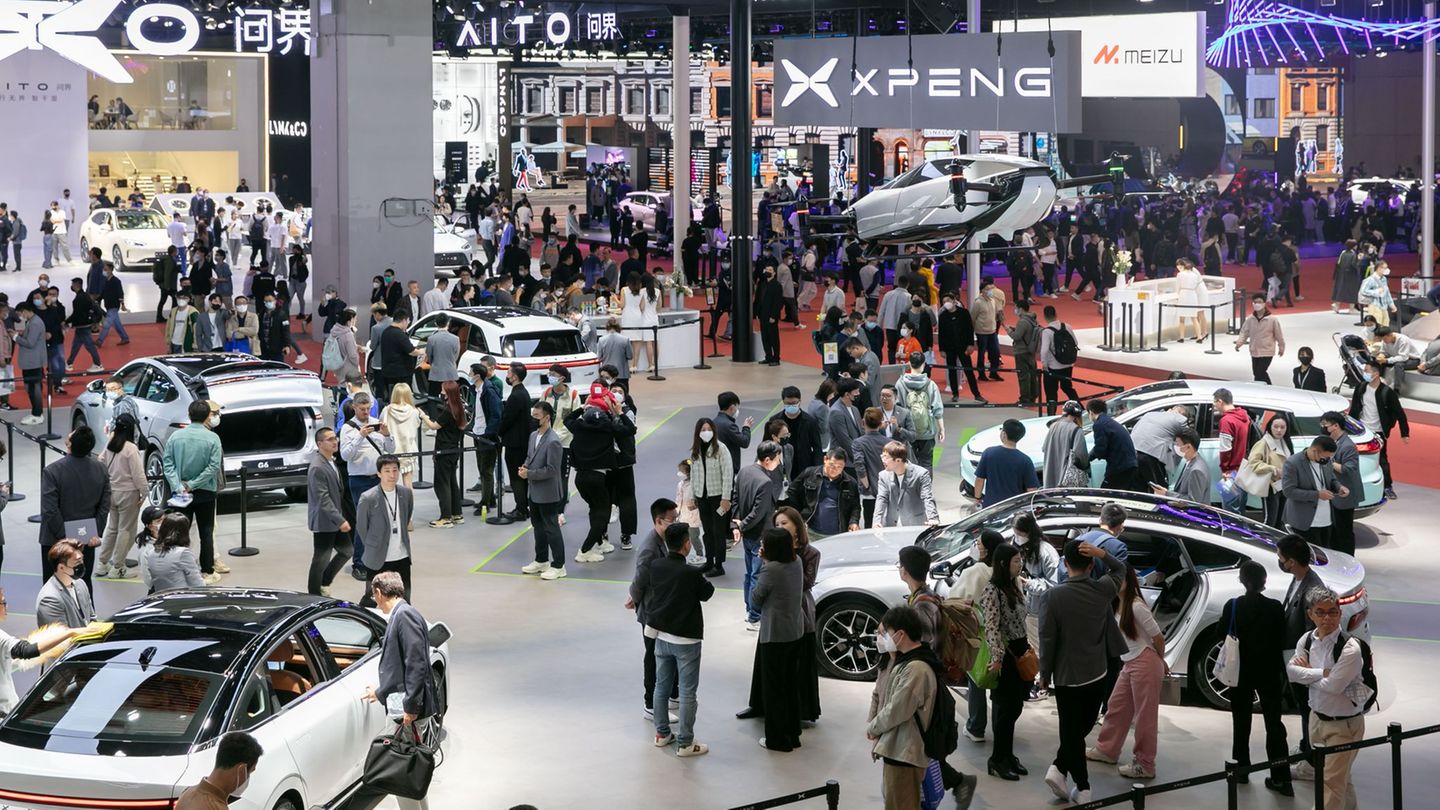

Car show in Shanghai

This is how China’s car market ticks

Copy the current link

Add to the memorial list

In China, tech giants and domestic car companies have a race for leadership on the electric car market. Is there space for traditional German brands?

If you want to build cars successfully, you must be able to survive in China. German carmakers had done excellent business in the People’s Republic – until the Chinese catch up and overtook in some areas. At the upcoming auto show in Shanghai, it will be shown who is in front of the show of strength.

Because known and good reputation alone are not enough as guarantors of success. Understanding the market and its buyers is the new indicator. These questions and answers explain how China’s car market ticks and why it is also worth taking a look at the fair in the Far East in Germany.

What is the location on the Chinese car market?

China remains the world’s largest car market: around 31 million cars were sold there last year. But the competition is harder than ever. Local manufacturers have further expanded their lead at electric cars, which are particularly in demand in China. Industry leader BYD dominates the segment. New models come onto the market with high-tech features and assistance systems, often at no extra charge.

At the same time, technology companies such as Xiaomi and Huawei are entering the market. You bring your expertise in software, sensors and user experience and make networked vehicles “smartphones on wheels”. The consequences: an increasingly rapid innovation cycle, falling prices, massive overcapacity.

“Due to the overcapacities on the Chinese market, there is great pressure on manufacturers and suppliers to expand and export globally,” says auto expert Philipp Seidel from the management consultancy Arthur D. Little. This expansion pressure will be even more felt in Europe in the coming years – especially if the United States continued to be sealed off as a target market, he said.

How are German car manufacturers currently doing in China?

The German manufacturers have been losing the ground for years: Volkswagen, but also German premium brands such as Mercedes, BMW and Porsche, fight with problems because local electrical news gain market shares aggressively. The German brands are trying to oppose adjustments: they invest more on site and bring out models that are specially tailored to Chinese customers. The VW subsidiary Audi goes so far as to introduce its own new brand with the name in capital letters and without the four rings.

Nevertheless, the downward trend continued in the first quarter: the BMW Group lost a good 17 percent in China, Mercedes-Benz’s car division around 10 percent and Volkswagen at Group level. All three depend clearly from China. At Volkswagen, the market at Group level with 644,000 cars accounted for around 30 percent of the deliveries, at Mercedes it was 34 percent in the car sector and at BMW at Group level with 155,000 despite the strong decline.

Why are electric cars so popular in China?

Electric cars are much more common in China than in Germany. China has been promoting electromobility for years through state subsidies, tax relief and advantages in approval, which increased the proportion of electric vehicles in new car sales for the first time last summer. In addition, Chinese manufacturers offer a wide range of cheap models, some of which cost less than 10,000 euros. In Germany, on the other hand, electric cars are often more expensive, and the expansion of the charging infrastructure and political measures are slower or are not held.

What role do tariffs play in the trade between China and Europe?

Customs are currently causing tensions in the car trade between China and Europe. The EU imposed high punitive tariffs on electric cars from China at the end of 2024 due to accompanied Chinese state aids. Beijing condemned this as a protectionist and threatened countermeasures. German manufacturers and associations view the EU tariffs critically: the German VDA, for example, gave the taxes a mistake and urges negotiations. Talks about alternatives, such as minimum prices for Chinese e-cars.

So far, Chinese brands have played almost no role on the German car market. If you take Chinese brands in a narrower sense and let the Swedish brand Volvo, including the daughter Polestar and Smart, which belongs together by the Chinese Geely group, that Geely and Mercedes, together in 2024, came to a share of 1.0 percent of the German new registrations, of which the largest part of MG Roewe was by far. Even industry sizes such as BYD only came up with around 2,900 new registrations or 0.1 percent market share.

Why is the fair interesting for German consumers?

The Auto Shanghai 2025 fair is a shop window for the global automotive future – and therefore also exciting for German audiences. Chinese state media report that over 100 new models will celebrate their debut in Shanghai. Among them are some world premieres of German brands. Expert Seidel refers to Volkswagen’s new product offensive: “Although these are initially intended for the Chinese market, they can also provide information about the upcoming global product strategy – and thus also to vehicles and functions that we could soon see in Europe,” he says.

German suppliers such as Bosch will also present their innovations. The topic of autonomous driving should be particularly important this year. Here, too, the Chinese manufacturers want to take the lead at electric cars before.

dpa

Source: Stern