Menu

Shanghaier Aut show: How China drives its e-car revolution ahead

Categories

Most Read

Mother’s Day sales fell 3.5% annually

October 19, 2025

No Comments

They will do everything possible to generate panic with the dollar

October 19, 2025

No Comments

Meat increased less than inflation in the last four months: the reasons

October 19, 2025

No Comments

Economist warns of real wage increases at the expense of competitiveness

October 19, 2025

No Comments

Bahn: New boss Evelyn Palla announces major renovations

October 19, 2025

No Comments

Latest Posts

The Moroccan coach’s warning before the final of the U20 World Cup with Argentina: “No one is invincible”

October 19, 2025

No Comments

October 19, 2025 – 15:03 It will be the duel between the most successful team in history in this category and an African team seeking

Which are the provinces with the largest number of workers and what salaries do they pay?

October 19, 2025

No Comments

Public employment: large regional gaps The National Directorate of Provincial Affairs (DNAP) estimated that, by December 2024, the country had an average of 50 provincial

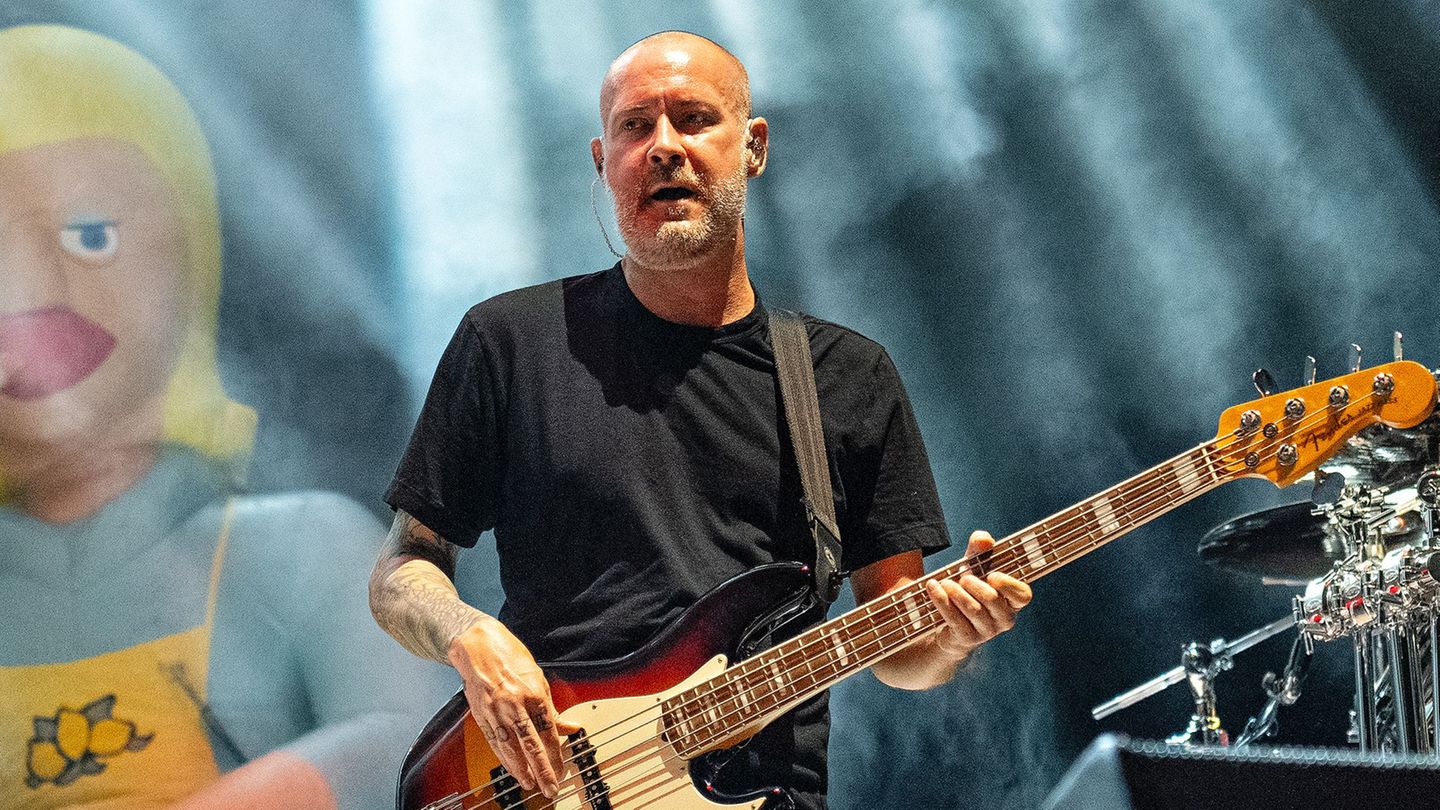

Nu-metal band: Limp Bizkit bassist Sam Rivers dies

October 19, 2025

No Comments

Lisa HarrisI am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.