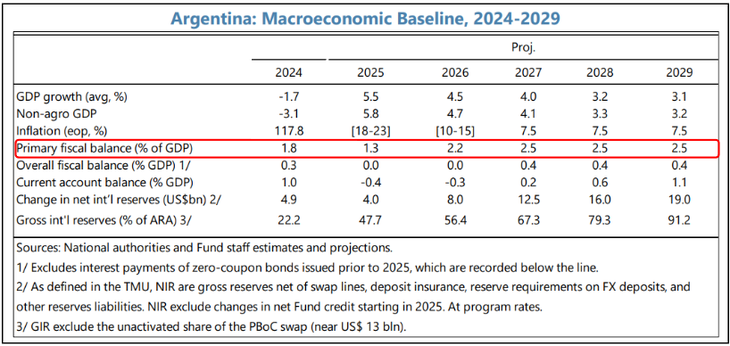

The new agreement with the International Monetary Fund (IMF) contemplate for this year a Primary surplus of 1.3% of GDP as long as it was foreseeable, it provides that The financial surplus is zero. Getting that number will be a challenge for the Ministry of Economy, beyond President Javier Milei said he will ensure that he reaches 1.6%.

According to the program approved by the Board of the organism, This year there will be less adjustment than in 2024. It will be of the 0.5% of GDP, since last year it closed with 1.8%. You could say, then, that to maintain 1.8% of last year the government would have to make another adjustment of 1%.

To reach 1.3%, the 46% must be contributed by consumersthat they will have to endure the Total removal of subsidies.

A fact to keep in mind is that The agreement with the IMF exposes the first official scheme of expenses and income for Argentina in 2025, Because the government this year decided to handle with the 2023 extended budget. In other words, it shows How much does the government plan to spend this year and where the resources will come from, exposed in PBI percentages.

How is the tax program for this year

According to the organism document, for the dismantling of extraordinary income generated last year the program foresees a Total income shrink equivalent to 1.3% of GDP.

Of this, the elimination of the tax Country represents 1.1% of the product. On the other hand, it is estimated that the liquefaction effect for the devaluation of 2023 was 0.2%, which is also lost; While the taxes of taxes and advances of the fiscal package that already entered in 2024, will stop contributing another 0.2% this year.

In favor they will play Export withholdings, which generate a positive effect of 0.2% of GDP Due to the base of comparison with 2024, which was lower.

Vsingresos expenses.png

By Measures to generate more income Resources are expected this year 0.4% of GDP. These will come from a Fiscal reform that would leave 0.2% of GDP and the increase in fuel tax, which will contribute another 0.3%. In the opposite direction, the temporary reduction of retentions will act, which will generate a loss of 0.1% of GDP.

As for the spent, There the heart of this year’s adjustment is concentrated. There will be a saving 0.8% of GDP, composed of 0.6%, due to subsidies and 0.2% due to an improvement in social spending.

On the other hand, it is expected that the combination of improving fiscal dynamism with the highest indexed expense, will imply a deficit ofl 0.3% of GDP, which is divided into an improvement of social security income of 0.6%, which is compensated with a rise of social expenditure of 0.6%. Non -fiscal income falls 0.3% of GDP. Meanwhile, other unspecified expenses represent a 0.1% deficit of GDP.

Javier Milei’s promise with the greatest primary surplus

The President Javier Milei promised that in 2025 the primary surplus will be 1.6% of GDP, that is, 0.3 points above the agreed. That implies that the adjustment level for 2025 is not 0.5% but 0.8%. The difference, meanwhile, would become a fiscal surplus.

Analysts are not clear where the resources would come from. Some assume that the Effect of freezing of the $ 70,000 bond of retirees with the greatest inflation that there will be now after the modification of the exchange regime, It could liquefy the expense in part. On the side of the highest income, the tax expenditure could be reduced.

No margin to lower taxes

According to the Argentine Political Economy Center (CEPA) In successive years, “the fiscal adjustment in the primary result is significantly increased. ”

Baseline.png

“In 2026 it amounts to 2.2% and in 2027 to 2.5%. Although the fiscal adjustment is 0.9% between 2025 and 2026, it does not translate into improving the financial result: The difference are debt services, ”explains the report. That is to say that Most of the remaining money will be directed to pay debt interest.

In that way, to the government He will have little margin in the coming years to rehearse important taxes. In fact, it is pointed out that as a result of the tax reform they will raise income. In principle, this year and the next one will allocate what interests. Only in 2027 it will have a 0.4 financial surplus from GDP onwards.

Source: Ambito