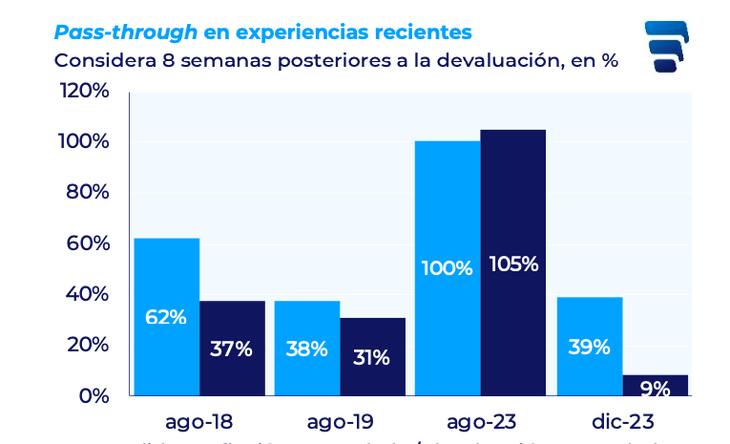

He Wholesale dollar closed the last business day of the week with a price of $ 1,126 For purchase and $ 1,135 For sale, which represented a daily drop of $ 65. Despite this punctual decline, in the weekly accumulated the currency rose $ 52.50. The immediate reaction after The modification of the exchange scheme and confirmation of the details of the according to the International Monetary Fund (IMF)It was a wholesale exchange rate of 10.5%. This movement once again generated the question about the intensity and speed with which changes in the Fx They move to prices, a phenomenon known as “Pass Through“, which is usually observed in contexts of devaluation.

It should be noted that in countries with high inflation or little credibility in its monetary policy, the “Pass-Through“It is usually faster and higher. The first estimates made by the market -based on the data collected during Monday and Tuesday -revealed that, although a slight acceleration in prices is perceived, This time he was much less pronounced than in previous devaluatory episodes.

From Pxq, the consultant of Emmanuel Álvarez AgisThey say that when focusing between Saturday and Tuesday, the items that most felt the impact of the new regime of “between bands” were those related to electronic componentssuch as: Computers, printers and monitors (+6.3%), computer accessories (+5.7%) and televisions (+3.0%). Outside this segment, the “food out of the home” item stands out, which on Tuesday registered an increase of +6.2%.

The graphic shows the daily evolution of prices during the months of March and April. “It can be seen that between April 14 and 15, the daily variation of prices went from 0.1% to 0.3%, which reflects a slight increase in inflationary rhythmalthough still far from the peaks achieved in similar situations, “concludes Pxq.

April inflation is requisitive

The data suggests that, despite the devaluation, the transfer at prices was moderate compared to previous events, but does not mean that it will not have its impact on the April inflation data.

In fact, from Econviewsthe consultant of Miguel Ángel Kiguel, They expect price dynamics to accelerate in the coming months, “but the “Pass Through” It should be less than in previous episodes, thanks to fiscal consolidation, improvement in relative price alignment and greater confidence. “We hope that inflation will be moderated towards the elections,” he says.

It happens that The official dollar was the great government ally in the fight against inflation. The strategy of maintaining a monthly devaluation at 2% initially and then 1% (Crawling PEG) served to anchor expectations and that the consumer price index (CPI) falls faster than expected.

PXQ.PNG

“This was not free. As a result of this plan, the real exchange rate was delayed until it reached a historically low level and the accumulation of reserves was committed,” says the consultant. The market began to perceive that situation as unsustainable and led to the Central Bank to sell U $ 2,487 million in the 19 rounds prior to last Friday’s ads.

In fact, from GMA They coincide with Kiguel’s gaze and wonder How much could this new stretch of the road last? Of course, nobody knows, but the consultant expects “that minimally to the elections, and perhaps also until the inflation level allows even greater exchange flexibility and a monetary scheme based on the interest rate such as that of “Inflation targeting”.

They warn that, if the inflation level did not quickly accompany 1% of the upper band, this limit could be at a level too appreciated in real terms. “This situation, in the absence of improvements in Argentine productivity via reforms, could make us see changes sooner rather than later “.

So the main risks of this new regime, apart from the reserves goal set by the IMF, They are in inflation, economic activity and international context, which could affect the chances of libertarian management in legislative elections. “There is also a risk that the exchange rate will touch the band’s roof, although this seems less likely if monetary policy is handled correctly. We do not benefit a rate of exchange too close to the floor,” says Econviews.

The reduced Pass Through effect

According to the latest Advance report of Capital & Growth Labor (LCG) Inflation in food and drinks was 0.8% in the third week of April (after ads), which implies a variation similar to the previous week, with a decrease of 0.1 percentage points.

In addition, it indicates that the average monthly inflation of four weeks is maintained in 3.8%but the measurement against the tips fell 1.6 percentage points to 3%. In three weeks, a 2.5% inflation accumulates.

Again, it stands out meats, baked and dairy products like the items that more contribute to weekly inflationwhile drinks recorded falls after increases the previous week.

Thus, things, although a rebound in April inflation is expected, the data does not show an uncontrolled rebound of the price dynamics in the measurement made by LCG this week.

Facimex.png

Finally, the weekly report of FACIMEX VALUES comments that “Society will assess exchange normalization than the limited impact on inflation and economic activity “. And he admits that the beginning of the new exchange scheme showed a slight rise of the exchange rate, But with a reduced “pass-through”which will lead to a limited impact on inflation.

And -In line with Econviews It considers that this phenomenon is due to fiscal balance, monetary restriction and expectations anchor. FACIMEX projects an inflation of 4% in April and 3.5% in May, and then decreased to 2% in the third quarter of 2025, to close the year around 30% per year.

Source: Ambito