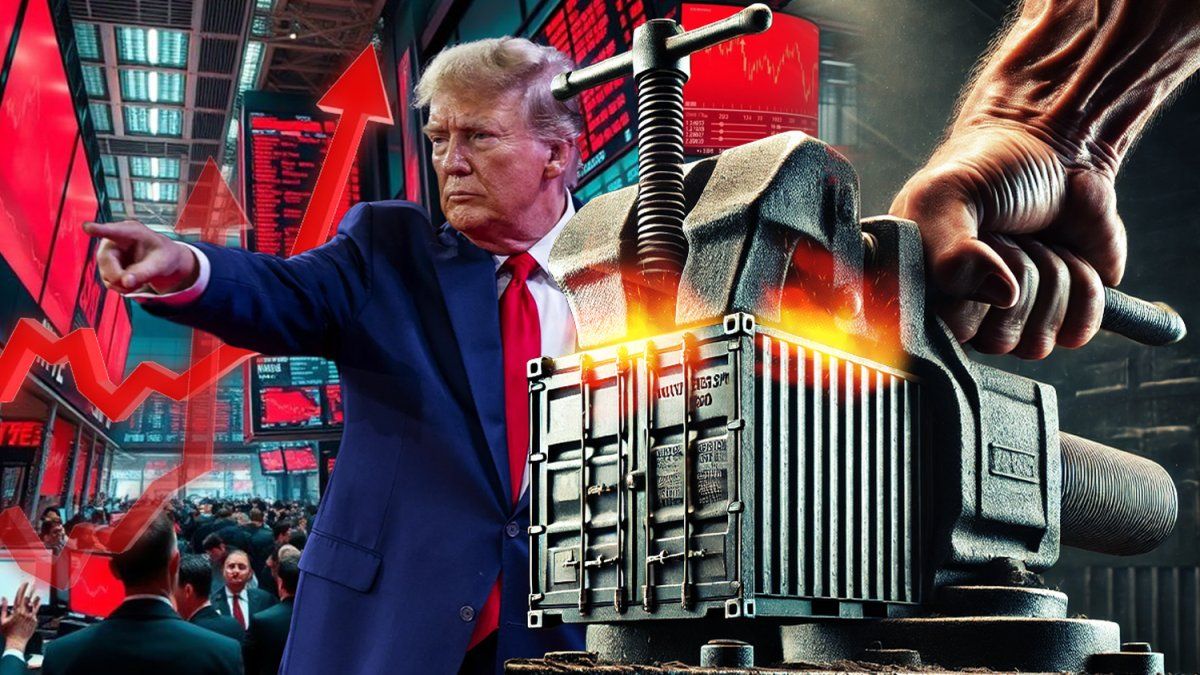

Tensions between US President Donald Trump and director of the Jerome Powell Federal Reserve System They twisted this week after the president threatened to dismiss him. This measure would imply staggering the independence of the US Central Bank.

Before its tariff trade war hit its economy, The Republican insisted that the Fed cut their interest rates to boost growth. But Powell’s determination as his own time increased the president’s frustration.

In the middle of the commercial war, Trump redoubles the pressure on the Fed

Several analysts suggest that the conflict between the White House and the Fed can destabilize financial markets. Powell, meanwhile, ruled out to leave his position in advance And this week he recalled that the independence of the entity is “guaranteed by law.”

“That the president of the Fed has to talk about the issue means that they are seriously” the threats of the White House, the Chief economist of KPMG told AFP, Diane Swonk.

Many experts argue that the general increase in Trump’s tariffs could decelerate the growth of the economy and increase pricesat least in the short term.

Trump and Powell.jpg

Donald Trump threatened to dismiss the president of the Federal Reserve, who believes “in the law.”

This would also remove the objective of the Fed from achieving annual inflation of 2%which would force high interest rates for longer.

“They will conflict,” said Wolfe Research chief economist, Stephanie Roth. But he ruled out that the Fed “will succumb to political pressure”: “They will not react because Trump posted a message demanding” lowering the fees, said the analyst. If they did “it would be the recipe for a disaster.”

The independence of the Fed is “essential”

Most analysts agree that Trump does not have legal power for such dismissal. The Fed organization allows you to be protected from political influences, with limitation of presidential power and requires the confirmation of the Senate.

“Independence is absolutely essential for Fed. Countries that do not have an independent central bank have remarkably weaker coins and notoriously higher interest rates,” Roth recalled.

A serious threat would come if a judicial process begins before the Supreme Court. The Trump government wants to challenge a jurisprudence of 1935 which prevents the US president from saying the chiefs of independent government agencies.

Trump Jerome Powell (1) .jpg

After commercial turbulence for Donald Trump’s tariffs, public debt yields shot up.

During the commercial turbulence for the Trump tariff war, the yields of the US public debt shot and the dollar fell, indicating that investors could stop seeing the United States as the capital refuge that once was.

This unexpected movement prompted Trump to suspend an important part, which meant a respite for financial markets.

If investors perceive that the ability of the Fed to act independently against the progress of inflation is in doubt, The American debt risk premium would rise again, subjecting Trump’s administration to new pressures.

Source: Ambito