For Alfredo Romanopresident of Romano Group, the new exchange scheme that applies the government “It is transition “and not a definitive goal. The author of “Dollarized Argentina“-The book he wrote with Emilio Ocampo,” said a dollar that reaches $ 1,000 “It is interpreted as a step towards dollarization“, under a” vital “process of deregulation of the economy, tax decrease, zero issuance and closing of the Central Bank of the Argentine Republic (BCRA).

Therefore, the specialist is convinced that the currency around that price does not imply only an electoral influence, but that the government’s economic plan “The exchange discussion in Argentina would end.”

Next, the dialogue that Roman had with Scope:

Journalist: How would you define the new exchange scheme? How a goal fulfilled from the government or a transition program?

Alfredo Romano: A transition scheme where the government shows again that it has a long -term economic program and suggests to the market that there are no improvisations or untimely changes. In addition, the Guidance The president has been clear, consolidating the idea that at some point will close the Central Bank so that no other administration can broadcast in Argentina.

Q.: A dollar that floats in the $ 1,000 allows you to think about a dollarization scheme?

AR: The long -term objective, based on what the president has communicated repeatedly is to go to a definitive closure of the Central Bank, and allow the dollar to compete legally against the weight. The last purpose will be to buy those pesos and end up dollaring but the process can be in the medium term. In the short term, the monetary rule of emission 0 continues to consolidate and give more and more tools to people so that they can operate, buy, sell or treasure dollars. The objective is to ensure that stability generates a greater income of dollars to the financial system, strengthening it and giving it more and more prominence in the daily transactions of human and legal persons.

1200x1200WZ.JPG

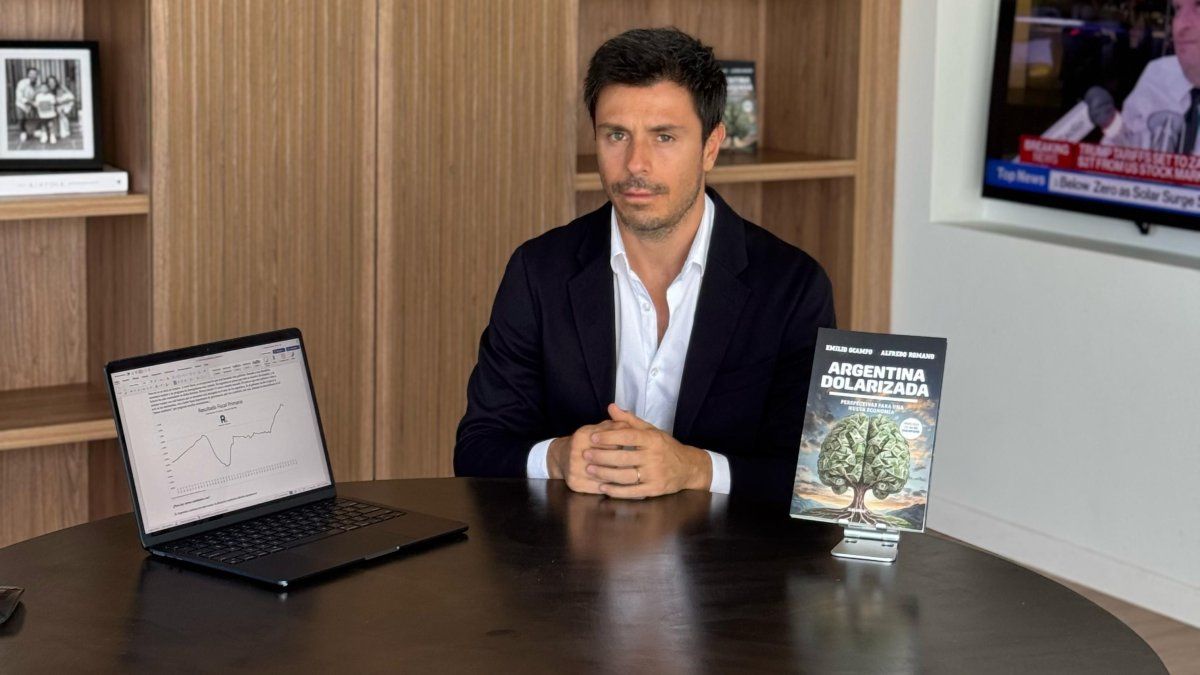

The book that Alfredo Romano wrote with Emilio Ocampo.

Q.: What are the counterparts of a dollar in that value?

AR: It is essential that Argentina continue to open its economy, deregulating it and above all, it continues to advance in tax decline together with a labor reform. The discussion is that the sequence that these actions are carried out are not necessarily going at the same rate. This is what generates noise in some economists who proclaim for a devaluation to fictionally adjust Argentine competitiveness/productivity.

Q.: A dollar at $ 1,000 is a macroeconomically sustainable quote or responds to a value with electoral interference?

AR: If the Government continues this path, the exchange discussion in our country will definitely end. In Argentina it is thought that everything is resolved by devaluing, and history has been overwhelming in that decision. We have taken 13 zeros to our currency. The issue is that this government comes to try to break this story that is deeply rooted in Argentines. In Romano Group we did a productivity study where we obtained the following conclusions:

- Which are crucial structural reforms, investment in human capital, innovation, infrastructure and a solid fiscal and regulatory framework to attract investments and promote sustainable economic growth. The monetary regime itself does not determine the level of competitiveness and productivity of a country.

- The case of Ireland could indicate that an economy under an inflexible monetary regime is capable of achieving high levels of productivity and competitiveness.

- Both in developed and development economies, a devaluation does not necessarily guarantee an increase in competitiveness. In the Argentine case, although a devaluation can make exports temporarily cheaper and more attractive in the international market, their effects are generally short -term and can be empty in terms of improving the structural competitiveness of an economy.

- In Argentina, devaluation does not address underlying problems such as low productivity, lack of innovation and the inefficiency of the labor market, and can generate inflation, which erodes purchasing power and negatively affects the confidence of economic agents.

- The educational level has a direct impact on the quality of private registered salary, productivity and competitiveness of the economy.

Background-of-Dollars-Banknotes-1jpg.webp

Will the dollarization phase finally arrive in Milei’s economic plan?

Q.: Can the dollar even pierce the $ 1,000 barrier, as fur was it?

AR: It is not a team of improvised, therefore if Furiase, who is part of the economic team suggests what can pierce it, I think we must at least leave the benefit of the doubt. It would not also be surprising whether the income of dollars from the field, energy and financial flow is still deepened. The president also continues to suggest that the convertibility dollar is $ 900, that is, the support of the pesos of the economy with the dollars that the BCRA has. In addition, it is important to highlight what with this exchange stability, the real future rate is positive, further lowering devaluation expectations.

Q.: How can the purchase of dollars converge and the payment of debt in 2025 with a price that promotes exit abroad and the acquisition of imported goods?

AR: Argentina already has all the dollars necessary to pay amortizations such as coupons in 2025. In the short term due to the income of dollars obtained by different international organizations, there will be no problems due to lack of dollars. However, it is very important for the country to return to markets to continue rolling its debt, how any normal economy in the world.

Q.: Do you see a return to the markets in 2026, in a context convulsed internationally?

AR: It can be before since if Trump had not generated the international cimbronazo with the rates, Argentina had already been in a position to access the markets. Therefore, if the international context improves, it is expected that Argentina can return to the markets soon, lowering its country risk to the levels of Pakistan, Nigeria or Egypt, three economies that coexist with financial deficit, while Argentina has primary and financial surplus.

Source: Ambito