Menu

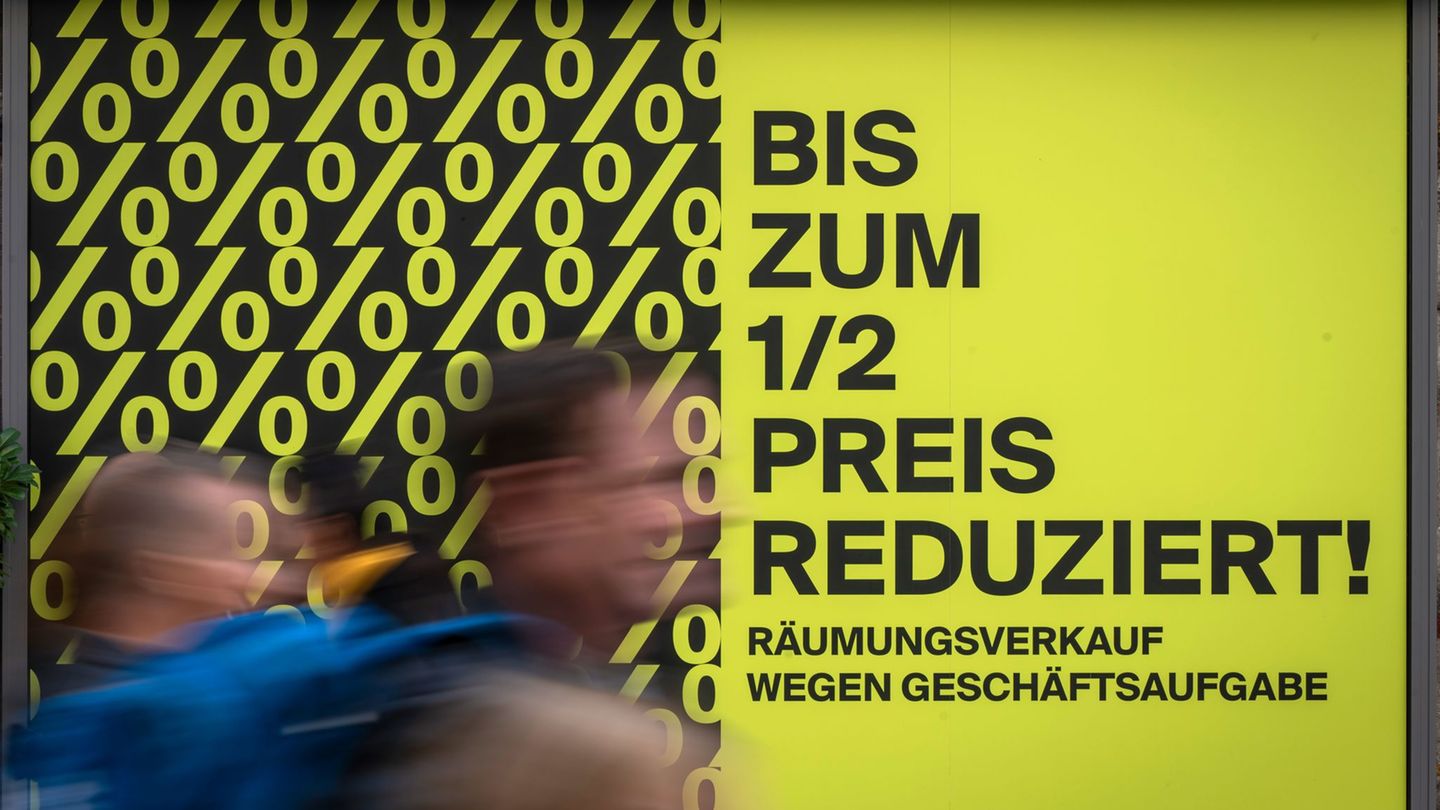

As a result of the economic flaut: Departments in Western Europe at the highest level since 2013

Categories

Most Read

This is the best date for your trip to Disney

October 21, 2025

No Comments

China displaced Brazil as the main trading partner for the first time in almost three years: what were the causes?

October 21, 2025

No Comments

Chrambl from DHDL: What can the washing cube do for a better climate?

October 20, 2025

No Comments

Imports jumped 10% monthly and set a new record

October 20, 2025

No Comments

the keys to the agreement and the technical information that will be kept secret

October 20, 2025

No Comments

Latest Posts

Epstein scandal: Book by Epstein victim Giuffre increases pressure on Prince Andrew

October 21, 2025

No Comments

Lisa HarrisI am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor

Harvest is over: Final estimate: Smallest wine harvest in 15 years

October 21, 2025

No Comments

Reading is over Final estimate: Smallest wine harvest in 15 years Copy the current link Add to watchlist After the harvest there is still talk

This is the best date for your trip to Disney

October 21, 2025

No Comments

October 20, 2025 – 9:30 p.m. Escaping the crowds and saving every dollar is possible if you choose the right month to visit Disney without

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.