The tax collection of April reached $ 13.7 billionwith a nominal interannual variation of 57.9%, he informed the Customs Collection and Control Agency (ARCA). As for the result of the first four -month period, the Government made income of $ 54.9 billion, with a nominal increase of 75.4%.

The agency reported that during the past month the collection was affected, among other issues, by “The modifications in the exchange scheme that took place since April 14, which included the elimination of the restrictions on access to the gear market for the purchase of foreign currency of human people residents, the flexibility of access to it for foreign trade operations, and the exchange flotation regime within bands.”

As for the Value Added Tax (VAT) Income from $ 4.7 billion which marks a nominal growth of 43.7% and a real drop of 0.7%.

For its side, the Profit tax recorded a nominal growth of 96% and 33% realwith a total of $ 2.4 billion. In the month the expiration of the fifth anticipation of human persons operated, for fiscal period 2024. The increase in employee withholdings in dependency and retired relationship. This is due to a lower comparison base because in April 2024 the “cedular tax was in force to high income ”.

For its side, the tax on Debit and bank credits also registered a strong nominal increase of 72.4% and of the real 17%, With income for $ 1 billion. “It positively stressed that this month had one more business day compared to the previous year,” said Arca. The agency said that “during April returns were made to certain agents of perception for balances in favor of the country tax”,

ARCA-REC-ABRIL-2025.png

Regarding income from Social Security, a collection of $ 3.6 billion was recorded, with a nominal improvement of 85.2% and 25% real. According to the collection agency, they affected in favor “the increase in average gross remuneration” and “the increase in the maximum limit of the tax base of employee contributions compared to the previous year.”

As for Export withholdings, The official data marks income by $ 662,352 million, with a nominal improvement of 108% and real 41%. Keep in mind that the Blend dollar was eliminated in April, so the entire liquidation was taken for the official dollar market.

As for Import rights, there were revenues of $ 508,183 million, with a variation of 81.4% and real 22%. Positively influenced the increase in the exchange rate and the increase in imports compared to the previous year. For its part, in Personal assets barely gathered $ 58,753 million, with a nominal decrease of 26% which implies a real decrease of 50%.

Collection: The opinion of the private

Collection-ABRIL-IAF.JPEG

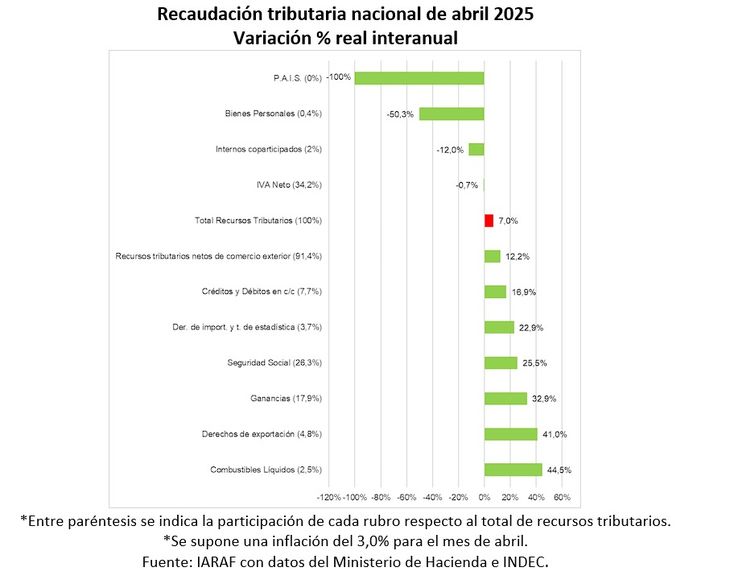

He Argentine Institute of Fiscal Analysis (Iaraf) He estimated that “the first months of the year continue with a real year -on -year rise in national tax collection” and estimates that “it would have promoted 7%.”

“By excluding collection by taxes related to foreign trade, The real interannual variation would be positive for 12%”says the private report.

Analyzing for tributethe collection that would fall, Without taking into account the elimination of the country tax, it would be that of Personal goods, which would have done it in a real year -on -year 50%.

The taxes of Greater real increase would be liquid fuels with 44.5%, followed by export rights with 41%and profits with 33%.

The main tax, VAT would have declined a real 0.7% during April 2025. “It is important to highlight that it negatively affects the collection of the tax The repeal of the suspension of the certificates of exclusion of customs perception, “explains the Iaraf.

Source: Ambito