Car manufacturers under pressure

Experts have little hope for Cologne Ford-Werke

Copy the current link

Add to the memorial list

Ford opened his Cologne electric car plant only two years ago. The hope was great. But the spirit of optimism is blown away. Now there is probably a novelty in the company’s history.

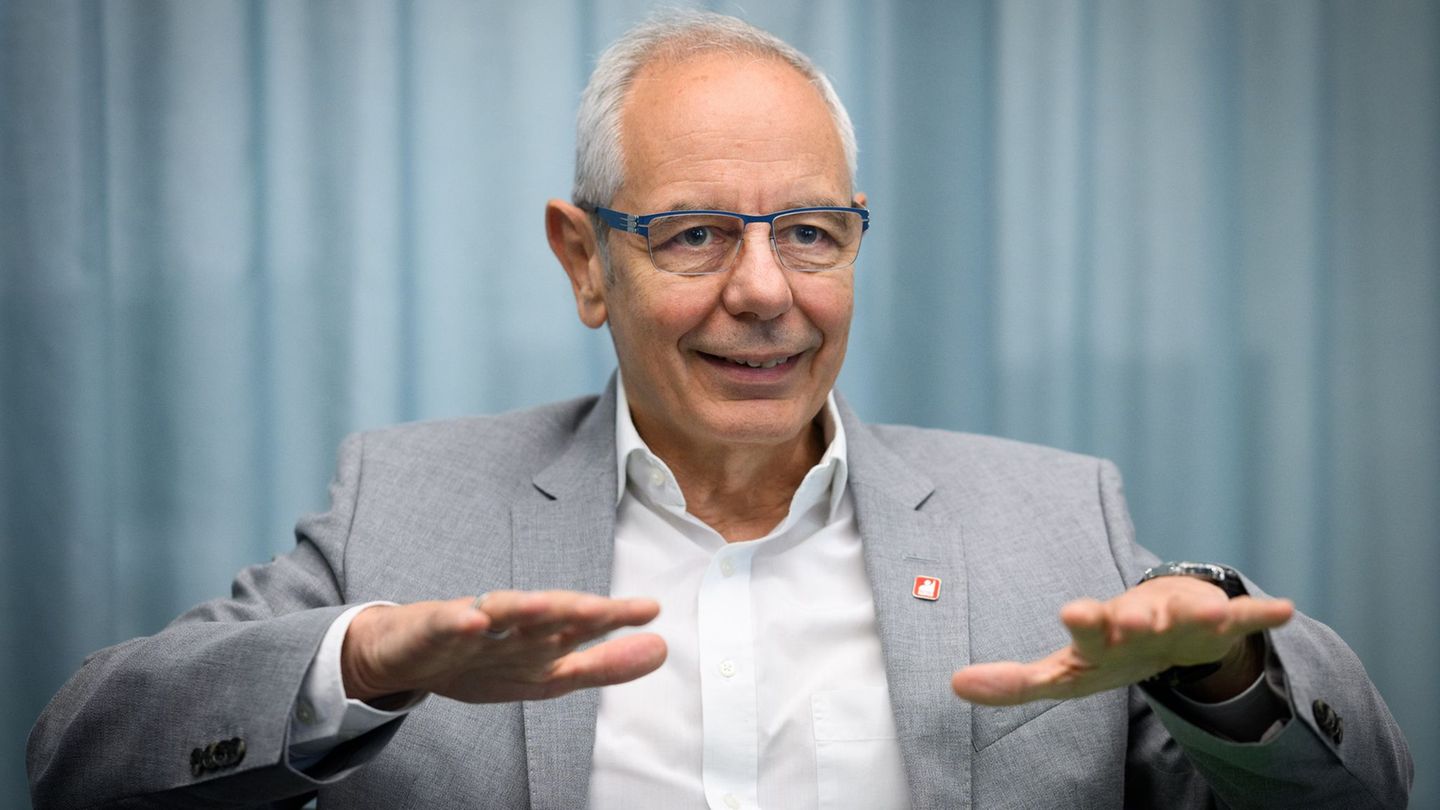

According to industry experts, the carmaker Ford has a dark future in Europe. “The location is bad and the perspective is even worse,” says the director of the Bochum car institute Car, Ferdinand Dudenhöffer. Car stands for “Center Automotive Research”. “Ford is too small in the car sector to work in Europe – that is now and that will very likely be the case in the future.”

The situation at the Cologne Ford works is tense. This week there could be strikes for the first time since it was founded in 1930 that are directed against hard savings plans of management.

Industry specialist Dudenhöffer looks pessimistically into the future of Ford-Werke GmbH. The quantities sold are too low and the personnel costs are too high. Ford has long been losing market shares in Germany and Europe. “Ford shrinks and shrinks – now it is so small in Europe that continued operation in the current constellation makes little sense.” The car manufacturer has its European headquarters and two works in Cologne, a total of 11,500 people are employed there. In 2018 there were still 20,000.

Last year, according to the number of authorities, only 3.5 percent of the newly approved cars in Germany were a Ford, two years earlier it was 5.0 percent. The proportion of commercial vehicles is significantly higher, but they are not produced in Germany.

Several solutions are conceivable

There are two solutions, according to Dudenhöffer: The US mother group could sell its European car business. “Then you would get rid of the problem.” Car production could be preserved in Cologne, but the development department and administrative areas would migrate to the buyer’s headquarters.

The second solution would be to found a joint venture with another car manufacturer and thereby get higher quantities and lower costs. “Then you may finally become competitive,” says Dudenhöffer. A possible partner would be Renault.

The director of the Center of Automotive Management (CAM) in Bergisch Gladbach, Stefan Bratzel, sees a third way to get out of the currently tense situation. “The US mother group would have to put billions in the development and production of new electric cars and to upgrade the brand image.”

The previously guaranteed investments of several hundred million euros for the Cologne Ford works for a period of four years would be far too little. The Ford headquarters in the USA would have to show a determination that it had missed in recent years.

Ford electric cars are not cheap

Ford is currently producing two electric car models in Cologne, the sale of which is below expectations. Central components are bought by Volkswagen. “This means that the added value for Ford is not very deep, which makes the business not very attractive,” says Bratzel. Ford was too late and then only on the subject of e-mobility with half the strength, which is now revenge.

Ford also failed to have its decades of low-price image, which it had as a manufacturer of combustion engines like the Fiesta, to convert credibly into a higher-priced image. The list price of the Ford Explorer electric car is 39,900 euros in its cheapest edition, other expenses are significantly more expensive. The Ford Capri starts at 42,400 euros. “Why should I buy a Ford if I also get a Volkswagen streamer for the same money and the technology it contains is largely the same?” Says Bratzel.

The perspective for Ford in Europe is also bad because the competition will increase. “Chinese providers push onto the market and significantly increase competitive pressure.” All in all, Ford has “a huge task” in front of him with his car business, says Bratzel.

“For years, Ford produced the needs of the European car market for years – the false cars were simply brought out. It was similar with General Motors and Opel – in the end the Americans gave up and sold Opel.” This is more difficult at Ford because the Ford car brand would not have to be separated from the Ford commercial vehicle brand.

dpa

Source: Stern