“Our main challenge now is to get the arrival of investments to motorize private employment and reduce the dependence of the public sector. ”

In relation to the economic growth that derives from national policies, he said: “We see that some provinces They are better positioned than others. In the south of the country there is great wealth. The Northern Challenge is to bet on investment and achieve the growth of the private sector. With that intention we are going down some taxes. ”

“Regarding the reduction of fiscal burden, we see that there are good intentions from the nation. But Much is missing to see how the provinces will do with their own taxes. And also with the small print of these reforms, since there is talk of encouraging the fiscal competence between provinces, but it must be analyzed well, because it depends a lot according to where each company invoices. Besides, There is still great informality. I think it is missing A deeper discussion To advance with the reform, ”he said.

Regarding the relationship with the National Government, the Chaco Minister commented: “At times it becomes difficult, although it works very well. Joint management helped us to pay US $ 240 million of maturities we barely assumed. We asked for an advance of co -participation and gave it to us. And the debt compensation worked.”

Buenos Aires: “We have a fiscal weakness derived from the Copartitioning Law”

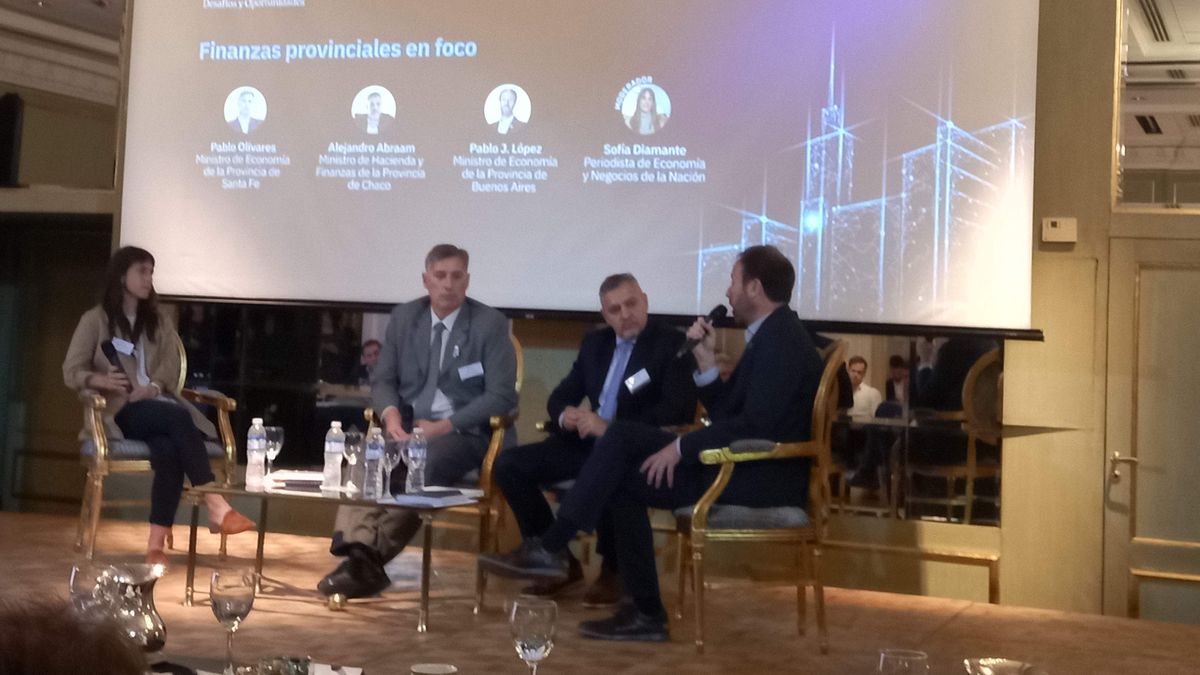

For his part, the Minister of Economy of the Province of Buenos Aires, Pablo LópezHe stressed that this district concentrates 50% of the national industry and represents 40% of Argentine exports.

“Our great strength is the ability to generate wealth and own resourcesbut at the same time we have a fiscal weakness derived from the Copartitioning Law, which harms us since we are receiving 20% of resources when with any indicator taken into account should be more than 30%. This is a great pending discussion, ”he said.

“The year 2024 was very complex, and we suffered a fall in economic activity that, if we take out the agriculture that had a special situation, it is seen that The fall was more than 6% In everything that is industry, construction and trade, which are the activities that generate the most employment and more fiscal resources, ”he added.

“On the other hand, there is a management that harms us with non -automatic transfers, with a nation debt with the province accumulating. We suffer a resource cut that It was unpublished Because of its magnitude, ”he said, invoicing the discretionary handling of the National Executive Power.

And he stressed that anyway “we finish 2024 with tax indicators that showed Primary surplus that covered current expenses and only the capital spending was financed with indebtedespecially to give continuity to public works. ”

As for the economic growth of the Casa Rosada, he said that “the key is the sectoral dynamics of this process. The economy works at different speeds. Everything that has to do with natural and primary resources goes fast. But other sectors do not see a virtuous dynamic. It is what happens with the industry, with the SMEs they suffered in 2024 and continue like this due to the fall in domestic consumption and the opening of imports. In short, we see that there is still no general economic growth or a recovery of the lost in 2024”

On the tax issue, the Buenos Aires minister said that “although what was said so far it is not entirely concrete, we believe that to apply any tax change It is essential that its federal dimension, the situation and opinion of the provinces be taken into accountthat there is federal debate ”.

“A tax reform directly impacts the finances and obligations that the provinces in terms of spending have, and also in the municipalities. The nation so far It made unilateral decisions in tax matters that hit in the provinces and that threatens the capacities to meet the needs of the provincial inhabitants, ”he completed.

Santa Fe: “Not everything is worth making an adjustment in public accounts”

For his part, the Minister of Economy of Santa Fe, Pablo Olivares, said that “the year 2024 was very complex nationwide and also in the provinces. But Not everything is worth making an adjustment in the country’s accounts. It is like reorganizing an airline, you have to make all the necessary changes but you have to always take care of passengers that are transported. ”

“In Santa Fe we achieved fiscal balance under the premise of being tremendously austere in the present and tremendously generous for the future, as our governor usually says. We made the adjustment with a road map and not to the shoves. But from now on the sustainability of this plan has to give economic growth. And that impact is still not seen. ”

“We support the national objectives to move towards A tax simplification. But similar attempts were already many in our history, and They had no supportd. Therefore, you have to do it in a consensual way, to ensure that it can last in time. Currently, in my province of every 10 thousand pesos that invoices a business, there is a national tax burden of 1,800 pesos and the provincial is 200 pesos. But people look around and find no remuneration of services so they pay the nation. ”

Furiase: “The dollar will fluctuate near the floor of the exchange band”

The day organized by ADCAP and DLA Piper, began with an exhibition by the Central Bank director Federico Furiasewho explained the process that led to the removal of the exchange rate and the instrumentation of a flotation between exchange rate bands.

“This exchange flotation scheme It is designed for the exchange rate to be closer to the floor than the roof For a matter of currency flows, since there is no monetary emission, the primary surplus continues to remove pesos from the market at a rate of $ 1 billion per month since from here at the end of June the seasonality of the harvest will influence, which will generate a good offer of dollars, ”he explained.

Subsequently, experts Sebastián Maril, Regional Director of Latam Advisor, and Marcelo EtchebarneManaging partner of Dla Piper, analyzed THE PANORAMA OF JUDGMENTS facing Argentina against international courts for cases such as The PBI coupon and the expropriation of YPFamong others.

They estimated that potential liabilities for these demands They are around US $24,000 millionalthough they could be significantly reduced by negotiation with the creditors when executing the sentences.

In another panel, the former Minister of Economy presented Hernán Lacunza and the economist Martín Rapetti, Executive Director of Balance. Both analyzed the macroeconomic challenges of the country.

There was also a space for the analysis of the political context for the mid -term elections this year, in charge of the consultants Alejandro Catterberg (Polyriarchy) and Federico Aurelio (Aresco-Aurellio).

Source: Ambito