Although the government managed to keep in the First semester growth around 8%, it still has a great effort to do in the remainder of the year. It influences this scenario that several measures taken to lower fiscal pressure will make it difficult to achieve the objectives of 2025.

If it is taken into account that The economy would be growing at a rate of 5.5% year -on -year in the first months of the yeardepending on the drag effect of the end of 2024 and added to the low comparison base, it can be said that the revenue of the Treasury of the First four -month period are above what the activity indicates.

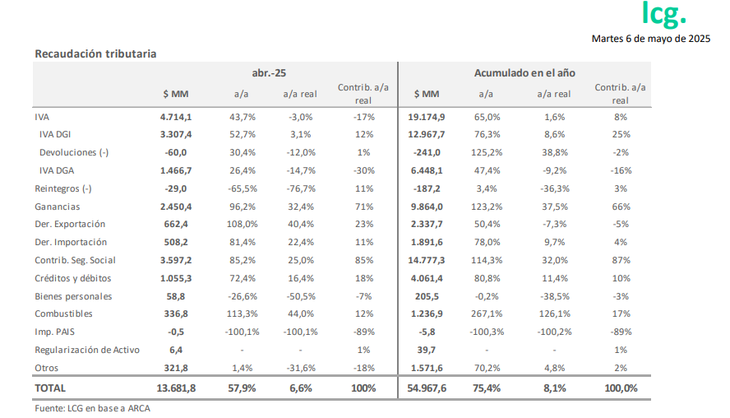

The total income reported by the Collection and Customs Control Agency (ARCA) of April This Monday they would indicate a growth of order of 6.5% interannual real With $ 13.6 billion. With this, the Government managed to add $ 54.9 billion at the start of the year.

Ark-Recurss-Tributios.png

But if they look at the four collection components that arca informs, which are National administration, social security contributions, provinces and other non -budgetary, It is noted that the federal government is resigning income in favor of the rest.

COUNTRY Tax: Effects on national collection

That is partly due to The disappearance of the country tax in December 2024 is affecting the component of the collection of taxes that are not co -participating. The tax that was charged to the sale of dollars contributed 1.1% of GDP only for the central government. Of this, the provinces saw nothing.

Now the situation was reversed. The provinces received $ 4.33 billion in April, which implied a real rise in order 9.8%, while the National Administration, with $ 5.4 billion, had a rise of barely of the order of 2%.

That data would be a sign that the government is not able to replace the country tax, since your own collection is growing below the activity, even if it remains above inflation. They would be almost 3 points of difference.

Another components Informs Arca, by Social Security case, he has tickets for $ 3.4 billion in April, with a real increase of 25.5%, pushed by the real rise of wages of the last year. While non -budgetary revenues added $ 422,376 million, which implies a real 30% drop.

The consultant Labour, Capital & Grouth (LCG) points out in its latest tax collection report that it “continued to grow in real terms.”

“Social Security, DGI and fuel gains traction growth. The main explanation factor was the strong increase in social security, From the real recovery of wages, the update of the top for employee contributions and access to the moratorium ”, Explain the consultant.

LCG-RECAUDATION.PNG

Regarding the tax on Profit said that “it marked its 6th month of real growth with 42% per year”. “They influenced advances on a greater determined tax for societies, the reduction of MNI for human persons and accession to payment facilities in moratorium quotas,” explains the report.

Instead, It is noted that VAT DGI, which is related to domestic consumption, presented a positive real variation against April last year although “shows some deceleration (3%). Differently, what was collected by credits and debit continues to grow strong (16%). Fuels returned to decelerate its real growth, although it still increases strongly (44%), explained by the progressive update of the tax and price adjustment, ”says LCG.

The consultant raises for what follows in the year there are four factors that They will affect national collection, which are the elimination of the country tax; THE TEMPORARY LOW OF RETENTIONS FOR THE FIELDthe definitive elimination for regional economies and part of the industry; the reduction internal taxes for expensive cars and motorcycles; and the special regime of entry to personal goods. All will subtract funds from the National Administration.

In that sense, LCG estimates that this year the collection Total could be around $ 197 billion, which would imply a 2.7% rise compared to 2024, But a fall in relation to GDP.

Source: Ambito