The manufacturing industry sank 4.5% monthly in March, which meant the worst decline since December 2023month crossed by the devaluation that Javier Milei validated as soon as he arrived at the Casa Rosada. The growing macroeconomic instability, reflected in the acceleration of inflation and the increase in the exchange gap, were factors that impacted the activity in the third month of the year.

With this fall, The DESESTATIONALIZED SERIES OF INDEC Industrial Production Index (IPI) had its minimum registration since June 2024. In interannual terms, the sector presented an improvement of 5.2%; Beyond the positive data, it is worth highlighting the very low comparison base and that the variation was more limited than that of the previous three months.

What was the fall of the industry in March?

Recently, the consultant Orlando Ferreres calculated that the economic activity contracted a monthly 1.2% in March and that the industry represented the main negative incidence. The entity stressed that the fall was related to the context of uncertainty that prevailed during March and the first days of April at the local and international levelbut forward they see a “more orderly” situation.

Before consulting Scopethe Director of Productive Planning of Fundar, Daniel Schteingartsaid that March was a “very bad month” for the industry and that the Inflation acceleration (From 2.4% to 3.7%) “it has possibly generated a drop in consumption.” In addition, he highlighted the relevance of the greater participation of imports on total of industrial products, in the context of commercial opening and appreciation of the exchange rate.

It should be added that, in addition to the highest price increases, March was marked by a growth of almost ten points in the exchange gap, due to the exhaustion of the “Crawling PEG” of 1% monthly and the expectation that the agreement with the International Monetary Fund (IMF) was going to bring a new exchange schemesomething that finally ended up.

The LCG consultant explained that 13 of the 16 industrial items exhibited a monthly deterioration. The most negative numbers were observed in tobacco (-34.7%), rubber and plastic (-12.4%), non-metallic mineral products (-9%), chemicals (-8.7%) and cars (-8%). At the other extreme, the only activities that eluded the trend were basic metallic industries, other oil transport and refining equipment.

image.png

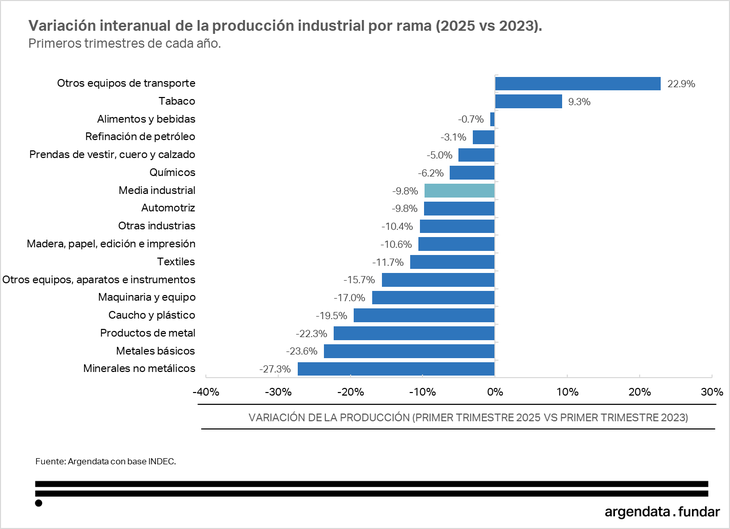

The industry produces almost 10% less than two years ago

Although in the accumulated of the first quarter the industry produced more than in the same period of 2024, The comparison with 2023 gave a strong contraction of almost 10%. Schteingart stressed three key factors to understand this collapse.

IPI.PNG

First, he highlighted the commercial opening, since, while the domestic demand remained almost stable, The national offer lost ground against the arrival of cheaper imported articles.

In the second instance, he marked that The setbacks were generalized among all items. “Only ‘other transport equipment’ – implemented by the boom of the local motorcycle assembly, favored by the return of credit and the ease of importing parts – and ‘tobacco’,” he deepened. “

Finally, he pointed out that The worst performances were verified in the construction linked industrieswith collapses close to 25% in non -metallic minerals, such as cement and glass, or basic metals, such as steel and iron. “The minimum public works (not compensated for the reactivation of private work) explains this,” he said.

What is expected for the rest of 2025?

For AprilLCG said that data is still missing to accurately anticipate what happened in a particular month, in which the new agreement with the IMF was signed. Anyway, predicted a recovery compared to Marchsomething that so far was verified in the automotive sector, with a monthly improvement of almost 12%.

Nevertheless, forward he saw that the industry will continue to have an “erratic” dynamic.

Source: Ambito