The study emphasizes that the deposits in dollars, which had begun to decrease after the first stage of the laundering in September 2024, resumed their growth after the lifting of exchange restrictions in mid -April.

The process of re -existence of the economy continues.

Depositphotos

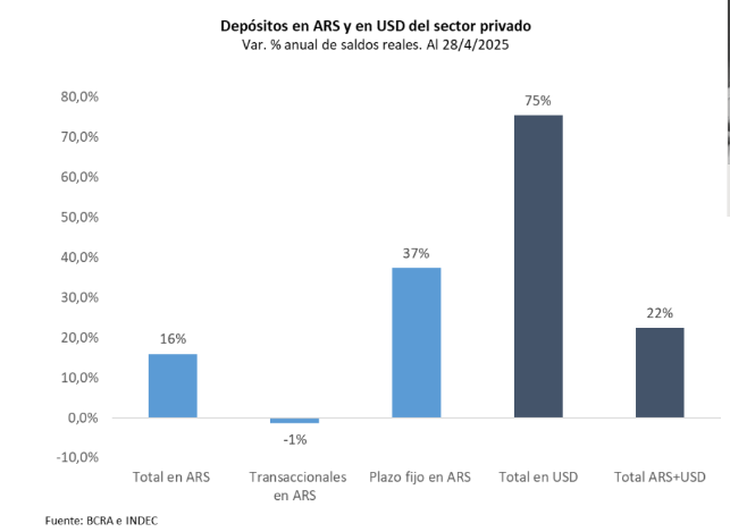

In the twelve months prior to April 28, the private deposits in dollars They grew at a remarkable pace, almost five times faster than deposits in pesos: a 75% compared to 16%.

The content you want to access is exclusive to subscribers.

This jump in foreign currency deposits is explained, in part, by the effect of Lighting of capital implemented by the government in the second semester of 2024, which mobilized near U $ S31.2 billionand also for the behavior of deposits in pesos: while the Sight deposits 1%fell, the Fixed deadlines in pesos 37%rose, well below the increase in dollars, according to a recent reporter report Quantumfounded by the former Secretary of Finance Daniel Marx.

In addition, the study emphasizes that the deposits in dollars, which had begun to decrease after the first stage of money laundering in September 2024, they resumed their growth after the lifting of exchange restrictions In mid -April. In just two weeks after that measure, more than US $ 1,100 increased.

Screen capture 2025-05-11 140218.png

This jump in foreign currency deposits is explained, in part, by the effect of money laundering.

Transvasing and Exchange Expectations

The report suggests that this recovery in dollar deposits could be linked to a perception of favorable exchange ratewhich drives the conversion of fixed deadlines into pesos to dollars. A phenomenon that, if maintained, could reflect a certain skepticism around the “strong weight”since the deposits in pesos stagnate, while the credits in that currency continue to grow.

An eventual savings transfer in pesos to dollars could be moderated if the government decides to raise interest rates. However, until now It does not seem to be a prioritysince such a measure would affect economic activity and could interfere with the official “deflation” strategy, based on maintaining the Official dollar near the floor of the new exchange band announced on April 11.

Rising credits and remoteization process

Despite the disparate evolution of the deposits, the report highlights a strong recovery of credit to the private sector. In the last twelve months, the Loans in pesos grew 99% in real termsdriven by an increase in 113% in consumer loans and of 77% in those destined for companies. For its part, the dollars in dollars fired 151%which led to a total credit increase of 106% in real terms.

In monthly terms, Dolk loans continue to grow at 7.9%similar rhythm to that of previous stages. In pesos, credits continue to expand to a Rhythm of 3.5% real monthlywith consumption as the main engine.

Quantum interprets this scenario as part of a “Reconetization” process of the economy, both in pesos and in dollars. A phenomenon encouraged by the elimination of exchange controls for human people and a greater supply of foreign exchange, driven in part by seasonal factors.

Source: Ambito