The exchange rate appreciation generated a rage for trips and purchases abroad. Credit card expenses accelerated, reached US $ 591 million and marked a new record in April. The figure is above the consumption of that month in 2018 before the run that condemned the Government of Mauricio Macri was unleashed. Beyond seasonality, they expect the phenomenon to continue: there was a “sales boom” door by door by the hot and Tourists are excited about the return of Collapint to Formula 1 and the World Cup Clubs.

According to a relief of Profit-Consultants, the expenses made by Argentines with credit cards abroad reached US $ 591 million in April and April and They exceeded the US $ 559 million that were disbursed in that same month of 2018before the exchange run that marked the end of the Government of Mauricio Macri was unleashed.

WhatsApp Image 2025-05-16 at 16.33.23.jpeg

The phenomenon has been consolidated since last of last year with the exchange appreciation process. In the first four months of 2025, expenses abroad accumulated US $ 2,536 million and reached similar levels to those of 2018, despite the gap that governed during this year between the price of the dollar to treasure (first the MEP and now the officer), with the dollar card.

One of the main reasons for rebound is the EMISIVE TOURISM GROWTH. The latest data from INDEC mark a rise of 98.8% year -on -year at the departure of tourists and 68% in hikers, who are those that cross the borders but return to the country on the same day.

In the summer season Much of the growth was given by tourists who traveled to Brazil to take advantage of the weight and devaluation of the real. According to Embratur, there were more than 1.5 million Argentines who arrived alone in the first two months of the year.

Colapinto and Club World Cup activate demand

The projection is that despite the lowest seasonality, expenses will be maintained high in historical terms. While the dollar is still in the lower part of the band, that is the intention, the incentives to travel abroad will follow. Besides There are some specific events that triggered the interest of travelers in unusual moments of the year.

Resen communicated this week that since the announcement of Franco Colapinto’s return to Formula 1 they noticed a “strong growth in the interest in accompanying him in his next careers”. Trips searches to destinations where they will compete were quintupled in the last hours, according to a statement from the company that points to the competences that will be played in Bologna, Monaco, Barcelona, Montreal and Austria.

Something similaR detected the same firm in February, when the Club World Cup schedule was announced. In those days, the demand to travel to destinations such as Miami and Los Angeles also multiplied by five compared to the previous three weeks. Another fact, The two games with more tickets sold for the competition correspond to an Argentine club: the Boca Juniors Athletic Club.

Buy Boom for the Hot Sale

Consumers also activate expenses abroad without moving home. The phenomenon from the door to the door has been growing accelerated from flexibility which carried the government of Javier Milei last year. In fact, according to INDEC data is the economic use of imports with higher increases.

In that framework, The Hot Sale did not go unnoticed. In Tendamia, one of the main platforms that applies that modality, detected a growth of the order of 300% on the first day of the promotional days with respect to last year. Some of the most demanded products were the shirts of sports brands and dress, the toys the PlayStation 5 and the Airpods 4.

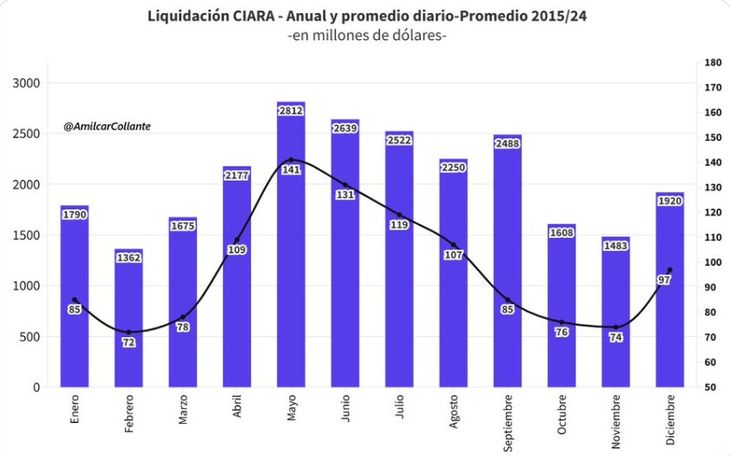

But not everything that shines is gold, for the economist Amílcar Collante there is some consensus in which until June the seasonality will play in favor of the exchange pax But then “There are several factors between July and October that can add pressure to the official dollar”. Among them he mentions: the reversal of agro liquidation, the least energy surplus and the typical dollarization of portfolios in the previous elections.

WhatsApp Image 2025-05-17 at 17.51.31.jpeg

The question is that the Central Bank will ask the greatest pressure. Will you remain on the sidelines to the band’s roof or will you sacrifice reservations in order to keep the dollar at bay to the elections?

Source: Ambito