During April 2025, Metallurgical activity recorded an interannual increase of 4.3% and an increase of 0.3% compared to the previous month. However, this growth was not uniform in all sectors, with significant casualties in areas such as the foundry and auto parts. Despite this increase, the sector accumulates a growth of 3.8% during the year, although last year suffered an accumulated decrease of -12.1%.

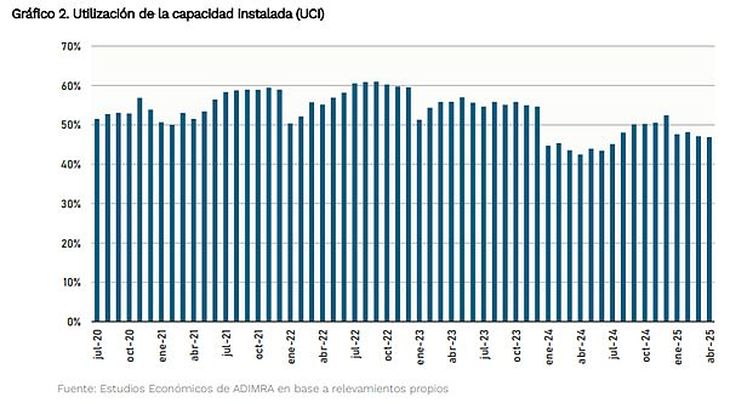

According to the report prepared by the Department of Economic Studies of the Association of Metallurgical Industrialists of the Argentine Republic (Adimra), The use of The installed capacity (ICU) recorded an increase of 4.4 points percentages with respect to the same month of the previous year. However, this value remains one of the lowest in historical terms.

Metallurgical Index.jpg

Sectorial performance

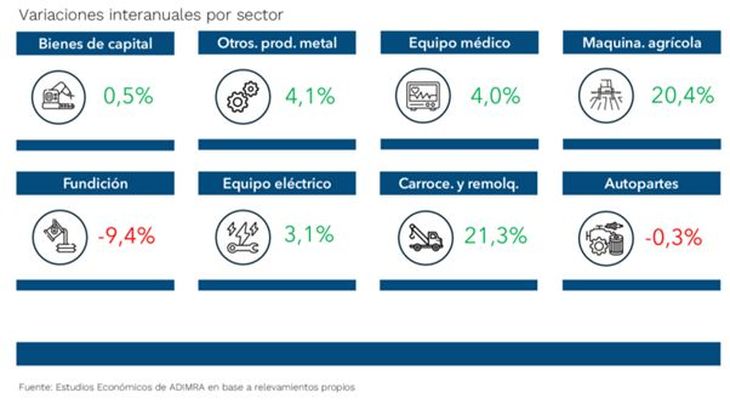

At the sector levelagricultural machinery (20.4%) and bodies and trailers (21.3%) They consolidated as the main drivers of metallurgical activity, maintaining an ascending trajectory since the beginning of the year. In contrast, the foundry sector (-9.4%) continues to be one of the most affected, followed by auto parts manufacturers (-0.3%). The situation of the foundry reflects a more prolonged contraction process that continues to affect the whole sector.

Metallurgical Index 2.jpg

On the other hand, Capital goods (0.5%) barely managed to sustain a positive year -on -year variation in Aprilbut its monthly evolution shows signals of stagnation. After an initial rebound in early 2025, the activity seems to have stagnated, without consolidating a sustained recovery trajectory. This dynamic raises questions about the solidity of the rebound in this key segment for the metallurgical framework.

Other sectors such as electrical equipment and devices (3.1%) and medical equipment (4.0%) again registered positive variations, aligned with a gradual recovery that has been maintained since the end of 2024.

Value chain analysis

Metallurgical Index 3.jpg

When analyzing the activity of metallurgical companies based on the value chain they provide, it is observed that most industrial sectors touched their lowest point throughout 2024. While mild reactivation signals are evident in 2025, the rebound continues to be very heterogeneous. While sectors such as agricultural machinery and bodies and trailers exhibit a firm and sustained recovery, other items such as foundry, auto parts and capital goods still face difficulties in consolidating a structural improvement.

“Despite positive statistical data, metallurgical activity in general shows stability without significant advances, with the specific exception of the body sectors and trailers and agricultural machinery, which recorded increases greater than 20%,” The president of Adimra, Elio del Re.

In addition, he completed: “Without considering these specific sectors, the growth of the rest of the metallurgical industry was only 1%, also starting a month of very low comparison in the previous year.” He also stressed that “all developed countries have a strong metallurgical industry, and Argentina cannot be the exception.”

Provincial Performance

In the provincial analysis, the companies of the main metallurgical provinces registered positive interannual variations, in line with the general average of the sector, which was 4.3%. Córdoba (6.7%), Santa Fe (5.5%), Entre Ríos (4.3%), Mendoza (3.8%) and Buenos Aires (3.9%) showed performances that, although with different intensities, reflect an improvement with respect to the same month of the previous year.

Employment and Foreign Trade

In spite of the strong contractions in the activity verified in recent months, there is still no situation of such magnitude in the level of employment provided by companies in the sector, registering a fall in interannual terms of -2.2% and with respect to March it is stable.

During March (last data available), exports of metallurgical products totaled 382 million dollars, which represents an interannual drop of 5.2%. On the other hand, the imports of the sector increased by 43.2% compared to the same month of the previous year. Significant increases in imports of capital goods (64%) were observed, reaching levels comparable to those registered in 2022 and 2023.

In summary, although there are recovery signs in certain sectors, metallurgical activity in Argentina faces significant challenges that require robust attention and strategies to ensure sustained and balanced growth in the future.

Source: Ambito