The economy contracted 1.8% monthly in March according to INDEC, so it was the first drop in almost a year and the deepest since December 2023. It happened in a month with instability in the financial markets, in the face of the expectation of a change in the exchange scheme within the framework of negotiations with the International Monetary Fund (IMF).

The setback with respect to February was given in the midst of the questions, both from the IMF and many economists, to the “Crawling Peg” of 1% monthly that the Central Bank (BCRA) was applying for the price of the dollar, which was persistently deepening the exchange delay.

image.png

“Let us remember that March was a month of great uncertainty for an imminent agreement with the IMF, with Dollarization of portfolios and fall of reserves, along with a decrease in purchasing power From the salary, “said the LCG consultancy in a report published on Wednesday.

Within that framework, many private activity indicators had been anticipating a cooling of the economy. As an examplethe production of cars collapsed 16.5% monthly and the cement offices did it by 6%according to the unstacilities of LCG.

In addition, there were also setbacks in the production of iron and meat, in the demand for general electricity, in the deeds of the Metropolitan Area of Buenos Aires (AMBA) and in retail sales, among other negative data.

Can the economy resume the recovery path?

“Although the trend-cycle series showed a slight advance of 0.2%, the setback in the monthly series would reflect that the economy faces Difficulties in sustaining the rhythm of activity in the short term“Securities said from Aurum.

Pamela MoralesEconviews analyst, he said in dialogue with Scope that “In April we can see a reboundsince the first advanced data point to that. “The same avizo from LCG, given the low comparison base that leaves March; according to their survey of advanced data, rebounded in the production of cars (+11.9%), cement offices (+10.9%), meat production (+12.6%), deeds (+17.5%) and retail sales (+0.3%).

Anyway, in Econviews they see a Activity growing slowly towards the end of the year, partly by the elections and another part by the low exchange rate. “Royal real wages are going to play against consumption, but credit in pesos will sustain the purchase of durable goods“Morales deepened about it.

LCG also expects a Improves forward “a little weaker and erratic, maintaining disparities between sectors”. “By 2025 we estimate a growth around 5% per year, leverage in a 2.7 percentage points left the last 2024 quarter,” he projected.

Since April 2024 that the monthly Economic Activity Estimator (EMAE) of INDEC did not throw falls. In addition, it was the greatest decrease since the end of 2023, after the devaluation of the government of Javier Milei a few days after assuming the presidency.

Economic activity improved in annual terms, but from a low floor

From a very low floor, in interannual terms the monthly estimator of Economic Activity (EMAE) registered an improvement of 5.6%, while In the first quarter it accumulated an advance of 6.1%. The annual rebound was mainly explained by trade performances (+9.3%), financial intermediation (+29.3%) and the manufacturing industry (+4.2%).

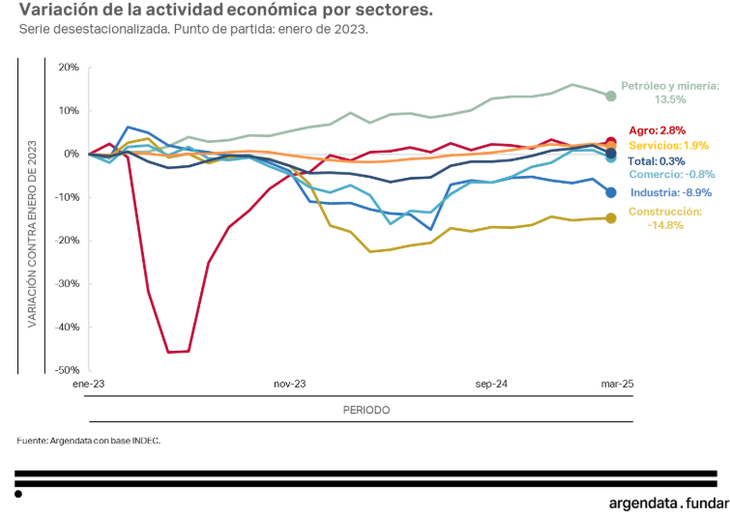

With these numbers, The economy was only 0.3% above the level of early 2023. According to an estimate of founding, the positive variation was caused fundamentally because of the dynamics of oil and mining (+13.5%)being also relevant the data of the agriculture and the services sector.

image.png

At the far end, Construction and industry, two of the most relevant sectors of the local economy, suffered deterioration of 14.8% and 8.9% in relation to two years ago. In the case of trade, a decrease was also verified, although of less magnitude (-0.8%).

Source: Ambito