Federal Court of Justice

Why hardly any bank customers claimed inadmissible fees

Copy the current link

Add to the memorial list

Without the active consent of customers, banks and savings banks may not raise the account fees. The BGH made this clear in 2021. Nevertheless, only a few consumers demanded their money back. Why?

Four years after the consumer -friendly judgment of the Federal Court of Justice (BGH), only a few customers reclaimed money from their bank or savings bank. This emerges from a representative survey of the Verivox comparison portal. Accordingly, only 11 percent of the respondents made any claims.

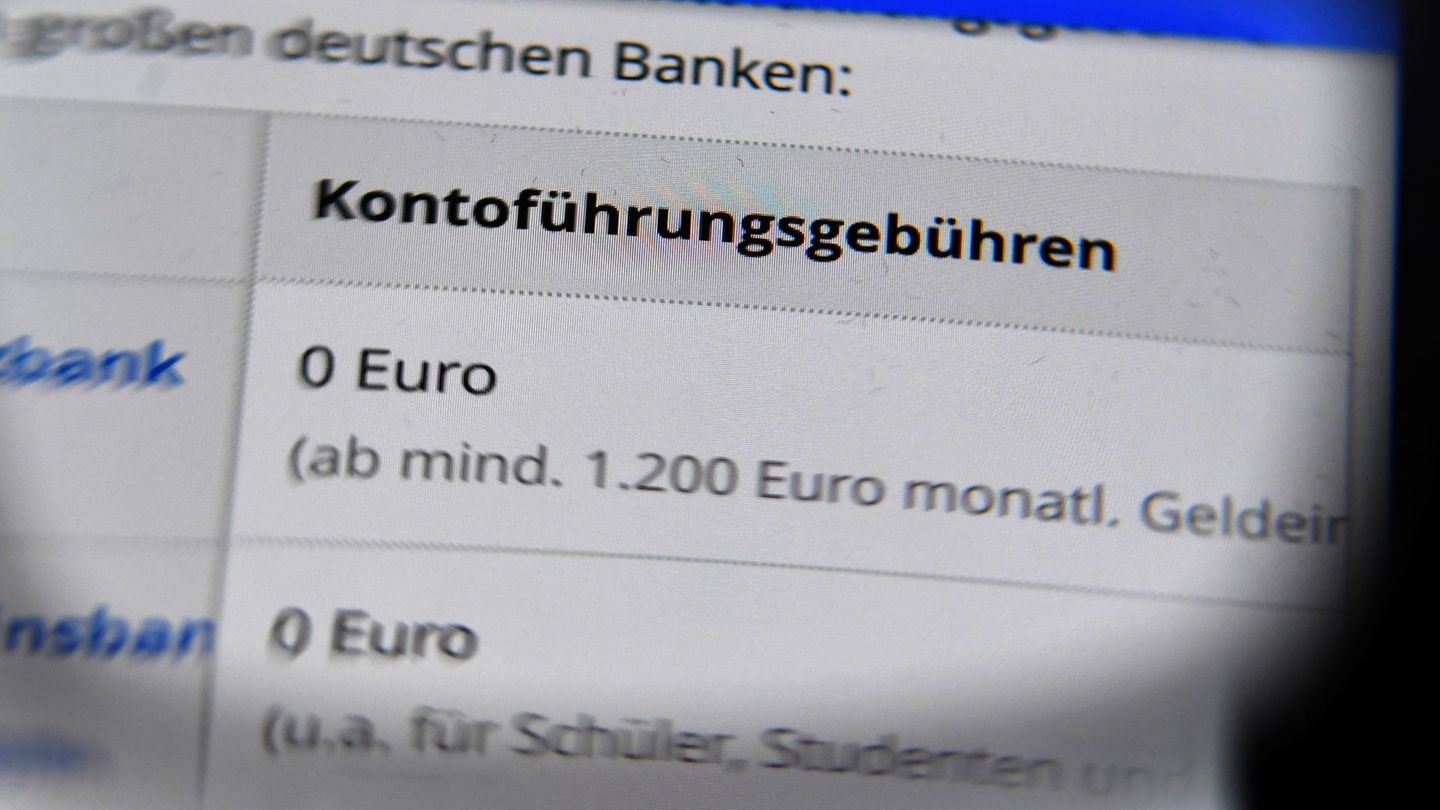

In April 2021, the BGH declared so -called approval fiction clauses in the general terms and conditions of banks and savings banks inadmissible. After these clauses, the consent of the customers was, for example, to change the account fees if they were not actively contradicting within a certain period. After the judgment, numerous consumers were entitled to repayment illegally raised fees.

At least 40 percent would be entitled

“We know from previous studies that the checking account was more expensive in at least 40 percent of all customers in the three years before the judgment,” says Verivox Managing Director Oliver Maier. “Regardless of disputed limitation questions, at least all of these customers could have requested reimbursements.” Not a single bank is known to the company that caught up with the necessary consent of the customers before the Karlsruhe judgment.

In the summer of 2021, 82 percent of those surveyed had given that they want to reclaim paid fees if they were entitled to it. According to the latest study, reality looks different. Four out of ten respondents did not know the BGH judgment at all. But also of those who knew about the Karlsruhe decision also waived more than 80 percent of possible reimbursement claims.

According to the study, only 34 percent did not claim any repayments because they would have had no claim. 23 percent the effort was too great, 21 percent were not certain whether the judgment also applies to them. 14 percent stated that the effort was not worth it because they were not about a lot of money. And 7 percent were afraid of termination of your account or a burden on business relationships to your bank.

The BGH today negotiates a lawsuit about the repayment of fees of the Berlin Sparkasse, which was raised through an approval fiction clause. This time, among other things, the focus is on when the claims expire. It is unclear whether a judgment will be made on Tuesday.

dpa

Source: Stern