Almost 70 % of professionals that make up the value chain of Construction They claimed to have experienced a decrease in their level of activity during the last year. At the national level, 69 %of respondents reported an interannual contraction, with a majority (46 %) that placed the decline above 20 %.

15 % estimated decreases between 10 % and 20 %, and 10 % recorded falls below 10 %. Only 16 % maintained their activity levels, while the remaining 15 % declared increases: from them, 7 % grew below 10 % and only 2 % exceeded 20 % increase.

construction work in Australia.jpg

Construction: Concern for low demand.

The information follows from the 26th edition of the opinion study built (EOC) prepared by the group built between March 31 and April 25, 2025. The survey included 506 participants from all over the country.

In this measurement, the main difficulties at a general level were 3: 1. higher construction cost, 2. Low demand for the market, and 3. exchange uncertainty.

- Higher construction cost (1st place; 23%). Again, concentrated the greatest proportion of answers. It was the main difficulty for 4 links in the value chain: architects, developers, builders and engineers. It was the second difficulty for material distributors and MMO. And it was the third importance in importance for real estate.

- Low demand for the market (2nd place; 15%). Was The most important difficulty for material distributors and MMO. Meanwhile, it was the second in assessment for builders and real estate.

- Exchange uncertainty (3rd place; 13%). Was The most relevant obstacle to real estate, the second difficulty in importance for developers and the third for architects, builders and MMO.

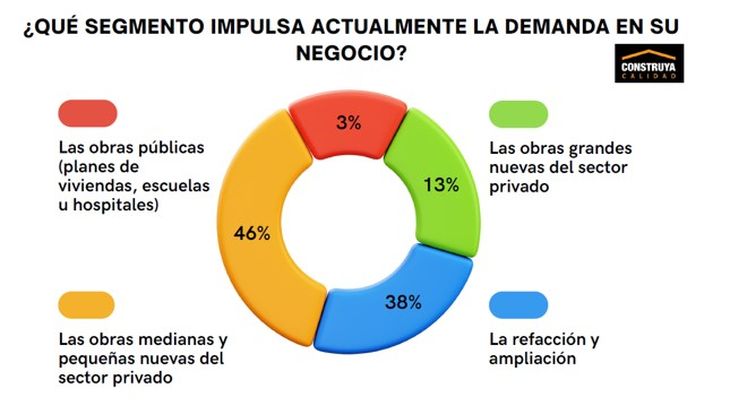

Segment impact

Major work teachers (MMO) and material distributors were the most punished: 83 % of the MMO and 76 % of distributors suffered contractions, mostly greater than 20 %. Architects and engineers also reflected significant falls (69 % and 75 % respectively), while real estate companies were the only link where positive responses (50 %) exceeded negative (40 %).

2.jpg

Source: Building opinion study – National Survey in the Construction Industry.

Main obstacles

High construction costs lead the barriers for 23 %of participants, followed by low market demand (15 %) and exchange uncertainty (13 %). For architects, the shortage of qualified labor was positioned as the second most critical difficulty. In regions such as Nea and NOA, private investment limitations completed the podium of challenges, while in Patagonia exchange uncertainty played a more relevant role.

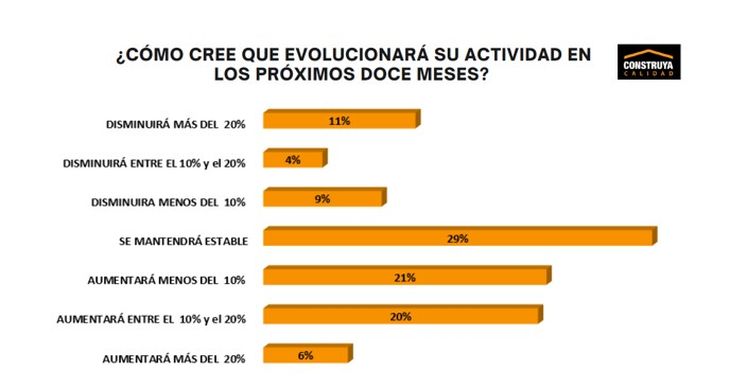

Up to rise expectations

Despite the current scenario, the perspectives improved slightly: 47 % of professionals anticipate a rebound in the next twelve months (4 percentage points more than in the previous measurement), 29 % foresee stability and 24 % project new falls.

6.jpg

Source: Building opinion study – National Survey in the Construction Industry.

Impulse factors

Construction as a value refuge continues to be the main engine for 21 %of respondents, followed by the growth of economic activity (19 %), the dynamism of private works (11 %) and money laundering (11 %). Real estate, in particular, highlighted the greatest availability of financing (10 %) as a key to soften the cycle.

Savings and investment

In terms of savings, construction leads with 35 % of preferences, leaving the dollar behind the shares (16 % each). Public bonds occupied third place (13 %), while the fixed deadlines added 8 %. Cryptocurrencies and bank deposits represented 5 % and the remaining percentage.

7.jpg

Source: Building opinion study – National Survey in the Construction Industry.

The EOC 2025 ratifies the resilience of the sector in the face of an adverse context, where high costs and volatility prevail contrast with incipient optimism that could translate into greater dynamism if identified facilitators are consolidated.

Source: Ambito