He Campo would contribute US $ 3,300 million for retentions In the first semester of 2025, 25% more than in the same period last year, despite the temporal reduction of the aliquots announced at the beginning of the year, as the Rosario Broke (BCR) estimates in a report.

The increase in the collection of the main agroindustrial products is linked to the highest commercialized volume, exhibited in the millions of tons (MT) registered by means of the affidavit of sale abroad (DJVE).

In this regard, the report explained that “This increase responds to an increase in the declared total volume, That among all the products contemplated, it is projected to close the first semester about 53 MT declared, almost 60% more than what is declared to sell abroad (DJVE) in the same period of the previous year. “

The impact of the increase in the declared volume counteracted the temporary decline of the withholdings to the main crops, which the national government announced at the end of January, by reducing the aliquots of the soybeans from 33% to 26% and its derivatives from 31% to 24.5%. For wheat, barley, sorghum and corn, the aliquot went from 12% to 9.5%, while sunflower was reduced from 7% to 5.5%.

dex_1_13.png

The increase in collection of the main agroindustrial products is linked to the highest marketed volume

He Tax relief for the agricultural sector governs until June 30 For the aforementioned crops, except for wheat and barley that will retain the decrease arranged until March 31, 2026, contemplating the next fine harvest that is beginning to sow.

In that line, the report added: “Although the aliquots in force during most of the semester were reduced and that the average export prices for the main products They were located below those registered in the first half of last year (fundamentally those of the soy complex), the highest volume drives this collection increase. “

AGRO: The projections of the Stock Exchange for this year

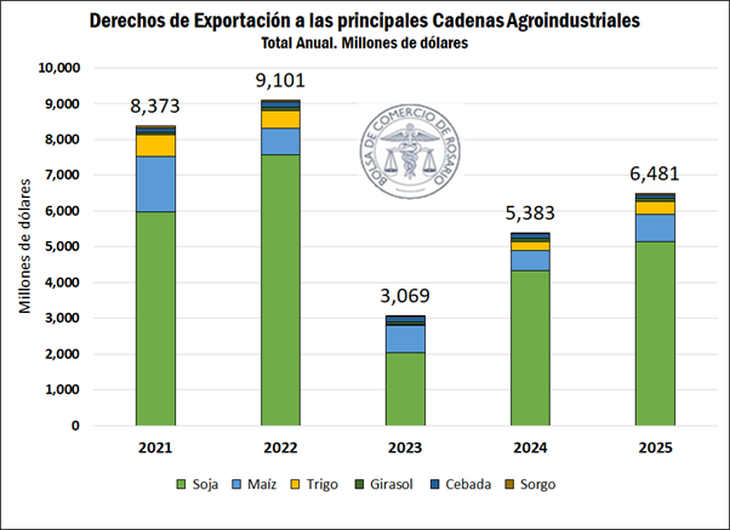

With respect to the projections for the year, from the BCR said that “they are located in a total amount of almost US $ 6,500 million”, indicating that “this calculation starts from what remains to be sold outside the estimated exportable balances for the current campaign and export prices in force to date.”

When comparing the projected annual total for 2025 with previous years, they reflect that “it is appreciated that this amount represents an increase of just over US $ 1 billion in relation to the previous year, but is far from the amounts that were reached in 2021 and 2022, years in which international prices were at levels considerably higher than the current ones. “

dex_3_9.png

Soybean and derivatives concentrate 80% of the proceeds

Among the contribution of each of the chains, the study revealed that “the soy complex stands out fundamentally, which is projected to close the year at US $ 5,140 million, 80% of the total projected for the year” explaining that “this responds to soybeans and its derivatives are agro -industrial products that must face the greatest aliquot.”

Disaggregating between what each of the complex products contributes, he pointed out that “soybean by -products are the main contributor, with a projected total of US $ 2,760 million, an amount similar to that of last year” and explained that “the export rights of soybean oil are estimated at US $ 1,700 million, while the bean would contribute almost US $ 600 million. “

In this regard, the analysis indicated that “comparing with last year, the main increase comes from the side of soybean oil, product of a greater export flow that has been recorded since the year began.”

Source: Ambito