The latest official data on Economic activity They showed that in March there was an abrupt interruption of the recovery that had been observed in the previous months. While many consultants expect that, with the greatest exchange calm, the economy will resume the growth path, The profile of this rebound turns on two great alarms: its little impact on employment generation and the greatest demand for dollars for the progress of imports.

In the third month of the year the monthly Economic Activity Estimator (EMAE) of INDEC contracted 1.8% monthlywhich meant the first setback in almost a year and the deepest since 2023. The decline occurred in the midst of the growing doubts about the sustainability of the exchange scheme that the Central Bank (BCRA) was applying, within the framework of the negotiations between the Government and the International Monetary Fund (IMF) to close a new agreement.

For the coming months, private estimates are more optimistic. Ecogo, LCG and Econviews, for example, foresee that the April data will be positive, driven by an improvement in indicators linked to trade and construction (with credits and deeds by throwing strong advances).

On the contrary, it balancing predicted a new decline for the fourth month of the year, because the post -stabilization according to the IMF took to arrive already the weak production of the agricultural sector by lean climate conditions. However, for May they estimate a better number.

In general terms, analysts see that greater certainty that brought the new exchange schemewith a devaluation less than expected, and the Inflation deceleration They contributed to motorize the economy again. However, most see in the Stagnation of real wages A serious consumption, which could put a roof to the dynamism of the activity.

Milei’s growth model hits very intensive sectors in employment

In addition, from the Economic Studies Management of the Province Bank They warned that, even if the economy resumes its improvements, Javier Milei’s government growth model rewards sectors not very intensive in employmentwhich is a problem considering that in recent months many jobs were lost.

In this regard, a report by the entity exhibited that the best performance sectors (agriculture, energy and miner) explain 13% of the internal gross product (GDP), but only 7% of formal employment. In contrast, The most beaten items (construction, industry and, to a lesser extent, trade), have a greater weight in employment (45%) that in GDP (35%), although in this last variable they are also very relevant.

PBI.JPG employment

Source: Economic Studies Management of the Province Bank.

From the province they clarified that “all these sectors are important for the Argentine productive framework and our value aggregate possibilities, and the ideal would be for everyone to grow,” however, they noted that between 2012 and 2025 it almost never happened that all activities grow simultaneously, for which “”Prioritize one or another branch of activity, then, will have a dissimilar impact on income and quality of labor relations“

This little intensive nature in the generation of employment of the most thriving items It also influences, according to the work mentioned, the deterioration of wagesthat for formal workers of the private sector there are still 2% below the average of 3 2023, in real terms, while among the state a collapse of almost 20% is verified.

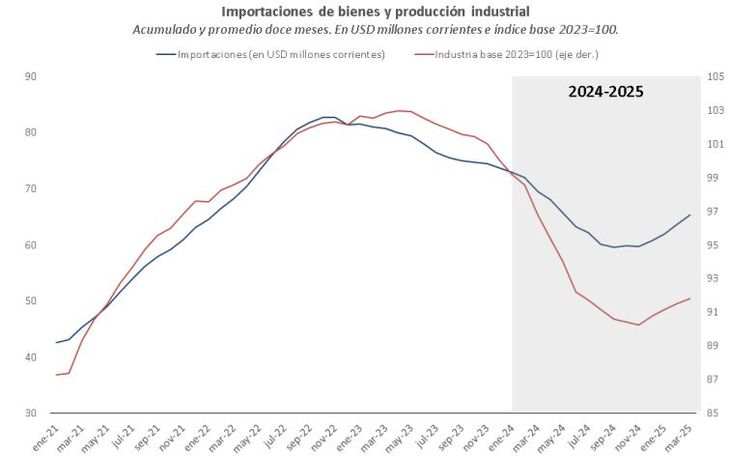

Export sectors lead recovery, but imports grow at a greater rhythm

The analysis of the province emphasizes that this growth model should be favorable in terms of accumulation of foreign exchange, since among the winners they highlight export sectors, while the losers usually consume more dollars than they generate. However, this does not seem to be reflected in reality, since Imports have been climbing well from what economic activity does.

Impo.jpg elasticity

Source: Economic Studies Management of the Province Bank.

“The exchange rate appreciation and the flexibility of tariffs and other commercial barriers, especially in the segment of final goods, explain this dynamic,” they said. The process of exchange delay and commercial opening does not seem to be close to its end, so there are not too many elements to enhance that this relationship will not be maintained in the coming months. In parallel, The replacement of local production with imported products will also contribute to the lag of employment regarding the evolution of aggregate demand.

In summary, after a very critical March, good signs in economic activity reappeared. Even so, the shape of this recovery does not look virtuous in terms of employment and salaries, while the commercial opening and the cheap dollar also make it difficult to overcome external restriction.

Source: Ambito